Financial market data provider Xignite serves 9+ million API calls per day and with today’s announcement of a new partnership, the company will add handsomely to that number. Xignite has partnered with Canada’s WealthSimple, which will leverage the California-based company’s APIs to power its new mobile stock trading app, WealthSimple Trade.

The app enables users to buy and sell more than 8,000 publicly-traded stocks and ETFs. Embedded within the app, Xignite’s APIs offer users real-time stock price data, information to power trades, and algorithms that automate users’ investment decisions.

“We are proud to be a key enabler of the fintech revolution in Canada,” said Stephane Dubois, Xignite CEO. “We help power and inspire the disruption of the financial services industry by providing entrepreneurs like Wealthsimple with financial data APIs to help them invent new businesses and revolutionary user experiences. The world’s leading robo-advisors use Xignite market data to power their platforms and apps.”

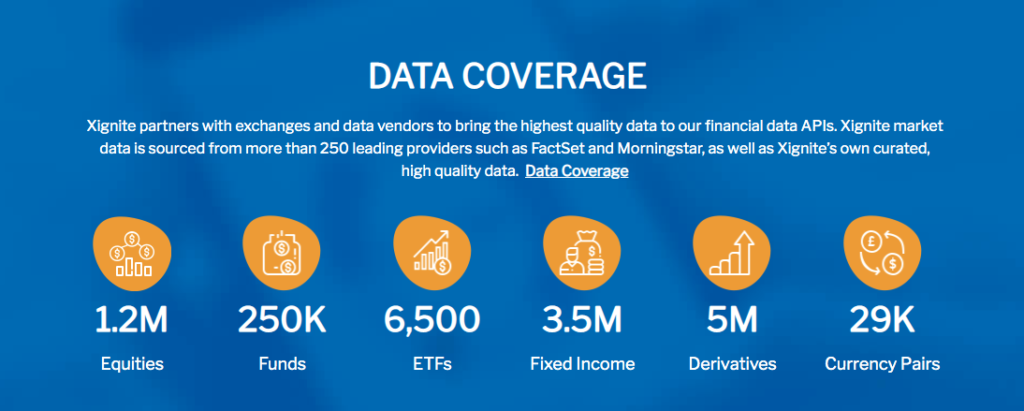

Xignite sources its cloud-based market data from 250+ providers, including data collectors, data originators, feed consolidators, OTC marketplaces, and index companies. In addition to leveraging data from Morningstar, FactSet, and EuroNext, Xignite also curates its own data. The comprehensive nature of Xignite’s data eliminates the need for clients to work with multiple vendors.

Xignite, which counts Interactive Data and Quandl as competitors, provides data to more than 800 organizations across the globe, including fellow Finovate alums Betterment, Personal Capital, Envestnet, and eToro. The company has raised almost $38 million since it was founded in 2000.

At the company’s FinovateAsia 2017 demo, Dubois showcased the Xignite Cloud Add-in, which integrates market data into spreadsheets.