A couple weeks back I had a conversation with Andrew Besheer, Head of North America for Appway, about the rise of challenger banks. Our discussion centered around some of the data points in Ron Shevlin’s piece, The Online Banking Insurgency of 2020, published in Forbes last month.

One of the questions that came up was if this surge in new challenger bank accounts is an accident of digital transformation? In other words, are Millennials and Gen Z consumers gravitating towards challenger banks because their websites appear more digitally savvy?

At its core, this is a chicken-and-egg question. Are challenger banks successful because their tech-first approach satisfies consumers? Or are underserved consumers driving challenger banks to create new products and services that banks are unable (or unwilling) to offer?

First, its important to recognize that both challenger banks and incumbents know their target market. That is, the challenger banks are catering to an audience looking for a different bank experience than the one that appeals to their parents.

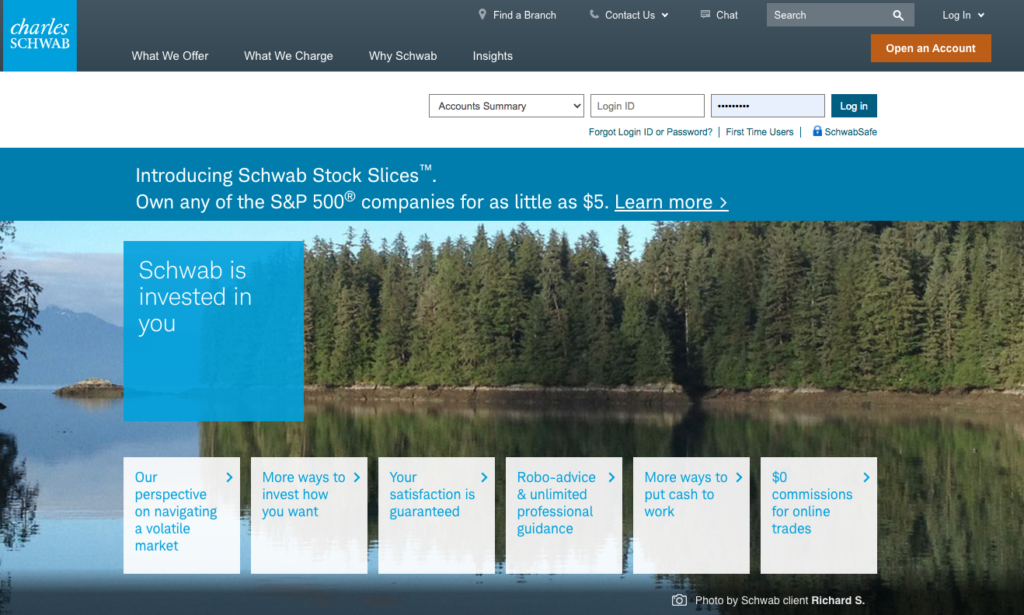

To answer this question, first, take a look at the outward appearance. Traditional banks’ websites are text-heavy, with long-winded fine print, and are intimidating enough to drive away less experienced consumers. Conversely, challenger banks use colloquial language and present websites that look simple and transparent. As an example, take a look at Charles Schwab’s website:

And now look at Dave’s:

Both are relatively technologically and digitally advanced banks, but they are appealing to two entirely different demographics.

Taking a look under the surface, the products and services each bank offers are also different. Schwab’s are heavily geared toward investing and trading, while what Dave offers– paycheck advances and credit building tools– seems to center around keeping its users afloat.

In the end, the two approaches are perfectly suited for users on opposite sides of the generational spectrum. My father and grandfather would never bank somewhere that had a cartoon as a mascot. And younger, Generation Z users don’t trust incumbent banks’ language and apparent lack of transparency.

Now, to answer the question, “are Millennials and Gen Z consumers gravitating towards challenger banks because their websites appear more digitally savvy?” The answer is no. Challenger banks are built from the ground up to entice this generation of users. And while the banks’ advanced digital capabilities help to draw users in, they are not the sole reason younger, tech-savvy users choose them.

You can check out the full interview, where Besheer and I delve further into the challenger banking conversation, on Appway’s website.

Photo by Mario Dobelmann on Unsplash