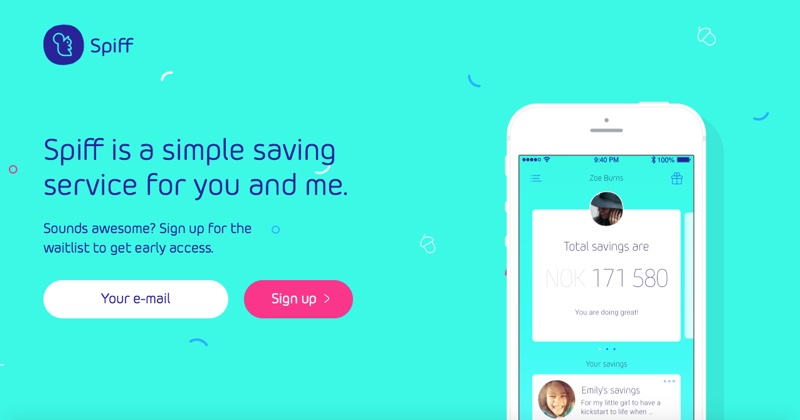

Spiff is a straightforward concept: a “simple and fun” savings service designed with women in mind. Founder and CEO Carl Wessmann credits the women in his life for helping him understand the importance of savings, and he’s returned the favor with a new technology that, as he explains it, “helps connect money with what it can accomplish” for users and their loved ones.

Spiff is poised to take advantage of the disconnect between the rising economic power of women and the fact that women are still a disproportionately small portion of the world’s savers and investors.

Spiff CMO Kristin Juland Møller and CEO Carl Wessmann demonstrated their technology at FinovateEurope 2016 in London.

“Our key demographic, women between 25 and 35, play an essential part in our mission to reduce wealth inequality,” said Spiff CMO Kristin Juland Møller. Noting that 1 in 4 millennial women are “already parents,” she pointed out that “by providing them with inspiration and savings tools they need, we will not only empower millions with good saving habits, but also empower future generations as they pass on their saving habits to their children.”

In Spiff’s Finovate debut, Møller showed three of Spiff’s key features:

In Spiff’s Finovate debut, Møller showed three of Spiff’s key features:

- Setting up a savings plan for oneself

- Setting up a savings plan for a dependent

- Sharing that savings plan with a relative, such as an aunt or grandparent

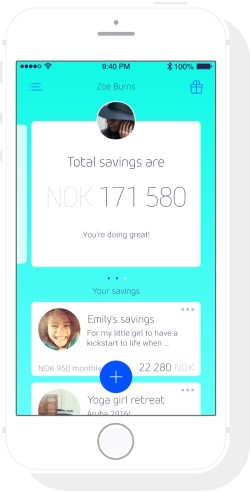

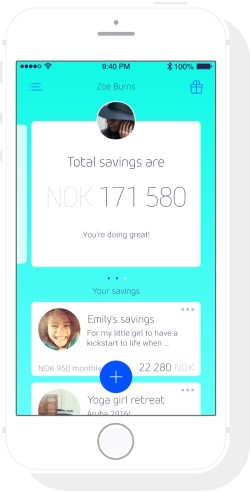

Møller presented the Spiff Dashboard, where she was able to choose between different types of savings plans (options included themes such as “Your Future,” “Your Kids,” and “Rainy Day”). The Savings Plan can be personalized with an image, as well as a description of the specific savings goal for the plan.

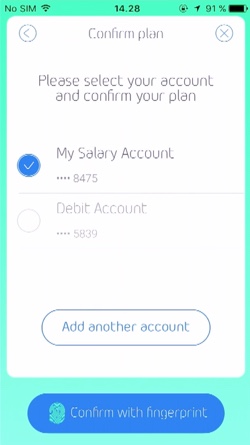

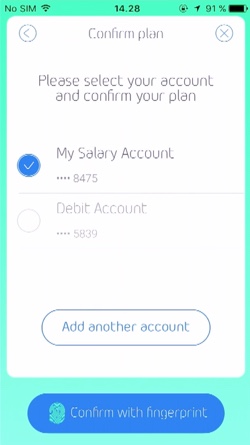

The user then chooses the amount of monthly savings to be automatically drawn from a connected account and set aside into either a savings account or a pre-selected investment fund. Choose a day of the month for the transaction and, after confirming the information, the savings plan is set.

“Saving is a family affair,” Møller said, showing next how a child’s savings plan built with Spiff could easily be shared with grandparents or other relatives via social media. “It’s something parents do for their kids, and grandparents do for their grandkids,” she said.

The stats

- Founded in January 2015

- Headquartered in Oslo, Norway

- Carl Wessmann is CEO and founder

- Raised $500,000 from investors in five countries

How it works

How it works

We sat down for a quick conversation with Møller during rehearsal day at FinovateEurope, and followed up with a few questions about Spiff, its focus on helping empower women financially, and what to look forward to from the company in 2016.

Finovate: What problem does Spiff solve?

Kristin Juland Møller: Spiff is a saving service, designed with women in mind. We want to empower women with smarter finance tools for saving, so we created a simple, social and fun savings app. Spiff connects money to what it can accomplish, for you and your loved ones. In simple, straightforward language.Â

Finovate: Who are your primary customers?

Møller: Women 25-35.

Finovate: How does Spiff solve the problem better?

Finovate: How does Spiff solve the problem better?

Møller: You need to build products that people love, not products that will only make you more profit. That means that you need to design products for key demographics, and we choose to focus on a key demographic that has been widely neglected from banks for the past hundred years. It’s time we shake it up.Â

Finovate: Tell us about your favorite implementation of Spiff.

Møller: Saving is a family affair. Grandparents save for their grandkids, parents for their kids, friends save for trips together, and young couples save for their first home. Spiff is a social savings app that allows you to share saving plans, give savings as a gift, and reinvent the charm of saving together. We cheer you on, and celebrate when you reach your goals!

Finovate: What in your background gave you the confidence to tackle this challenge?Â

Møller: Our founders are strongly influenced by Nordic values, equality, and the universal notion that women and men are worth the same. Our one founder Calle has written a Facebook Note on why this is important in his life. Keyword: Women https://www.facebook.com/notes/carl-nicolai-wessmann/the-women-of-my-life/10153213470391190

Strong and independent women around us have taught us the value of kindness, fairness and empathy—and the importance of saving. Spiff is built on these values.Â

Finovate: What are some upcoming initiatives from Spiff that we can look forward to over the next few months?

Møller: Testing has begun. And the early signs are that people love it. We are launching in Norway this year. Expansion will follow. We welcome everyone to join the Spiffy waitlist (www.getspiff.no), and be one of the first to try Spiff. We will also be part of one of the world’s best accelerators, TINC, in Silicon Valley.

Finovate: Where do you see Spiff a year or two from now? Â

Møller: We will have empowered one million women with smarter savings.Â

Check out Spiff’s demo video from FinovateEurope 2016.

In Spiff’s Finovate debut, Møller showed three of Spiff’s key features:

In Spiff’s Finovate debut, Møller showed three of Spiff’s key features: How it works

How it works Finovate: How does Spiff solve the problem better?

Finovate: How does Spiff solve the problem better?