![]()

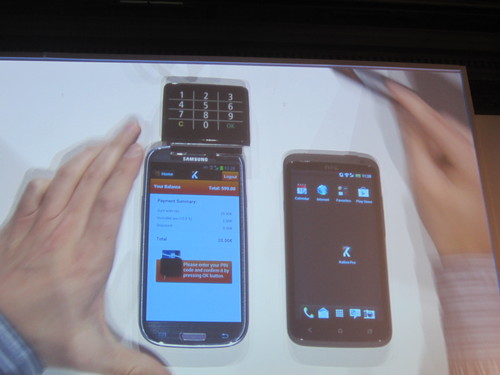

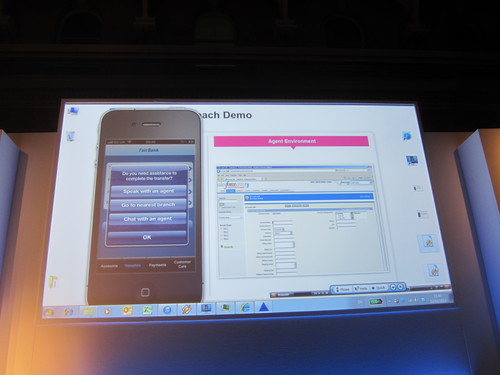

Midway through the second session of the day, here is Kalixa with a demo of their new m-wallet, Kalixa mpos:

“Kalixa mpos is a new mobile POS device enabling ‘prosumers’ and small businesses to accept payments anywhere, anytime, and anyhow. Kalixa mpos accepts all major debit and credit cards and can be used wherever, whenever. Kalixa mpos is totally seure and can offer businesses next day settlement without contract.Kalixa is a wallet linked to multiple devices – offering consumers one account, one wallet, one way to pay. As an m-wallet, Kalixa can make P2P and MFC transactions, in-store, online or payment over the phone, as well as offering the ability to withdraw cash from ATMs. With no exchange fees, no commission, no charges, Kalixa is prepaid and easy to load via internet banking, credit/debit card, voucher and direct company payments.”

Product Launched: February 2013