I’ve been busy catching up on all of the discussions that took place at FinovateFall last week (if you are on our attendee list, you can do the same), and a panel conversation on AI and bots stood out to me.

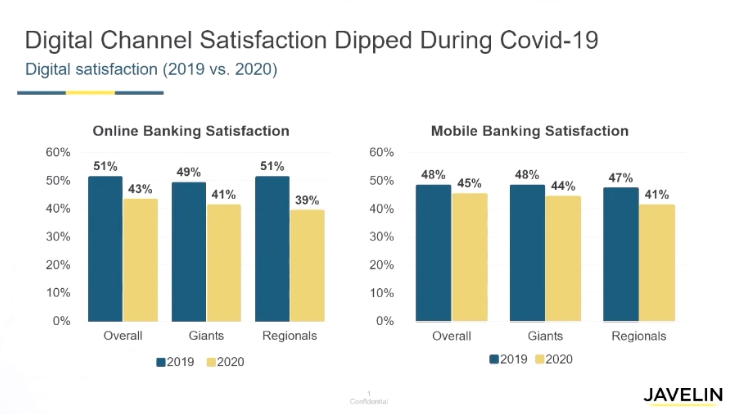

Leading the panel was Emmett Higdon, Director of Digital Banking at Javelin Strategy & Research, who shared the following graph:

Higdon explained that because branches were closed and call centers were overwhelmed, banks were pushing consumers to solve their issue or receive an answer to their question via digital channels. While this worked for some consumers, it frustrated others who were less digitally native or needed a more customized answer. To mitigate frustration, some banks turned to chatbots to create a hybridized approach that offered a high-tech, low-touch customer service experience.

Given the data from Higdon’s graph, it is apparent that some firms’ bots failed– they were ill equipped to handle the influx into their digital channels. Others, however, leveraged data, as well as their prior experience with their digital channels, to create a digital banking experience tailored to each customer.

Mallika Daswani VP of Digital Channels-Online and Mobile Banking at TD Bank said her firm leveraged the bank’s virtual assistant in the company’s mobile app. This tool could answer simple queries and alleviate burden from the call center, which was then able to focus on high-value activity such as conducting video calls with customers. This combination of assisted service and full service helped meet customer needs at scale.

Alexandra Mack, Solutions & Customer Marketing at Zendesk, noted that sending proactive messages to consumers can be crucial during this time. However, she noted it is important to avoid blasting a customer base with intrusive, ubiquitous messaging. Financial services companies can leverage AI to analyze customer information and direct them to self-service solutions.

The group also discussed improvements, specifically, meeting customer expectations and implementing sentiment analysis. The customer expects that the bank not only knows information about the customer, but also has details about the customer’s previous interactions, even if it occurred with a bot or in a different channel. Additionally, implementing sentiment analysis, which uses AI to sense consumer frustration and route them to the appropriate person to mitigate frustration, can vastly improve the customer experience.

When discussing customer communications and personal information, it’s impossible to leave data security out of the conversation. It can be difficult to protect consumer information (and remain compliant) when consumers switch channels or move from website-to-website. However, frustration can arise when consumers are required to authenticate multiple times. To eliminate this, banks can use voice biometrics in the background to create more efficient re-authentication and reduce wait times.

Automation can solve problems, but it takes effort to get to that point. It not requires applying new technologies but also implementing consumer data. In the end, a hybridized digital offering requires a multi-pronged approach with the entire bank on board.

Photo by Ashkan Forouzani on Unsplash