In the United States, banks have squandered $10+ billion providing free billpay during the past 12 years. But that’s about to change, if the model from Palo Alto-based Check (formerly PageOnce) takes hold.

First, a history lesson for anyone born after 1980.

For the first few years of the online era (mid-1990s), “electronic bill payment” was offered by banks and credit unions with monthly fees of $5 or $6. That made it roughly breakeven, at least if you didn’t count the sometimes heavy burden on customer service to solve problems caused by the very analog back-end of the so-called “electronic” service.

But then in 2002, Bank of America ruined even that by offering free billpay and advertising it widely on television (note 1). It even released internal data purporting to prove that what the bank gave up in fee income was more than compensated by intangibles such as higher deposit totals and lower customer churn (note 2). I like to think that if Bank of America had read their OBR more closely, it would be booking an extra $300 million per year in fee income (note 3), but I digress.

Back to present day: American consumers have grown accustomed to free billpay, and I don’t think that will change. But that’s what makes Silicon Valley’s mobile-billpay upstart so intriguing.

Let me introduce you to Palo Alto-based Check (still better known as PageOnce) which originally launched as a personal scheduler (hence, the original name). It quickly morphed into the first native mobile PFM, landing on the scene in 2008, just a year after Mint launched.

But given the difficulty of monetizing budget-and-spending PFM, Check has tried several ways to earn revenue including offers, credit bureau monitoring, subscription billpay, and now transaction-fee-based billpay. Apparently, the last has the most promise, so the company rebranded as Check (with URL check.me), a big risk given the prominence of its PageOnce brand.

_______________________________

How it works

_______________________________

1. Choose biller from previous entries or add a new bill (see screenshot #1)

2. Enter account number with biller OR enter username and password and a check will download for you (screenshot #2)

3. Choose amount (screenshot #3)

4. Choose speed of payment (screen #4):

– Scheduled

– Send now: Standard

– Send now: Expedited

5. Choose payment type: Credit card, debit card or bank account (screen #5)

(Note: credit card option is not available for paying other credit cards, which is a Visa/MasterCard rule according to the company).

6. Confirm and pay (screenshot #6)

And now for the twist. Were you imagining this service displayed across your spacious desktop browser? No way. This is mobile-only and works like a charm, though the fees are a little confusing (see below).

The mobile interface is great, using state-of-the-art technology tricks to cut down on data entry:

- Mobile camera used to import card details, powered by Card.io (see screenshot #8)

- Account aggregation to gather billing info (note 4)

- Comfortable mobile layout for selecting payment options

____________________________

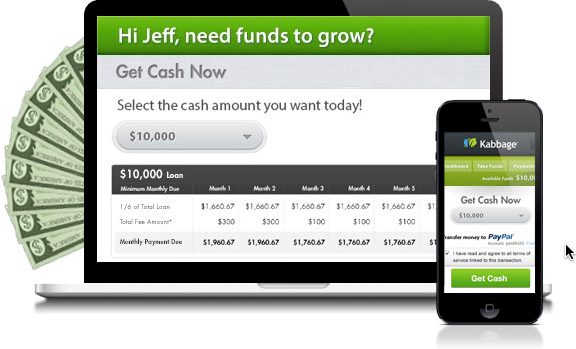

Pricing

____________________________

Check has free billpay of course. Just enter your bank account details, schedule the payment at least a week in advance, and you are good to go. However, for those not quite as organized, or who don’t like revealing their checking account number, users can choose to pay a 4% fee (min. $4.99) to pay via credit/debit card within two to three days. Or for $6.99 (flat), the payment can be made the next day.

Here’s the freemium pricing model:

3-to-5 day ACH >> Free for any size payment (subject to account-specific maximums)

2-3 day debit/credit card >> 4% service fee (minimum $4.99)

Next-day debit/credit card >> $6.99 flat-rate service fee (note 5)

_______________________________

Analysis

_______________________________

Check’s billpay system is designed for the mobile channel. For the most part, it works. Allowing users to easily choose payment source and delivery date (including next day) is critical to making billpay valuable. Banks would be wise to use a similar design (or license from Check), to increase fee revenues. I think it’s entirely possible that billpay becomes a stand-alone profit center under this model (note 6).

That said, with three or more payment sources combined with three payment speeds, scheduling new payments can get confusing, especially trying to determine tradeoffs between speed, source and price. When I originally set up the account, it seemed relatively straightforward. But when I went back the next month, it was hard to re-engage.

The company also needs to help users choose the payment method providing the best bank for the buck (optimizing price, speed and convenience). The company recently added a pop-up box (screenshot 7) that helps. And the applicable service fee is clearly shown at every step of the process, albeit in fairly small type (screenshot 6). I understand the company needs expedited and/or card-based payments to make a profit (similar to how PayPal defaults users to bank transfers instead of credit card payments). But users need to fully understand their options throughout the process (note 7).

Long-term, the Check service is more valuable if its users become accustomed to paying all their bills from the site, even if most are free bank transfers. That way Check becomes the go-to spot for billpay, and are more likely to be remembered when users need expedited payments or a credit card charge when funds are low.

_______________________________

Screenshots

_______________________________

#1 (left) Bills due list

#2 (right) Add a biller form

#3 (left) Choose amount

#4 (right) Choose payment speed

#5 (left): Choose payment source/type

#6 (right) Confirm payment screen (with fee disclosed)

#7 (left) Clicking on “?” on screen 6 launches a box with the fee schedule

#8 (right) Add credit and debit cards via scan

——–

Notes:

1. For more details of the history of billpay pricing, see our post from 2004 and OBR #109, Pricing Online Services (subscription, Aug 2004).

2. I have read dozens of these case studies, and I still don’t believe that anyone has proven that billpay CAUSES those results. Everything I’ve ever seen proved CORRELATION. Yes, billpay customers are more profitable and more loyal. But they would have been anyway without without subsidizing them with a costly, trouble-prone service. I still maintain that lifetime statement archives would be a better retention device, and far less expensive than free billpay (see OBR 118, Lifetime Statement Archives (subscription, June 2005).

3. Assume Bank of America would have 5 million active billpay customers paying $5 per month x 12 months = $300 mil

4. Hopefully, it’s only a matter of time (and a licensing deal with Mitek), before Check imports the billing statement directly into its app.

5. Due to its various payment-provider contracts, Check’s expedited payment pricing doesn’t always seem logical. For example, the company charges a flat fee of $6.99 for next-day delivery of any size payment. But for 2- to 3-day service, the charge varies by payment size (4%) with a minimum of $4.99. So, for any payment above $175, it’s cheaper to send overnight than via the slower 2- to 3-day service. On a $500 payment, that’s a savings of $13 to send overnight. To pay my current statement balance, it cost $90 to send via 2- to 3-day service or $6.99 overnight, a whopping $83 savings. And Check does not mention this when you cue up a $2,000 payment.

6. Besides fees based on transaction speed and payment source, we also believe there are significant potential revenues from credit lines used to cover payment-account shortfalls and the newest fee-income opportunity, expedited mobile check deposits (see IngoMoney, believed to be powering Regions Bank among others).

7. In the month I’ve spent testing the service, Check has made the service fee much more transparent, so I believe they are moving in the right direction.

![]() Along the same lines, most banks could do better providing peace of mind. The most important factors are transaction/payment reliability, service quality and, probably most important these days, security. Again, it’s about the peace of mind knowing that your bank will run your account flawlessly while keeping thieves at bay. And failing that, reimburse the losses without a business disruption.

Along the same lines, most banks could do better providing peace of mind. The most important factors are transaction/payment reliability, service quality and, probably most important these days, security. Again, it’s about the peace of mind knowing that your bank will run your account flawlessly while keeping thieves at bay. And failing that, reimburse the losses without a business disruption.

![clip_image002[8] clip_image002[8]](http://s3.amazonaws.com/finovate-archive/old/WindowsLiveWriter/cb0035956ea7_B397/clip_image002%5B8%5D_thumb.jpg)