This is part three of a six part blog series about savings technology. Last week we discussed how savings technology works in goals-based PFM platforms and standalone, automated savings platforms. Today, we’re shifting our focus to a younger generation.

Missed the other five savings categories? Check them out:

- Goals-based PFM

- Standalone, automated

- Crowdfunded savings

- Advice-only

- Passive investing

Generation Z, also known as the iGeneration, is defined as people born between the years 1995 to 2012. While this group generally doesn’t have much discretionary income (or any income at all), they are at a key age to learn how to manage their money.

Gen-Z targeted

Many banks understand the value of catering to younger generations– if you hook them young, it’s easier to score them as clients for life. Gen-Z targeted solutions work well for banks seeking easy client acquisition (a B2B model) and for parents who want to teach their children fiscal responsibility or are tired of giving hand-outs (a B2C model). Worldline and FamZoo both offer solutions for banks that appeal to kids as well as their parents.

- Worldline

At FinovateEurope last month, Worldline debuted its WL Connected Piggy Bank, a smart piggy bank that is connected with a tandem mobile banking app for kids. The piggy bank serves as a physical savings account for the kid– when a coin is deposited, the piggy lets out a snort.The connected mobile app helps the child recognize coins and add up the balance of the physical coins in their piggy bank combined with the amount in their online account. The parent-facing side of the mobile app allows parents to deposit money into the child’s online account using NFC between their phone and the piggy’s nose. Snort, snort!

Worldline’s Connected Piggy hogs the stage at FinovateEurope 2017 in London.

- FamZoo

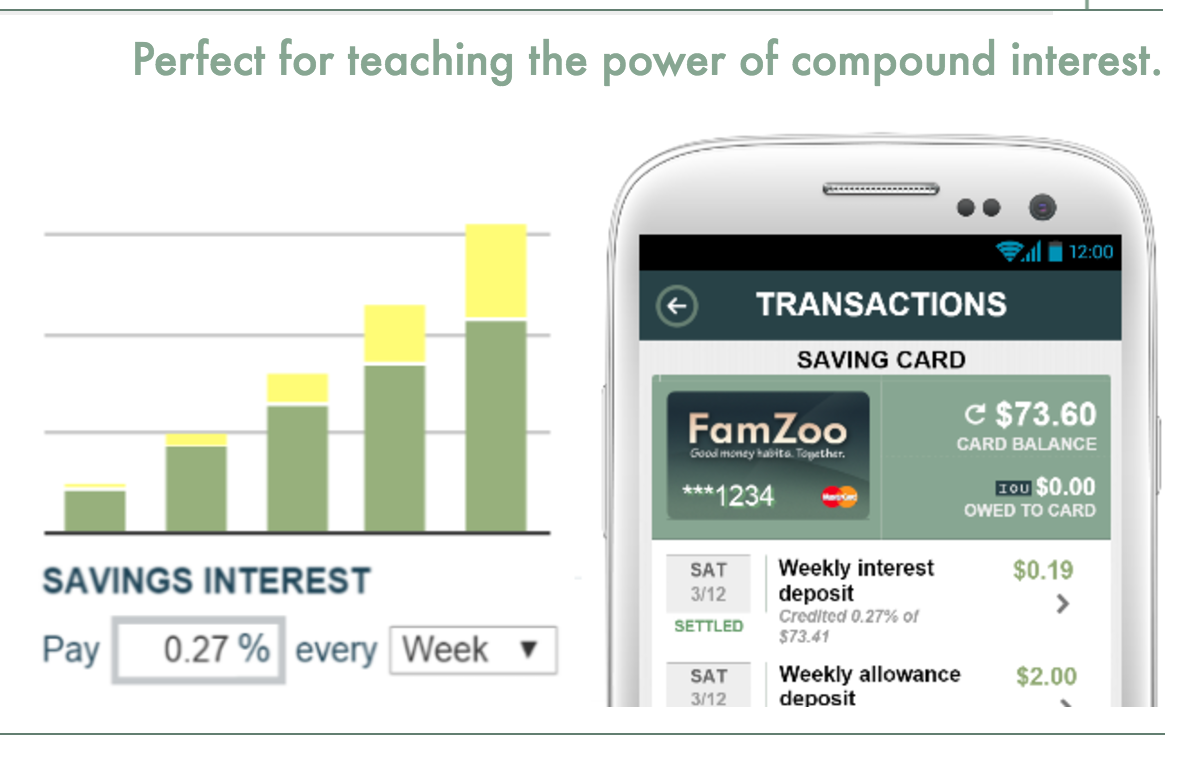

While FamZoo is geared mostly toward spending, it also helps teach kids the other faces of financial discipline– saving and giving. With FamZoo’s Virtual Family Bank, parents help kids manage their money. Among the features are parent-paid interest on savings balances and savings contribution matching. The app works with either an IOU account or prepaid cards, a feature FamZoo debuted at FinovateSpring 2013.Because they offer spending independence, the prepaid cards help the FamZoo app grow with the child through high school; something a piggy bank cannot do. FamZoo takes both a direct-to-consumer approach and a B2B approach. The company launched its partner edition at FinovateFall 2011, where it won Best of Show.

With FamZoo, parents set the compound interest rate with which they want to reward their child

With FamZoo, parents set the compound interest rate with which they want to reward their child

To recap, here are the types of savings tech we’ve seen so far:

- Goals-based PFM

- Standalone, automated

- GenZ-targeted

Stay tuned later this week for the final three categories.