“Envision” is an apt name for a new solution from a company renowned for its ability to turn big data into eye-popping, operational insights. This week Ayasdi, a specialist in machine intelligence software development and innovator in topological data analysis, introduced its latest technology, Ayasdi Envision. The new framework is built on the company’s enterprise-scale AI platform and makes it easier for businesses to develop and deploy intelligent applications.

“We’ve made it incredibly simple and natural for technical and non-technical counterparts to interact and collaborate on the development of intelligent applications using a visual, web-based workflow,” Ronaldo Ama, EVP, Product and Engineering at Ayasdi explained. “These applications surface the power of Ayasdi to discover, predict, justify, act, and learn on your data,” he said.

Pictured: Ayasdi Principal Data Strategist Michael Woods demonstrating Ayasdi Finance at FinovateFall 2014.

Ayasdi Envision provides an easy-to-learn and navigate interface that enables business users and data analysts to work collaboratively in a “workflow-oriented approach.” By using widgets as the building blocks, Envision allows platform users who are not developers to build relatively sophisticated applications that are tailored to solve specific business problems. In a conversation with Datanami, Ama explained that being able to have business users and data analyst working so closely meant less time and less money when it comes to development. He added that it was also an excellent example of how the Ayasdi brought the power of AI to “just a regular customer.”

Ayasdi’s technology takes advantage of the trend toward businesses using intelligent apps to maximize their use of big data. In the company’s announcement, it highlighted Gartner’s Top 10 Strategic Technology Trends for 2017 report which noted, “intelligent apps are not limited to new digital assistants – every existing software category from security tooling to enterprise applications such as marketing or ERP will be infused with AI enabled capabilities.”

During his Finovate demo, Ayasdi Principal Data Strategist Michael Woods explained the challenge succinctly. “Data generation is rapidly outpacing data interpretation. Which is to say that your businesses are capturing more data than you can effectively understand and act upon.” Because of this, Woods added, “there is significant value that you are failing to monetize in the data you have already captured today.” Since its founding in 2008, Ayasdi has helped companies ranging from Citigroup and General Electric to Anadarko and Mount Sinai Hospital gain critical insights from their data.

Headquartered in Menlo Park, California, Ayasdi demonstrated its Ayasdi Finance platform at FinovateFall 2014. Earlier this month, the company announced a partnership with HSBC to help the banking group automate compliance processes. Ayasdi hired former IBM executive Bob Griffin to serve as CEO in March, the same month the company was named to Planet Compliance’s inaugural RegTech Top 100 Power list. The company has raised more than $106 million in funding, most recently completing a $55 million Series C in March 2015. Ayasdi includes Kleiner Perkins Caufield & Byers, Institutional Venture Partners, FLOODGATE, and Khosla Ventures among its investors.

Highlighting the company’s history as a e-commerce innovator and its future as a “consumer-oriented, product driven, and technology intensive bank,” Siemiatkowski trained his sights on retail banking itself. “We will … (provide) solutions that ensure a smooth customer experience, help people streamline their financial lives and continue to support businesses by solving the complexity in handling payments,” he said, adding, “the opportunities are tremendous, it is a thrilling prospect.”

Highlighting the company’s history as a e-commerce innovator and its future as a “consumer-oriented, product driven, and technology intensive bank,” Siemiatkowski trained his sights on retail banking itself. “We will … (provide) solutions that ensure a smooth customer experience, help people streamline their financial lives and continue to support businesses by solving the complexity in handling payments,” he said, adding, “the opportunities are tremendous, it is a thrilling prospect.”

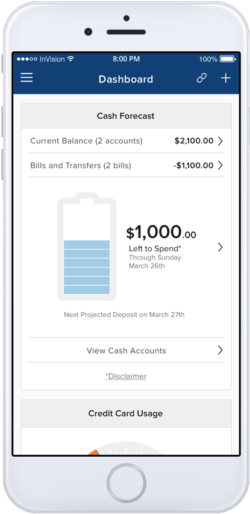

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

they’re the best, really (these guys, not the pics).”

they’re the best, really (these guys, not the pics).”