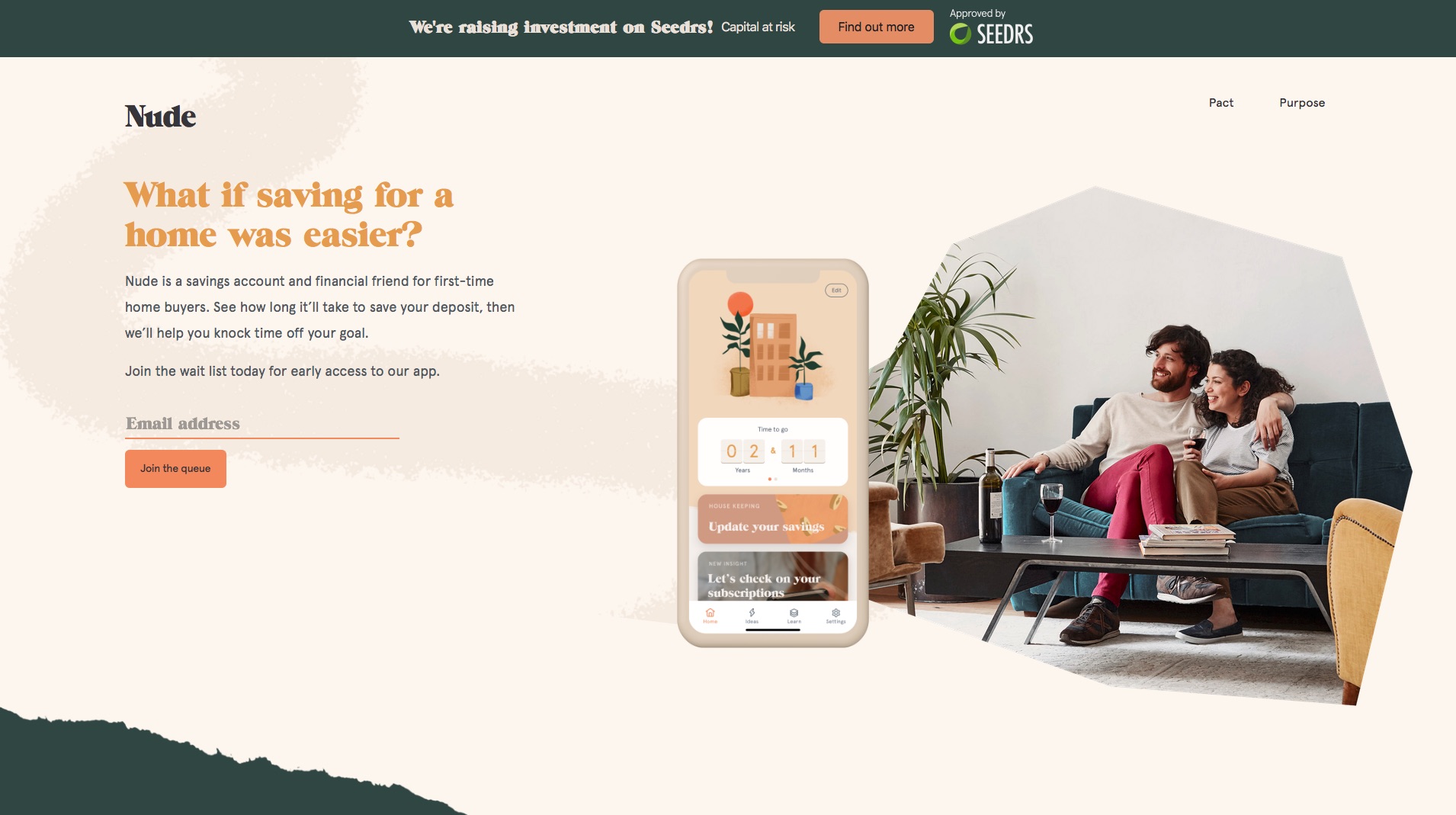

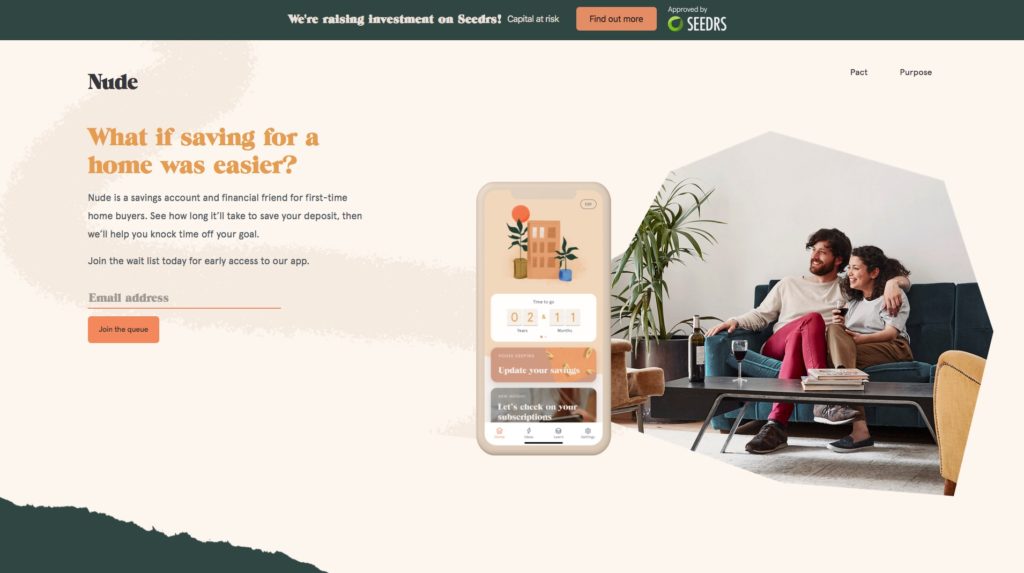

Nude, a U.K.-based fintech that helps prospective homebuyers save money to buy their first home, raised $4.1 million (£3.3 million) in a funding campaign waged on Seedrs. The company also managed to secure additional funding from the U.K. government’s Future Fund. Both fundings add to the $2.1 million (£1.7 million) in growth capital Nude secured last year.

“The challenges facing young people are huge, with a massive wealth imbalance, a complex financial system and little help,” Nude CEO and founder Crawford Taylor explained. “We’ve been planning, testing, and building Nude to make the financial world fairer and easier, starting with helping people buy their first home faster and easier than ever before.”

Nude combines a savings account, PFM app, and financial advisory to help homebuyers determine just how much money they will need to save for their first home by analyzing property location and type, as well as the homebuyer’s capacity to save. The app looks at the user’s overall spending to identity areas of potential savings that could be diverted towards the homebuying goal, and uncovers potential “savings boosters” such as government bonuses or savings “streaks” that can accelerate the saving process.

“We don’t think the financial world is very friendly, or easy, and it definitely doesn’t make you feel as good as you should when you’re managing to save up a house deposit,” Nude co-founder and CMO Marty Bell said. “We’re here to change that. Nude is like having a friend that’s really good with money with you, all the time.”

The company’s future plans include securing a banking license and offering mortgage products, as well as children’s accounts and retirement savings accounts.