This post is part of our live coverage of FinovateFall 2015.

PaySwag will tell us about the launch of its simple payment-collection app:

PaySwag will tell us about the launch of its simple payment-collection app:

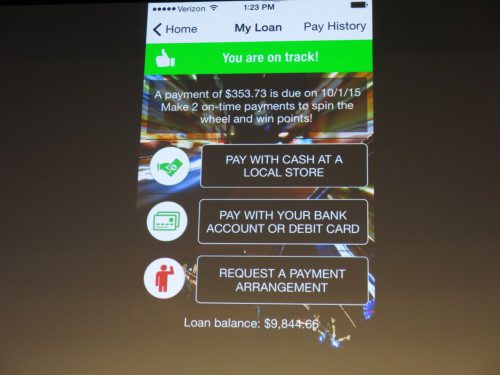

PaySwag‘s payment, rewards, education, and feedback engine offers a gamified mobile experience for improving the financial lives of the underbanked. The mobile app simplifies the collection of payments, fees, and fines with cash or cards. Customers are rewarded for paying on time, completing financial and life skills education, and maintaining communication.

Never before has this demographic been incentivized with Amazon gift cards, Redbox rentals, or Starbucks lattes just for keeping a payment plan. The robust administrative back-end also provides advanced workflow, security, integration, and analytics capabilities.

Presenters: PaySwag’s CEO Max Haynes and CTO Mark Miller

Product launch: September 2015

Metrics: $500,000 privately funded to date; 8 employees

Product distribution strategy: Direct to business (B2B); through financial institutions; through other fintech companies and platforms; licensed

HQ: Reno, Nevada

Founded: October 2014

Website: payswag.com