Guest post by Jeanne Capachin, Founder & Principal of CAPACHIN Research.

————————-

What do you do after you’ve led the call center for the White House? For Les Boothby, you run an amazing contact center for Elevations Credit Union, headquartered in Boulder, Colorado. There are several things about Les and what he does that point to the future of banking in a digital-first world.

What do you do after you’ve led the call center for the White House? For Les Boothby, you run an amazing contact center for Elevations Credit Union, headquartered in Boulder, Colorado. There are several things about Les and what he does that point to the future of banking in a digital-first world.

First, Les is passionate about his people and about member service. At Elevations, the contact center is a vibrant, engaging place to work. Les and his leadership team’s attitude and Elevations’ focus on service are in full view. This focus is borne out by the Just Say Yes attitude of the staff. Even if it means calls that last over an hour, or visits to a member’s home, they own the relationships and are prepared to do what it takes to solidify relationships.

A great demonstration of Elevations’ commitment came during my visit with Les and the Contact Center team last month. I was a few minutes early, and Les ended up being a few minutes late. Why? Because he was working with a member of his team and with a gentleman who couldn’t get into his online banking application. The call was escalated to Les when the inquiry became technically complex. The member had updated his operating system and anti-virus software which changed some advanced browser settings. They worked with this member for over 90 minutes checking software version updates and changing browser configuration settings and eventually succeeded. The payoff was a satisfied member able to continue banking online through his preferred browser.

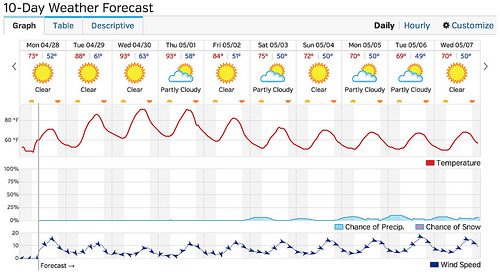

While the credit union’s service may be above and beyond what other institutions provide, this is what it takes to serve members and customers in a digital world. A significant portion of call center volume is about online, mobile, and tablet banking. At Elevations, technology-related calls were just 8% of the total in 2011, now they are 25%.

But when members call, they don’t want to talk to the Geek Squad. They are looking for a sympathetic person who can explain to them in plain English how to solve their problems. Elevations call center staff aren’t divided into technology and/or product specialists. Members have just two choices when they dial in: Member Services or Loan Information. With generalist call center staff focused on relationships, members needn’t navigate through a complex decision tree.

In addition to telephone support, the contact center also supports secure chat through the online channel. But the CU finds that members prefer picking up the phone. So as members embrace new technology for transactions, they turn to the oldest remote channel, the telephone, for more complex queries.

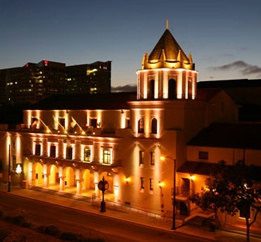

In its mission to serve its members anywhere and anytime, Elevations has also opened two new branches that are less branch, and more member advice/support center. These branches look more like a hotel lobby. There are tablets to walk members through digital banking services, an ATM, and a counter with a cash handler and two terminals. Through conversation and social interactions, the branch staff learn more about their member’s financial needs, and can introduce them to financial or technology products. If staff are in their offices, they happily bound out to greet members. The credit union embraces an omni-channel experience, and is using their physical locations to subtly transition members to digital channels.

__________________________________

Bottom line

__________________________________

As we build out omni-channel banking, the call center still plays a central role. It has long been the catch-all for complex issues, both technical and transaction related. Contact center representatives, like those at Elevations, must be able to think on their feet and make judgment calls. They must understand when to waive fees, when to offer additional services, probe to find root issues, and really own the problem.

At Elevations, hiring for attitude is key, and they empower their staff to solve problems. The CU has a comprehensive, month-long training program to educate all staff on member service, products, and technology. Contact center staff are briefed on all marketing programs before they are conducted, and educated on all digital solutions before they are introduced to the member base. Metrics in the contact center focus on enhancing and stabilizing relationships. Call volume is important, but more critical is the ability to retain members and sell appropriate products.

As institutions examine their omni-channel strategies, a refresh of the contact center should be part of the effort. If Elevations is an example of where we’re headed, we’ll be in good hands.

—————–

Figure 1: This is a Call Center?

Figure 2 Genius Bar at an Elevations Branch

—————–

Author: CAPACHIN Research founder and principal Jeanne Capachin has been working in the financial services industry for more than 30 years. Working with financial institutions, research providers, and technology vendors, Ms. Capachin educates and informs her clients and helps them grow their businesses. You can reach her at [email protected].