Akshatha Kamath, Content Marketing at MoEngage, explores the fintech landscape in South East Asia, and why fintechs need to work on their “stickiness” factor.

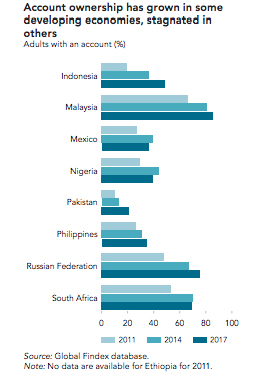

According to the World Bank’s Global Financial Inclusion Index database, Indonesia has made rapid progress in financial inclusion across East Asia and the Pacific. The country has come a long way from just 20% of the adults owning an account in 2011 to 48.9% owning an account in 2018. While the country still grapples with the challenges of the unbanked population, it has led to the growth of fintech companies.

The Fintech Landscape in Indonesia

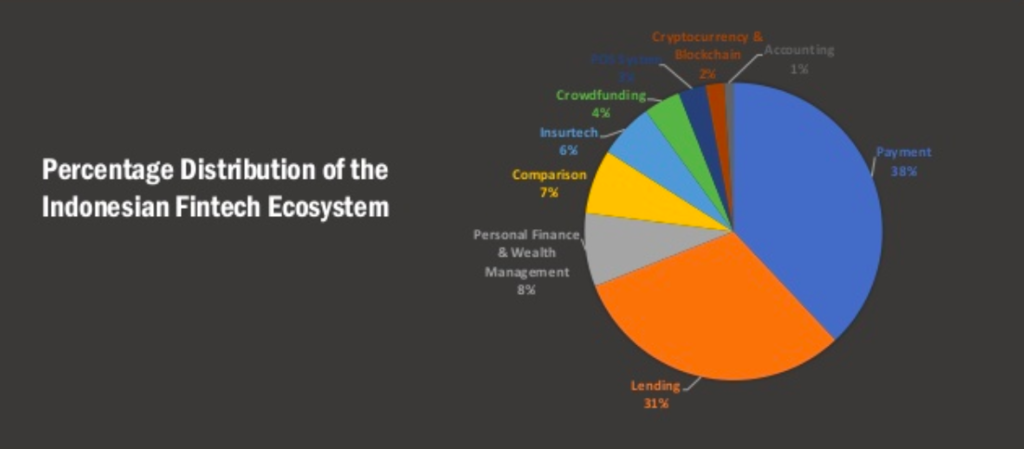

Indonesia has 167 fintech companies that offer payment, lending, personal finance, crypto and blockchain, crowdfunding, insurtech, and PoS services. The fintech industry is regulated by two entities – Bank Indonesia and Otoritas Jasa Keuangan (OJK). While Bank Indonesia oversees the monetary policies, OJK takes care of P2P lending, crowdfunding, digital banking, data security, insurtech, and consumer protection.

According to the Fintech Indonesia Report 2018, payment and lending form the major part of the fintech ecosystem.

The Growth Story of Fintech in Indonesia

As the Government pushes for financial inclusion among its citizens, Indonesia is also a witness to the growth story of fintech companies. With over 167 companies operating in Indonesia, the fintech market has grown by 16.3% with total investment in fintech companies reaching $176.75 million in 2017 alone.

Here are a few factors that are responsible for the growth story of fintech in Indonesia.

- Technology-enabled population: With a population of 261.12 million, the majority below the age of 35, technology is a key enabler for Indonesians. Over 143.2 million people have access to the internet, and mobile subscriptions are as high as 415.7 million.

- Topography: Another factor responsible for the popularity of fintech companies is the topography of Indonesia. Indonesia is an archipelago country made of 17,000 islands spanning across 50,000 kilometers from east to west. As banks face a challenge in reaching the most remote areas, fintech companies are helping the Government meet its financial inclusion goals by offering financial solutions in every nook and corner of the country.

- Easy loans for small-medium businesses: One of the challenges for small-medium businesses is the limitation in granting loans. According to financial regulators of Indonesia, banks and other financial institutions can only grant up to Rp600 trillion. In 2016 alone, the national loan demand had reached Rp1,600 trillion, due to which there was a restriction on availing bank loans. Fintech companies have simplified the process for the businesses by not asking for collaterals and enabling the debtors to submit the documents from anywhere, anytime.

- Convenience: While cash is still the preferred mode of payment, cashless transactions and e-money products provide convenience to the users.

Challenges of Indonesia’s Fintech Industry

While the fintech industry is working to push the government’s vision of financial inclusion and offering convenience to users, it has its own set of challenges.

- Low internet connectivity: Despite the high penetration of the internet, connectivity is still low in Indonesia. Considering that the internet is the key requisite for delivering services to customers, fintechs face a challenge in reaching out to its customers, while customers face problem in completing their transactions without any hassles.

- Preference for cash transactions: While Indonesia is shifting to cashless mode of payment, cash is still the preferred mode of payment for merchants.

- Strict regulation: This is one of the major challenges for fintech companies. There are only 40 P2P lending services registered with OJK due to the strict regulatory process laid down by OJK and Bank Indonesia. At one point in time, OJK published a list of 100 lenders who were not recognized, while Bank Indonesia announced the release of Fintech Regulation and Regulatory Sandbox in 2017 to protect the interest of the customers. According to a study by the Monash Business School on Indonesia’s fintech industry, the regulator’s decisions are well-intentioned as they want to encourage people to adopt the financial system and discourage fraudulent activities. However, the lack of clarity in the process is posing a challenge to fintech companies that have not received a green signal to operate from OJK.

- Lack of stickiness: According to Hootsuite, each consumer uses at least two or more fintech services. With so many fintech apps vying for the customer’s attention, increasing stickiness and engaging the users on the app can be quite a challenge for fintech companies.

How Kredivo Increased its Stickiness and Increased the Conversions by 40%

Kredivo is an Indonesia-based fintech company that allows e-commerce buyers to apply and qualify for instant credit and payback over time. Within three years of launch, Kredivo had become one of the fastest growing and the stickiest digital payment channels for e-commerce in Indonesia. Kredivo wanted to go a step further to engage new users who had downloaded the app, enable them to complete the transactions within the app, and boost the overall brand and app store SEO. It wanted a single marketing automation platform that could help them address engagement challenges and also handle newer channels and use cases in the future. Kredivo chose MoEngage’s Push Amplification to track the notifications that were sent. It also acted as a fall back to GCM and delivered notifications to devices with a failed delivery, which boosted the delivery rate by 20%.

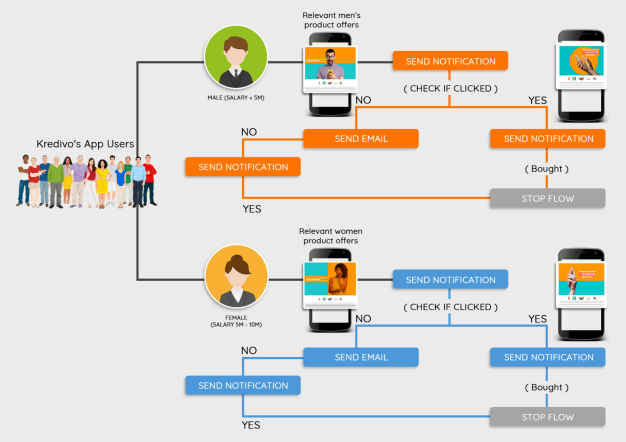

Kredivo also used MoEngage’s Automated Workflow to set up unique workflows based on user attributes such as age, gender, and income to send customized offers via emails and push notifications. The automated workflow led to a 40% increase in conversions within ten months.

In order to improve the SEO in the app store, Kredivo sent automated emails to the users who had completed an in-app transaction to leave their ratings and feedback. The triggered emails led to a 64% conversion rate.

All these efforts together helped Kredivo to improve the engagement on their app. You can read the complete case study here.

For a fintech company, personalized customer experiences and winning the trust of customers is crucial to sustain and stay ahead in this new and competitive industry. With marketing automation platforms like MoEngage, you can achieve this goal easily.