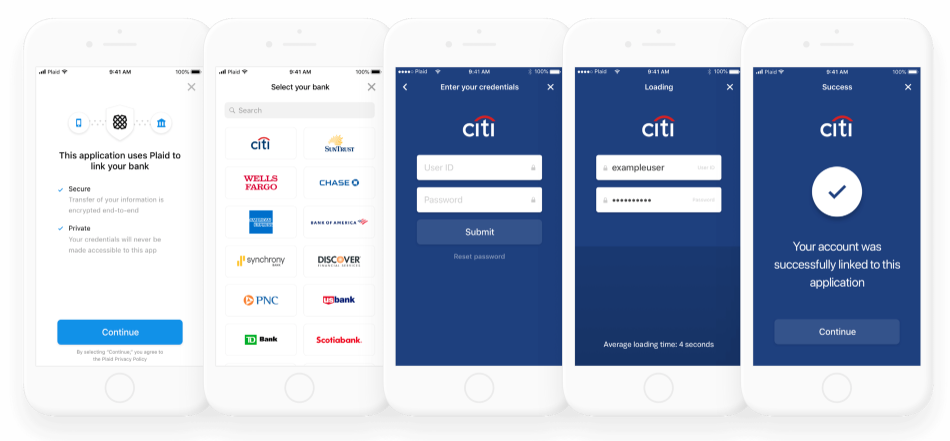

Fintech developer tools expert Plaid announced today it enhanced Liabilities, a product it launched in July to offer developers access to information about how much money a consumer owes.

Upon launch, Liabilities was limited to offering insight into consumers’ student loan balances. Today the tool has added support to show consumers’ credit card details. While Plaid has always offered information about consumer credit card transactions, today’s update broadens the information available by returning details about payment terms, APR type, APR percentage, interest charge amount, minimum payment, last payment date and amount, due dates, and more.

This new launch will allow developers create tools that help borrowers gain a clear picture of their financial obligations, consolidate debt, and pay down their credit card balance faster.

The credit card data tool is now available in Plaid’s sandbox, development, and production environments. The company will add more debt categories in the future to give developers more options to help their users manage and overcome their debt.

At FinDEVr San Fransisco 2014, the company’s founder, Zach Perret gave a presentation about leveraging the Plaid API for financial infrastructure. Plaid has raised $310 million since it was founded in 2013. After the company’s most recent investment last year, TechCrunch estimated Plaid to be valued at $2.65 billion.