U.S. peer-to-peer lending pioneer Lending Club closed the doors on its in-house small business lending operation. The good news is that it opened a window for small business clients through a round of partnerships.

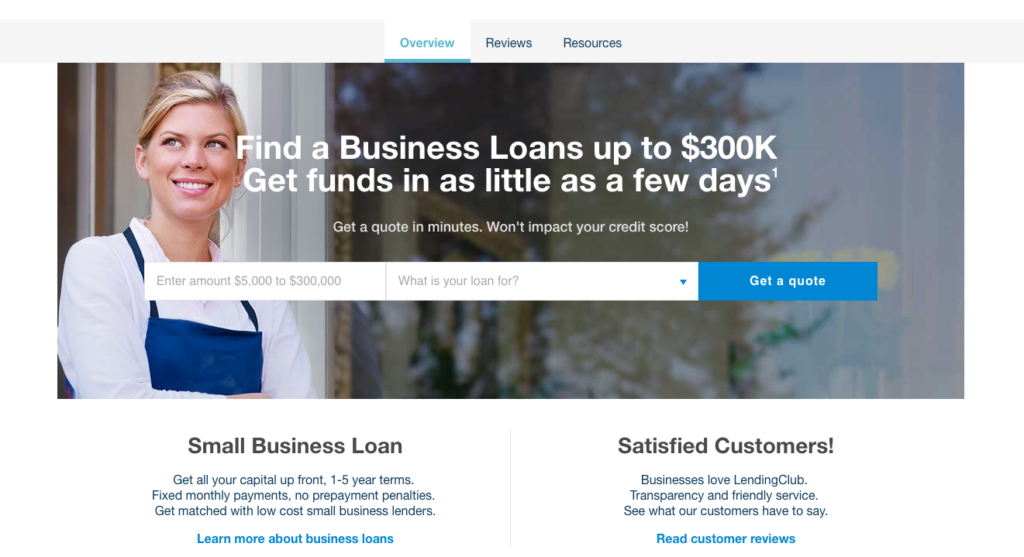

Opportunity Fund, a non-profit small business lender; Funding Circle, one of the largest alternative small business lending platforms in the U.S.; and Lending Club have teamed up to offer Lending Club’s small business clients access to credit. Businesses can now borrow up to $300,000 for rates as low as 5%.

“With partners like Opportunity Fund and Funding Circle, we’re creating an ecosystem where LendingClub’s members can take advantage of additional services from trusted providers that can help them generate more savings,” said Scott Sanborn, CEO of LendingClub. “This enables us to both deliver greater value to our applicants and capture a new revenue stream for LendingClub, while further simplifying our business and setting the stage for more partnerships and innovations for Club Members.”

Opportunity Fund will leverage LendingClub’s online application technology to provide prequalified offers to underserved small businesses, while Funding Circle will apply its credit assessment process to fund loans for established small businesses. Overall, the three will be able to serve a broader range of applicants, including those that may have previously been rejected because of limited credit, including businesses owned by minorities, women, and immigrant entrepreneurs.

Lending Club entered the small business lending market in 2014, before the company’s original CEO, Renaud Laplanche, resigned in 2016 amid accusations of loan-documentation errors.

Founded in 2006, Lending Club demoed at FinovateSpring 2009 and at the inaugural Finovate in 2007. The company went public in 2015 and today has a market capitalization of $1.46 billion.