Digital financial services company Wirecard is partnering with Xolo (formerly LeapIN) this week to offer a more robust set of banking services for gig economy entrepreneurs.

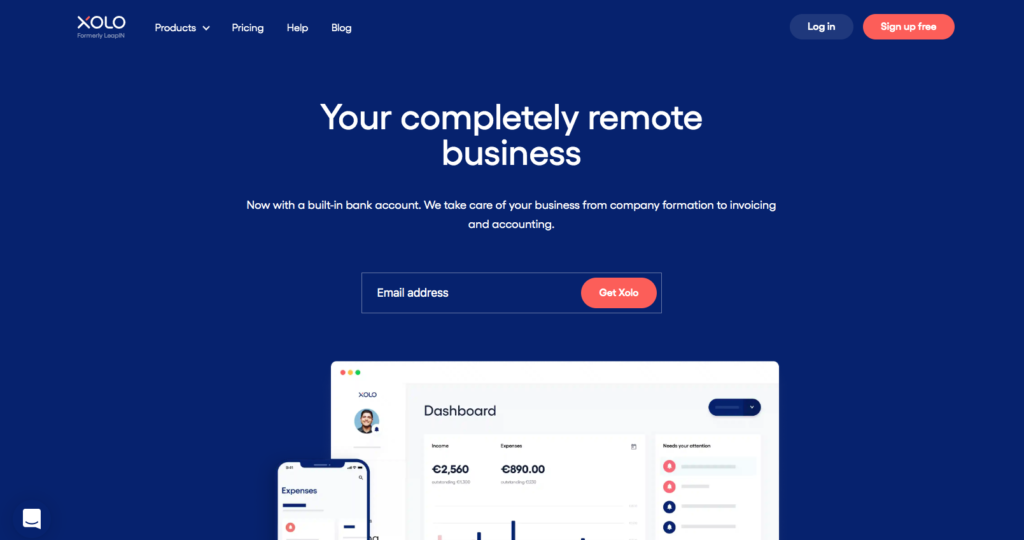

Under the agreement, Xolo, a platform that helps entrepreneurs launch and run micro-businesses, will bolster the banking and accounting tools on its existing platform. The company will leverage Wirecard’s banking license to allow its 30,000 users to open a business bank account online within 48 hours, receive a debit card, and monitor their banking, tax, and compliance activity.

The move targets gig economy workers, an underserved segment of the population that is growing at 17% per year with an estimated value of $204 billion in 2018.

“This new partnership marks a significant step for Xolo as we strive to establish a new virtual nation for freelancers and solopreneurs,” said Allan Martinson, Xolo CEO. “With the addition of Wirecard’s pioneering digital banking solution, we will continue to build out our vision for enabling millions of micro-businesses to get to market quicker and without the bureaucracy.”

Xolo’s news follows a recent announcement last month from U.K.-based Wollit, which raised funding for its platform that helps gig economy workers smooth out their fluctuating cashflow. There is a significant lack of services for this consumer segment across the globe, but startups and challenger banks have been slowly filling the gaps that banks have left open.