This post is part of our live coverage of FinovateFall 2015.

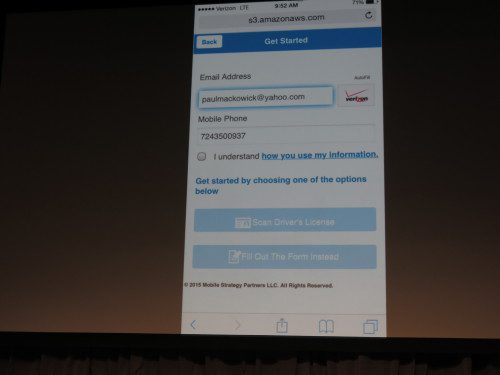

Gro Solutions demonstrated how its Account Opening solution reduces abandonment:

Gro Solutions demonstrated how its Account Opening solution reduces abandonment:

Gro Account Opening is the first and only solution on the market offering online, mobile web and native mobile app account-opening solutions for use by both financial institutions’ customers and employees. Gro Account Opening leverages an innovative, concise workflow along with a multilayered approach and other features to limit manual text input and reduce high abandonment rates. Whether online, on the go, or at the branch, financial institutions can open and fund new accounts in less than four minutes.

Gro presenters: CEO David Eads and CRO Paul Mackowick

Product Launch: November 2014

Metrics: In 2014, Gro Solutions’ parent company Mobile Strategy Partners (MSP) increased its year-end revenues by more than 200%. This increase was largely due to strong market adoption of its digital account opening solutions, which led to the launch of Gro Solutions. Gro Solutions has 30 full time employees and expects to have at least 46 financial institutions live by late 2015.

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

HQ: Atlanta, Georgia

Founded: July 2015

Website: grobanking.com

Twitter: @grobanking