This week’s edition of Finovate Global focuses on recent fintech headlines from Mexico, which boasts the second largest economy in Latin America.

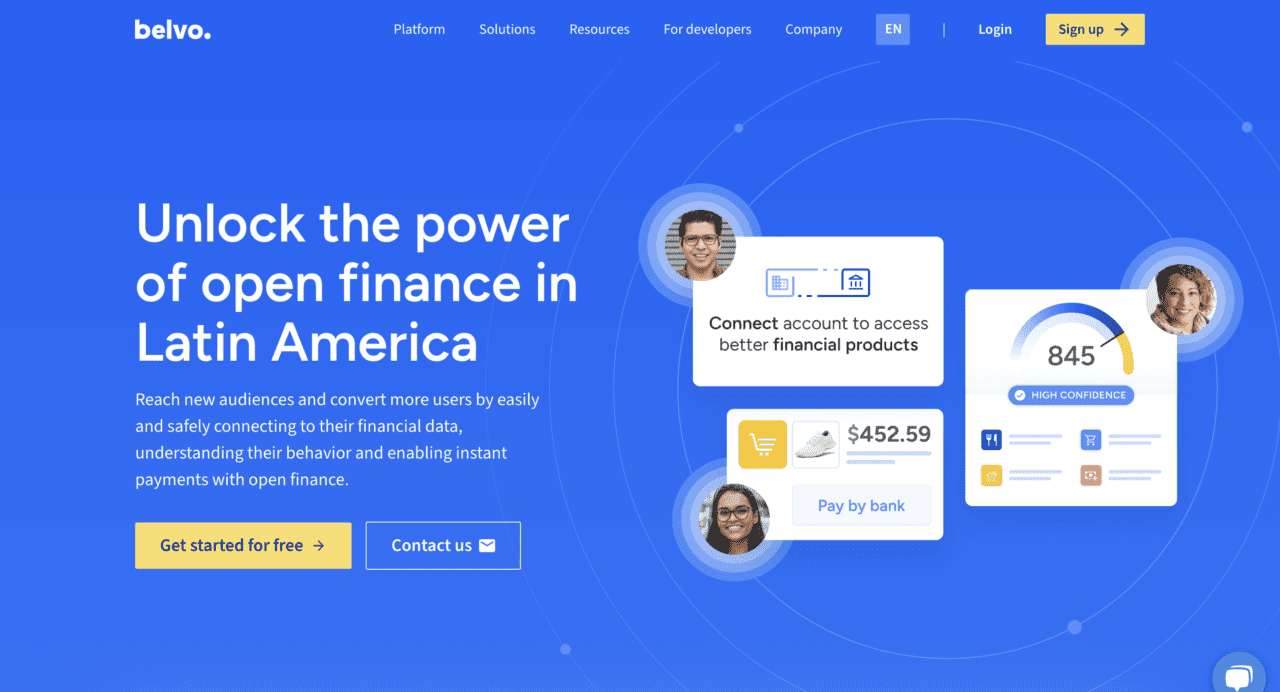

Belvo and JP Morgan Partner to Enhance Recurring Payments in Mexico

A strategic collaboration between Latin American open finance platform Belvo and J.P. Morgan Payments aims to automate and streamline the management of recurring payments via direct debit. The partnership will enable businesses in multiple sectors to deploy direct debit quickly and securely, enhancing the customer experience and boosting engagement.

“This alliance with J.P. Morgan Payments is a milestone for Belvo and the financial ecosystem in Mexico,” Federica Gregorini, General Manager of Belvo in Mexico, said. “Direct debit offers a modern and efficient solution that not only improves companies’ operational processes but also makes life easier for users. With this collaboration, we are taking recurring payment automation to the next level, making it more accessible for all types of businesses.”

Now a member of J.P. Morgan Payments Partner Network, Belvo will give companies in industries such as lending, insurance, utilities, subscription services, and more the ability to automate their recurring collections. By leveraging direct debit, these companies will reduce errors, ensure timely payments, and increase convenience for customers who will no longer have to make manual payments.

Founded in 2019 and headquartered in Mexico City, Belvo is a leading open finance and data payments platform. With partners including BBVA, Citibanamex, and Finovate alum Nubank, Belvo first launched its direct debit recurring payments solution in Colombia and Mexico in the fall of 2023. This week’s strategic collaboration with J.P. Morgan Payments will bring this technology to more businesses throughout Mexico.

“We are pleased to work with Belvo to offer our clients in the country access to a best-in-class direct debit solution, providing higher transaction success rates, new features such as partial debit payments, and more efficient settlements,” Francisco Molina Viamonte, Head of Mexico for J.P. Morgan Payments said.

TransUnion Acquires Trans Union de Mexico from Mexico’s Largest Credit Bureau

International information and insights company TransUnion has signed a definitive agreement to acquire majority ownership of Trans Union de Mexico, the consumer credit business of Mexico’s largest credit bureau, BurĂł de CrĂ©dito.

“Our expansion in Mexico continues our commitment to making trust possible in global commerce,” TransUnion President and CEO Chris Cartwright said. “Credit bureaus are a catalyst for financial inclusion, and we are excited for the opportunity to bring the benefits of our state-of-the-art technology, innovative solutions, and industry expertise to Mexican consumers and businesses.”

TransUnion currently owns approximately 26% of Trans Union de Mexico. Cash consideration for the transaction, in which TransUnion will acquire an additional 68% ownership stake, is $560 million (MXN 11.5 billion), with an enterprise value of $818 million (MXN 16.8 billion). Buró de Crédito’s commercial credit business is not a part of this transaction.

“We anticipate that our planned acquisition of BurĂł de CrĂ©dito’s consumer credit business will strengthen our leadership position in Latin America and will make TransUnion the largest credit bureau in Spanish-speaking Latin America,” Regional President of TransUnion Latin America Carlos Valencia said. “We see substantial opportunity to introduce global products like trended and alternative credit data, fraud mitigation solutions, and consumer engagement tools. We also plan to expand beyond traditional financial services into adjacencies such as FinTech and insurance.”

TransUnion made its Finovate debut in 2016 at FinovateFall. The company returned to the Finovate stage last year for FinovateSpring 2024 to demonstrate its Enhanced BreachIQ solution, which provides modern, gamified consumer identity protection. Part of TransUnion’s TruEmpower suite of solutions, Enhanced BreachIQ builds an Identity Safety Score based on the user’s individual and unique data breach history. It also provides Breach Risk Scores that measure the severity of incidents in which their data was exposed, and a Personalized Action Plan of practical risk mitigation steps.

Founded in 1968, TransUnion is headquartered in Chicago. The company trades on the New York Stock Exchange under the ticker TRU and has a market capitalization of $18.4 billion.

Airwallex Acquires MexPago as Part of Latin American Expansion

Speaking of acquisitions in Mexican fintech and financial services, global financial platform Airwallex has finalized its acquisition of Mexico-based payment service provider MexPago, a licensed Institution of Electronic Payment Funds (IFPE). The acquisition, along with recent news that Airwallex has secured a payment institution license from Banco Central do Brasil, will enable the company to connect its international financial infrastructure with Brazil and Mexico, supporting local businesses.

“Mexico plays a pivotal role in the global economy, serving as a key link between North and South America and a critical hub for cross-border payments,” MexPago CEO and founder Luis Castillejos Ordaz said. “We’re proud to join forces with Airwallex to enable seamless and secure cross-border transactions for businesses worldwide. MexPago’s domestic capabilities, combined with Airwallex’s global reach will deliver even greater value to our shared customers. Together, we will unlock borderless opportunities for businesses here in Latin America and around the world.”

Founded in 2014, MexPago is headquartered in Huixquilucan, part of Greater Mexico City. Post-acquisition, Castillejos will serve as Country Manager for Airwallex, Mexico, where he will manage operations and help Airwallex’s customers successfully navigate the Mexican market.

Here is our look at fintech innovation around the world.

Asia-Pacific

- UnionDigitalBank, the digital banking arm of Union Bank of the Philippines, partnered with fintech lending platform JuanHand.

- Japanese international payment provider JCB forged a strategic collaboration with DOKO to boost JCB card acceptance in the U.K.

- Backbase announced that its client, Vietnam-based An Binh Commercial Joint Stock Bank (ABBANK) has launched ABBANK Business, a new digital banking platform.

Sub-Saharan Africa

- KCB Bank Kenya and UnionPay International (UPI) teamed up to boost e-commerce payment capabilities in Kenya.

- Old Mutual Wealth (OMW) South Africa secured a strategic collaboration with financial services technology provider Bravura.

- Mastercard opened its first office in Ghana this week.

Central and Eastern Europe

- Czech cybersecurity firm for financial institutions Wultra raised €3 million in funding.

- Ebury announced its acquisition of Lithuanian B2B cross-border payments solutions provider ArcaPay.

- Lithuania required financial institutions in the country to block payment card transactions from unregulated operators.

Middle East and Northern Africa

- Egyptian fintech Raseedi acquired microfinance lender Kashat.

- MENA-based fintech startup Zywa, which offers banking solutions for Gen Z customers, raised $3 million in funding.

- Saudi Arabian payments services provider HyperPay secured a license from the Saudi Central Bank (SAMA) to support the development of the financial services ecosystem in the kingdom.

Central and Southern Asia

- Amazon acquired India-based Buy Now, Pay Later firm Axio for $150 million.

- Pakistan-based commercial bank Bank Alfalah acquired a 9.9% equity stake in Jingle Pay.

- Indian equity management platform Hissa launched a new fund to help workers at growth-stage startups convert their vested stock options into cash.

Latin America and the Caribbean

- Cross-border payment solutions provider Bamboo partnered with Argentina-based e-commerce platform Tiendamia.

- J.P. Morgan Payments and Belvo teamed up to enhance recurring payments in Mexico.

- Crypto banking solutions company Coins.xyz launched in Brazil.

Photo by Jezael Melgoza on Unsplash