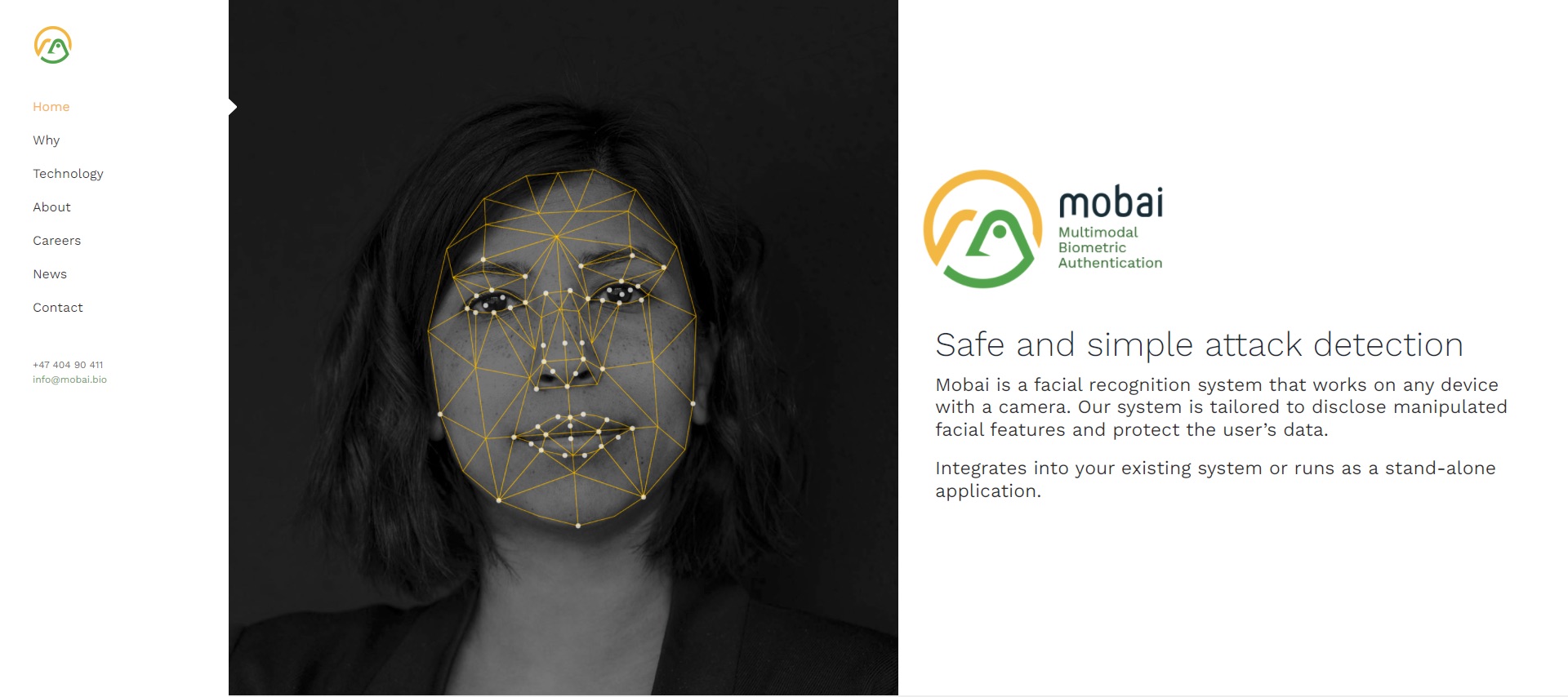

Norway-based biometric startup Mobai won $3.16 million (EUR 2.8 million) in funding to enhance the protection of personal biometric data in coalition with Vipps BankID, Sparebank1 Østlandet, KU Leuven, and NTNU. The project, named SALT for “Secure privacy preserving Authentication using faciaL biometrics to proTect your identity,” will bring new functionalities to Mobai’s facial recognition solution, and improve the quality of the technology to help firms meet eiDAS and AML regulations.

The project will drive innovation in the field of facial biometrics, particularly in the areas of biometric template protection, face quality assessment, and presentation attack detection. Mobai CEO Brage Strand noted in a statement that innovation in facial biometrics is especially urgent insofar as vulnerabilities in current authentication strategies such as passwords and even two-factor authentication increasingly have been exploited by fraudsters and cybercriminals.

“Our aim is to offer consumers a unique opportunity to prove who they are, as a way to combat the surge in phishing and identity theft we currently experience,” Strand said. He added the goal of the project was to move “beyond comparing a photo you store on a device with a selfie” to bring the same level of trust found in ePassports “into a digital domain.” Strand also emphasized the importance of leveraging “privacy-preserving technology” to ensure GDPR compliance and the integrity of personally identifiable information.

Mobai’s partners represent an interesting cross-section of the country’s financial services industry. Sparebank1 Østlandet is the fourth largest savings bank in Norway. Vipps is a payments and electronic ID provider with more than four million electronic ID users. NTNU is the Norwegian University of Science and Technology, the largest university in the country with more than 40,000 students; Mobai was spun out of NTNU’s Norwegian Biometrics Laboratory in 2019. Katholieke Universiteit Leuven is a research and educational institution, one of the oldest universities in Europe, with a reputation for pioneering scientific research.

“We see face recognition as a very promising and effective way to add an extra layer of security that will help combat identity theft, fraud, and money laundering,” Sparebank1 Østlandet EVP for Innovation and Business Development Dag Arne Hoberg said. “Imagine a situation where you may actually sign a mortgage electronically and use a ‘selfie’ as part of this process to confirm that your are the right person to sign.”

Meanwhile, in nearby Denmark, leading business automation software and services provider Visma announced its acquisition of expense management company Acubiz. Term of the transaction were not immediately available.

Visma will integrate Acubiz’s expense management solution into its Visma Enterprise HRM, but Acubiz will continue to function as an independent brand. The company, which has a 20% market share in Denmark and more than 200,000 users, offers solutions to help businesses better manage employee and travel expenses, as well as mileage reimbursement, invoice management, and time registration.

“I am excited to welcome another strong, Danish company into the Visma family,” Visma Enterprise A/S Managing Director Monika Juul Henriksen said. “There is no doubt that Acubiz is a perfect match not only businesswise but also in their culture and DNA. Acubiz wants to be the best – and so do we. Together, we will be even better.”

Founded in 1997 by Lars de Nully, Acubiz is based in Birkerød north of Copenhagen. This year, the company has forged partnerships with accounting firms Tal & Tanker and Tietotili, as well as with financial administration services provider Fiscales, HR software company Sympa, and Jutlander Bank.

In a year-end statement published on the Acubiz blog, the company noted that, in addition to its acquisition by Visma, it plans to unveil a new financial interface in 2022. The new UI will feature upgrades in performance, user-friendliness, and the ability to customize.

“By becoming a part of Visma, we do not only get a shortcut to new customers, markets, segments, and partners, we will also benefit from the knowledge and skills within legal, HR, marketing, and sales,” Acubiz Managing Director Henrik Malling said. “Being able to counsel with these experts is immensely valuable for us as a relatively small organization. So we honestly cannot wait to get started and to get to know all our new colleagues within Visma.”

FinovateEurope 2022 is right around the corner. If you are an innovative fintech company with new technology to show, then there’s no better time than now and no better forum than FinovateEurope. To learn more about how to demo your latest innovation at FinovateEurope 2022 in London, March 22-23, visit our FinovateEurope hub today!

Here is our look at fintech innovation around the world.

Asia-Pacific

- Japanese credit card network JCB teamed up with Keychain to offer offline payments using near-field communication (NFC), self-sovereign identity, and blockchain technology.

- Indonesia-based consumer payment platform Flip raised $48 million in Series B funding.

- Singaporean digital financial services provider Neofy chose IDmission to help ensure KYC and AML compliance, as well as identity verification.

Sub-Saharan Africa

- ImaliPay, a financial services platform geared toward freelancers and workers in the gig economy, went live in South Africa.

- Kenyan fintech Kwara secured $4 million in seed funding to help credit unions achieve digital transformation.

- Standard Bank announces Apple Pay as an alternative payment method for its customers in South Africa.

Central and Eastern Europe

- A partnership between Lithuania-based PAYSTRAX and European intelligent transaction monitoring platform Sentinel will enhance anti-money laundering practices for businesses in Europe.

- In collaboration with 40 banks, the Central Bank of Russia began testing its KYC platform this week.

- German AI-based asset management solution provider Othoz raised $11.2 million (€10 million) in Series A funding.

Middle East and Northern Africa

- Qatar Islamic Bank (QIB) introduced a new remittance service in partnership with Visa called Visa Direct.

- Arab Monetary Fund inked a Memorandum of Understanding (MoU) with Mastercard.

- Qatar-based telecom Ooredoo teamed up with i2c to launch a new digital payment initiative in Qatar.

Central and Southern Asia

- Pakistan’s TAG partnered with IDEMIA to introduce the country’s first green debit card.

- Indian fintech Uni, which offers consumers a pay-later solution called the Pay 1/3rd card, raised $70 million in Series A funding.

- Pakistan-based fintech JazzCash launched new digital-first shopping experience called AlaCart.

Latin America and the Caribbean

- Argentina-based fintech Uala launched its own brokerage service.

- The Market Research Telecast profiled Latin American cross-border payments fintech Global66.

- Brazilian fintech Ebanx acquired international money transfer company Remessa Online for $229 million.