Community banks and credit unions have long been the cornerstone of local economies. As technology and consumer preferences evolve, however, so must their revenue strategies.

Today’s Streamly video highlights a conversation I had with Rob Thacher, CEO at BankShift, a banking-as-a-service platform. During our conversation, Thacher and I discussed embedded finance, leveraging data to create personalized products, fintech partnerships, subscription services, and BankShift’s Brand on Banking.

BankShift built a business model all around the credit union space because they give dividends back to their members. And so we built a Brand on Banking ecosystem that enables community banks and credit unions to be different and have a new revenue stream. Financial institutions can embed their own technology inside that brand for revenues, for loyalty, and control.

BankShift creates a digital banking platform that helps community banks and credit unions generate new revenue streams, enforce control, and build loyalty. The company’s SDK provides low-code tools that help financial institutions create a branded, a unified app with a single login and a money transfer tool. The Oregon-based company was founded in 2020.

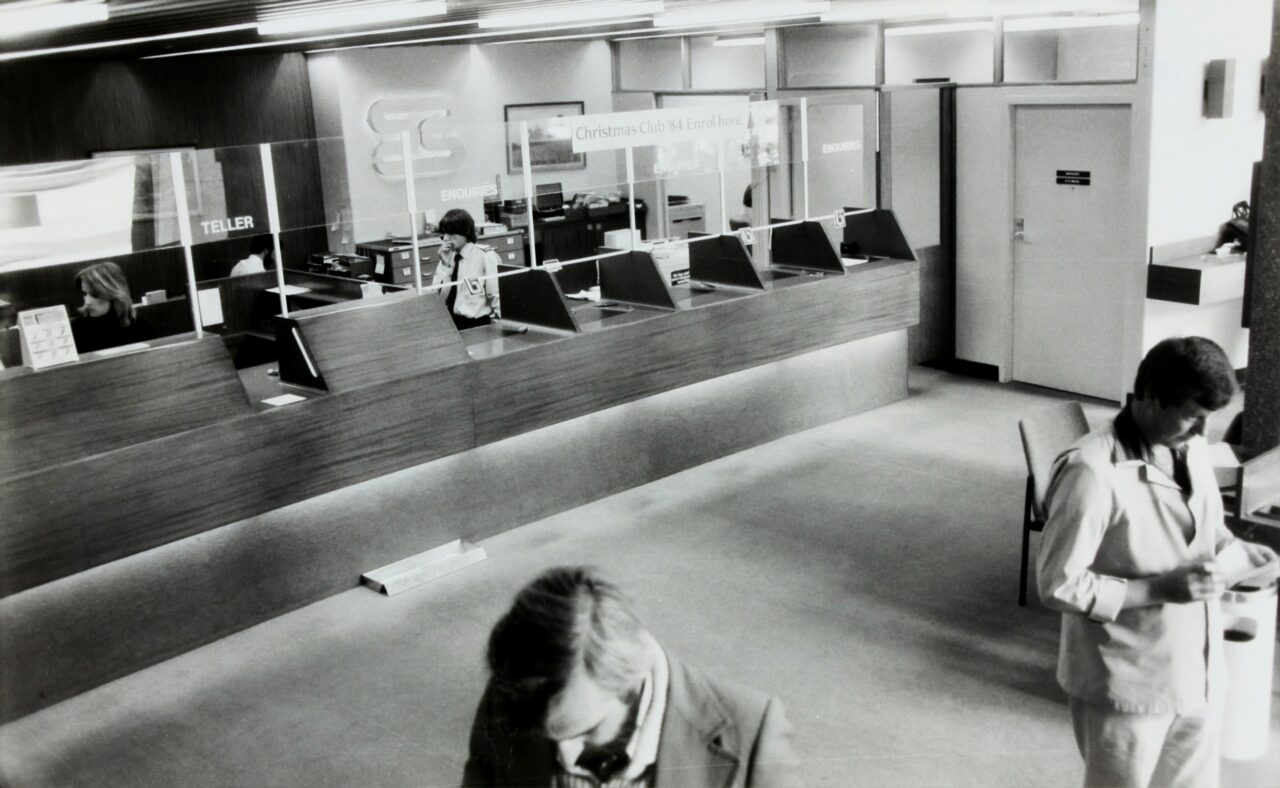

Photo by Museums Victoria on Unsplash