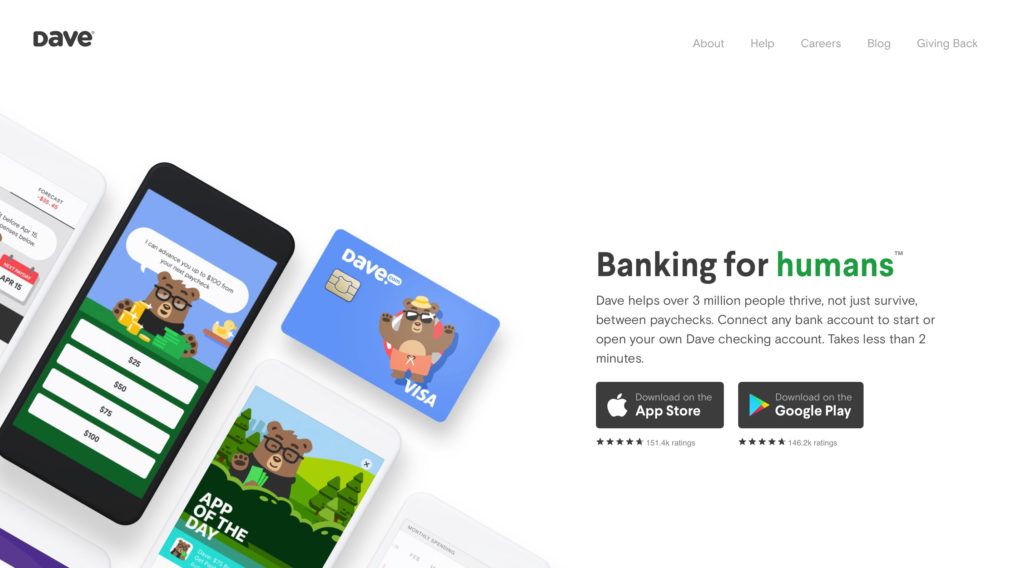

Fresh from being showcased by Forbes in its Next Billion Dollar Startups 2019 feature last month, PFM app Dave has partnered with leading financial services data platform MX, and will leverage the company’s technology to help users better analyze their expenses and manage their finances. The app, which has more than 3.5 million users, helps with budgeting and building credit, and improves cash flow by helping users access short-term financing between paydays. And rather than charge fees, Dave users pay for the service on a “tip-based model.”

“The deliberate approach Dave has taken to empower greater financial strength and solve the pervasive financial pain point of overdraft fees is inspiring and exactly the kind of innovation MX loves to enable through its highly available and augmented data platform,” MX Chief Customer Officer Nate Gardner explained.

Described as the finance version of David taking on the Goliath of the big banks, Dave was launched in 2016 by Paras Chitrakar, John Wolanin, and current CEO Jason Wilk. The app was named App of the Day at the Apple Store in the spring of 2017, and has been downloaded nearly 10 million times. In Forbes’ profile of the company last month, the authors noted that Dave had raised $13 million in funding, and estimated the company’s 2018 revenues at $19 million. Mark Cuban is among the company’s investors.

MX demonstrated its latest innovations at FinovateFall 2017, where it presented Discovered Accounts, a solution that helps financial institutions maximize the personalization opportunities that exist within transaction data. The company is a multiple time, Finovate Best of Show winner, having been honored by Finovate attendees six times since their Finovate debut in 2014 (as Money Desktop).

In June, MX announced a major funding, picking up $100 million in a round led by Battery Ventures. The additional capital took MX’s total financing to $175 million, and will help fuel product development and the hiring of what MX founder and CEO Ryan Caldwell called “the best talent in the industry.” He added, “We could have raised several times this amount, but we simply didn’t need the capital. We are disciplined in our spending and building for the long term.”

Dave is not the only partnership MX has forged this year. The company announced in May that it was teaming up with Meridian to make its Pulse personal financial wellness solution available to the credit union’s customers. Meridian is the largest credit union in Ontario, Canada, and the third largest in the country.

Also in May, MX partnered with fellow Finovate alum Kony, who will leverage MX’s PFM expertise to enhance its own digital banking experience product, Kony DBX.

Earning a 2019 Utah Genius award in April, Lehi, Utah-based MX has more than 2,000 financial institutions and 43 of the top 50 digital banking providers as partners. The company was founded in 2010.