Women-focused wealthtech firm Ellevest unveiled its newest offering today. The company, which was founded by former Merrill Lynch CEO and former Citigroup CFO Sallie Krawcheck, has expanded its online investing platform to launch banking services.

“At Ellevest, our mission is to get more money in the hands of women+ — because we know that everyone deserves the opportunity to build wealth, and that nothing bad happens when women have more money,” the company announced in a blog post. “Today, we’re launching the first-of-its-kind money membership designed to get more money in the hands of women+.”

The new banking services are available with an Ellevest membership, which ranges from $1 per month for the Essential plan to $5 per month for the Plus plan, and $9 per month for the Executive plan. All membership options include banking services, investing opportunities, and educational resources. Other services include personalized retirement recommendations and multi-goal investment accounts.

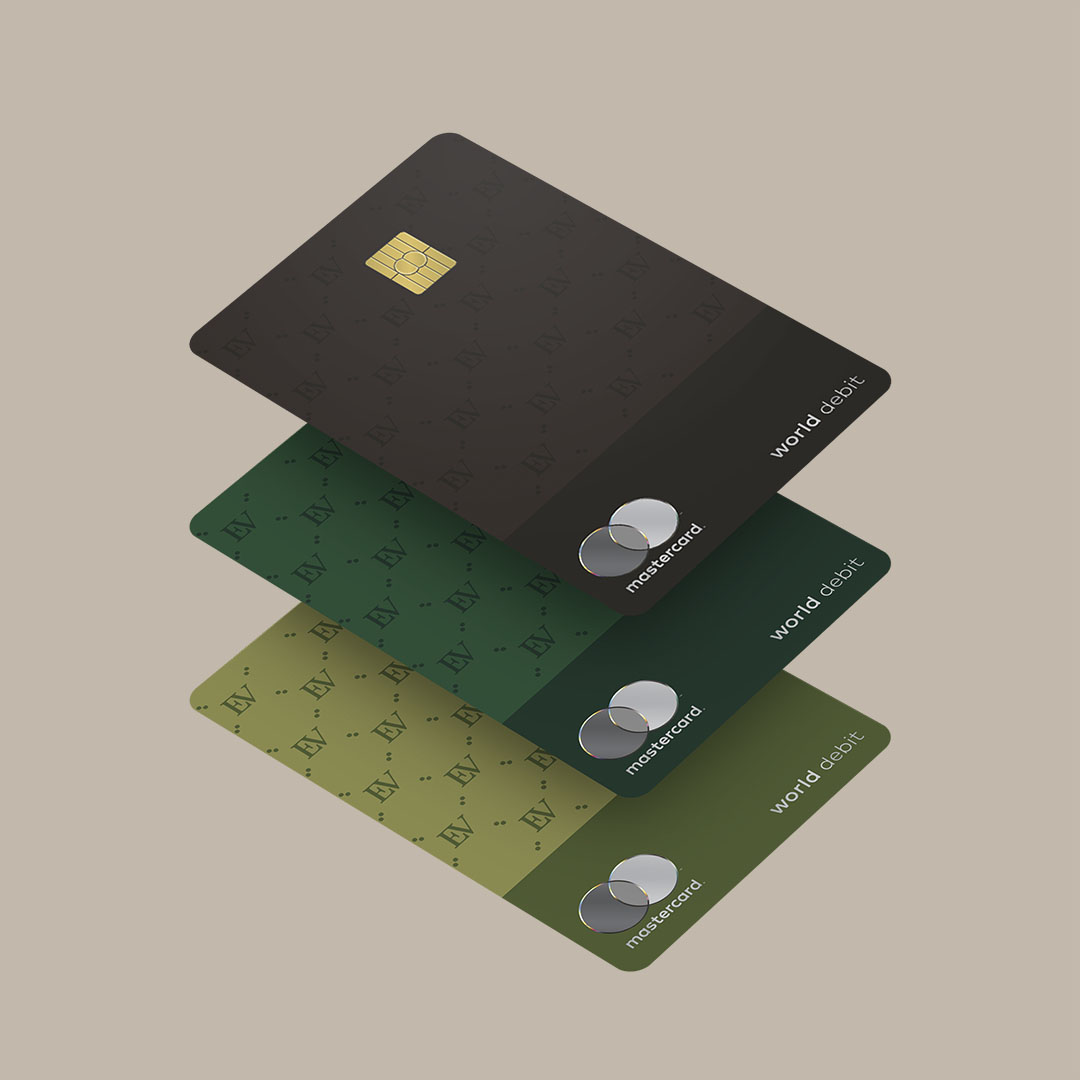

Members can access two accounts– one for spending and one for saving. The checking account comes with a World Debit Mastercard connected to an FDIC-insured account. The accounts boast no hidden fees, no minimum balance requirements, no transfer fees, no overdraft fees, and ATM fee reimbursements.

In the competitive world of challenger banks, none of these features stand out. However, Ellevest has created a bit of a cult following with its women-focused approach and content generation. The company has 180,000 followers on Instagram, which is 10x the number of followers that BBVA-owned Simple has, and more than Revolut, Monzo, and N26.

Ellevest’s gender-filtered approach further differentiates it when it comes to investing. The company’s personalized investment portfolio “includes a gender-aware investment algorithm that factors in important realities like pay gaps, career breaks, and average lifespans.”

Today’s announcement isn’t the first time a wealthtech platform has broadened its offerings to become a challenger bank. Betterment, Wealthfront, SoFi, M1 Finance, and Personal Capital all offer online-only checking accounts.

Ellevest was founded in 2014 and is headquartered in New York. The company has raised $77.6 million.