B2B digital banking platform Urban FT acquired Oregon-based iParse today. Urban FT plans to leverage iParse’s technology and its mobile banking-related patents.

Terms of the deal were not disclosed. Operations will continue as usual for iParse, which will function as a separate division from Urban FT. All staff (except for the founders, who are retiring) will continue as employees of Urban FT’s new unit. The company’s CEO, Richard Steggall, is calling the new deployment a “mobile banking plug-in solution” because it empowers financial institutions of any size to compete in the mobile banking space by plugging directly into their core, simulating integration. Urban FT estimates the mobile plug-in option will be available to clients within the next couple of months.

In the press release, Steggall said:

“The iParse tech strategically complements Urban FT’s suite of white-label mobile banking solutions by providing a proprietary way to bypass core processor integration, while delivering a robust mobile banking service for financial institutions to offer to their customers…. now credit unions and banks of any size can play—and play competitively—in the mobile banking space.”

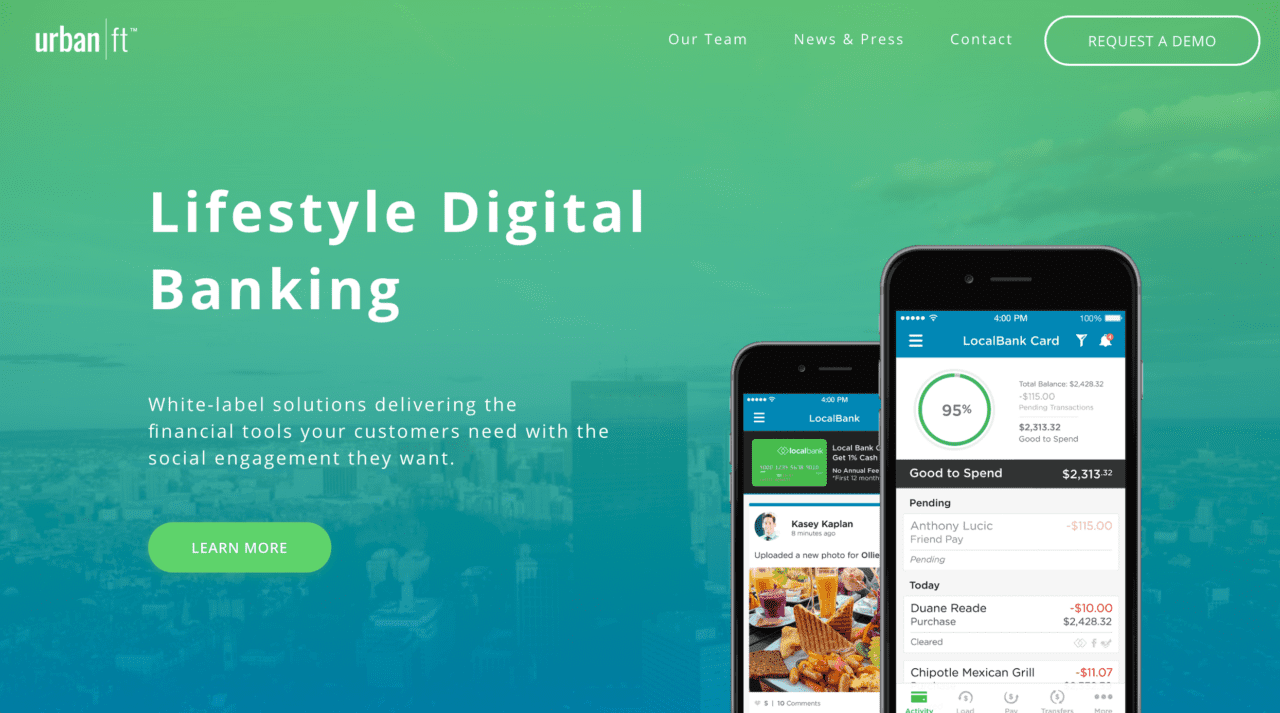

Founded in 2013, Urban FT expects the number of bank clients it serves to double to more than 150 within the next year. Kasey Kaplan, Urban FT President said, “On the bank side, we size the market at approximately 12,500 potential targets, and we know that almost 42 percent of credit unions have yet to launch any form of mobile banking.”

At FinovateFall 2016, Urban FT debuted the Workshop, a real-time mobile app management platform that enables banks to quickly configure, brand, and launch mobile banking apps without coding. The company has 40 employees and, in addition to financial institutions, also serves clients in telecommunications, insurance, and travel. Among the New York-based company’s partners are Sprint, Boost Mobile, Yelp, Banc of California, and Sunrise Banks.