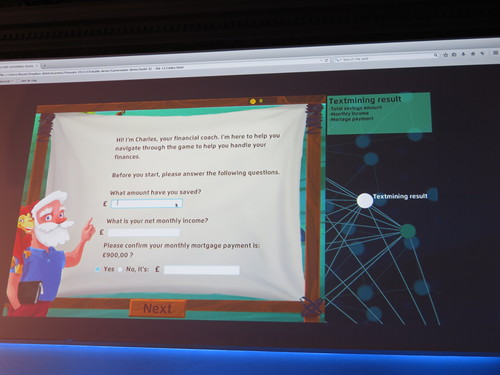

The Risk Game teaches the players how to budget more wisely. The starting point is the Financial Health Score (FHS), an index of a consumer’s financial health. The FHS determines the starting level in the game and drives the routing.

Players can use their earned points for saving and protecting themselves against unexpected events. Real life comes in when the players receive tips and see their FHS adjusted in their bank account based on their real behavior. The objective of the game is to activate people to better budget and therefore be able to pay their mortgage installments, reducing the risk for the bank.

AdviceGames Uses Gamification to Help Users Budget for their Mortgage

This post is part of our live coverage of FinovateEurope 2015.

AdviceGames unveiled its Risk Game to help users budget better for their mortgage:

Presenters Diederick van Thiel, CEO & Founder, and Rosali Steenkamer, COO & Founder

Product Launch: March 2015

Metrics: Privately owned, 15 employees, 7 customers, broke even in 2014

Product distribution strategy: Through financial institutions, through other fintech companies and platforms, licensed

HQ: Hilversum, The Netherlands

Website: advicegames.com