This week’s edition of Finovate Global takes a look at recent fintech developments in Latin America. The region was one of the few places in the world to see significant fintech funding in Q2 of 2023. Further, fintech in Latin America will be the focus of a special panel at FinovateSpring in May.

Here are a handful of headlines to help you get up to speed on the variety of fintech innovation happening in countries like Mexico and Colombia.

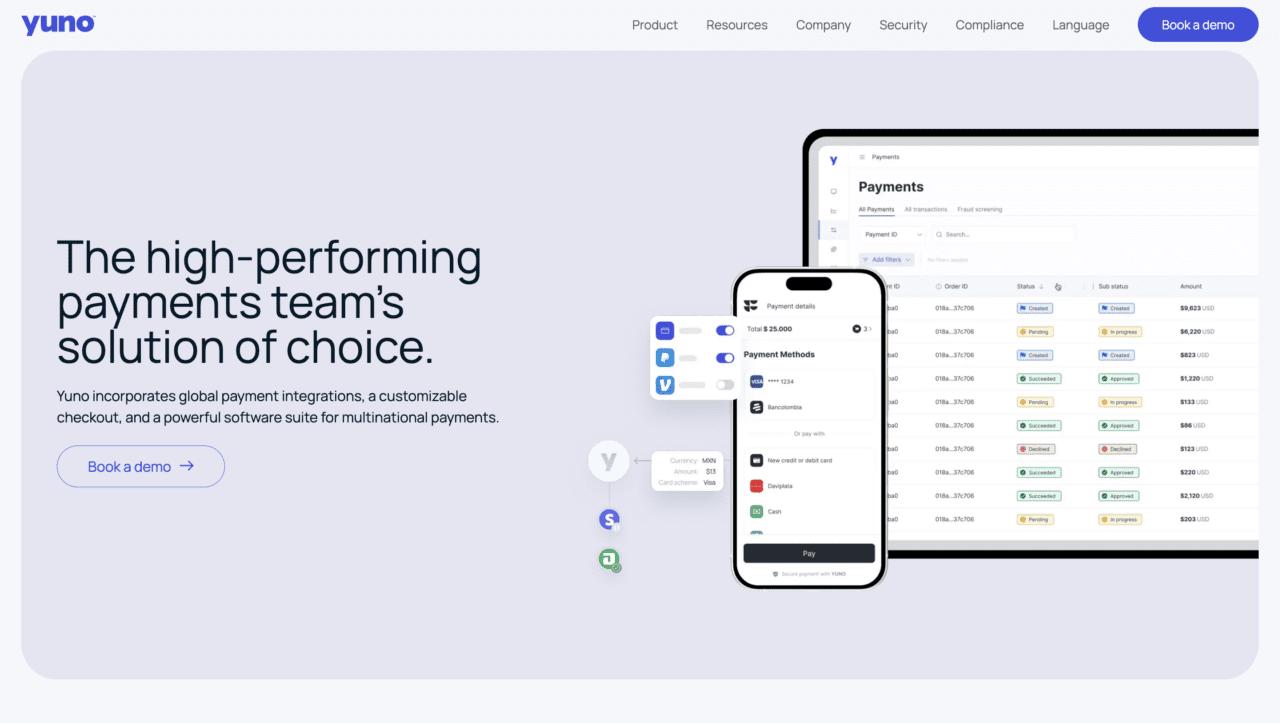

Colombian payments orchestration platform Yuno raises $25 million

Payments, as we say in the fintech business, is the gift that keeps giving. And this week, Colombian payments orchestration platform Yuno is on the receiving end. The company announced this week that it has raised $25 million in funding from a consortium of investors including DST Global Partners, Andreessen Horowitz, Tiger Global, Kaszek Ventures, and Monashees.

With customers ranging from McDonald’s to Avianca, Yuno offers fast and reliable payments orchestration for businesses in industries like e-commerce, retail, and mobility. The company’s platform offers features such as one-click checkout modifications and smart routing. Yuno also integrates data from all payment processors and anti-fraud tools into a single, unified interface. The company will use this week’s investment to support its operations in both North and South America. The investment also will help fuel Yuno’s expansion to new markets in Europe, Asia, and Africa.

“This financial backing validates our vision and our ability to take the global payments industry into the future, helping fuel positive change across many different sectors of the economy. We are thrilled to bring our cutting-edge solutions to new markets,” Yuno CEO and co-founder Juan Pablo Ortega said.

Mexico’s Ziff acquires digital lender Arrenda

Meanwhile, a few miles north, Mexican revenue-based financing company Ziff has acquired Arrenda, a Mexico-based digital lending startup. Terms of the transaction were not disclosed. Arrenda founder and CEO Joe Merullo will take the position of Chief Technology Officer in Ziff’s C-suite.

Ziff founder and CEO Gerardo Name said the acquisition will boost the company’s product offering and “enable us to rapidly penetrate new market sectors.” Currently, Ziff’s revenue-based financing solution provides liquidity to Mexican SMEs – which often have little to no credit histories – by funding up to 36 months of receivables. The acquisition will enable Ziff to leverage Arrenda’s Adelanta digital lending platform, which enables Mexican property owners convert future rental payments into cash within 24 hours. Name added that he hopes to see Ziff distribute more than $1 billion pesos to Mexican SMEs by the end of 2027.

BBVA Technology expands to Latin America

Created in 2023, BBVA Technology announced its expansion to Latin America this week. To be headquartered in Mexico, the new entity – officially titled “BBVA Technology en América” – represents the merger of a number of technology companies that previously operated under the name BBVA Axial Tech. The goal of the nearly 600-strong body is to help advance BBVA Group’s digital transformation objectives. The company noted that in addition to a regional expansion, the creation of BBVA will help boost career opportunities for BBVA’s tech talent.

From Mexico City, Mexico, BBVA Technology will provide technology services to BBVA firms operating in Argentina, Colombia, Mexico, Peru, Uruguay, and Venezuela. Former BBVA Axial Tech CEO Robert Altes will serve as CEO of the new company.

Note that BBVA has also set up a companion entity in Europe – “BBVA Technology in Europe” – led by CEO Ricardo Jurado and headquartered in Spain.

Here is our look at fintech innovation around the world.

Asia-Pacific

- Savis and Open Banking advisory firm Konsentus announced the creation of an operational structure for open banking in Vietnam.

- New Zealand-based Kiwibank went live with ACI Worldwide’s Enterprise Payments Platform.

- Hong Kong’s Mox partnered with Wise to enable low-cost, international payments directly from the Mox app.

Sub-Saharan Africa

- South African payroll and HR software company PaySpace agreed to be acquired by HR startup Deel for $100 million.

- Kenya’s Equity Bank launched instant withdrawals courtesy of a partnership with PayPal.

- A partnership between Mastercard and Ethiopian commercial bank Awash Bank will bring new payment solutions to consumers in the country.

Central and Eastern Europe

- E-commerce payments solution provider xpate announced a strategic migration to Mambu’s cloud banking platform.

- Turkish fintech Papara acquired T-bank.

- Polish regulators announced plans to regulate cryptocurrencies this year.

Middle East and Northern Africa

- Tarabut teamed up with Bahrainian fintech BENEFIT to launch a new consent authentication method.

- Is there a “silver lining” in Israel’s fintech funding slowdown?

- Mastercard forged a long-term global partnership with First Abu Dhabi Bank.

Central and Southern Asia

- Pakistan’s Raqami Islamic Digital Bank partnered with banking solutions provider Codebase Technologies.

- India’s central bank introduced a new self-regulatory framework for the nation’s fintechs.

- Turkish challenger bank Papara announced plans to acquire Pakistan-based digital wallet provider SadaPay.

Latin America and the Caribbean

- Mexican revenue-based financing fintech Ziff acquired digital lending company Arrenda.

- Chilean fintech Levannta raised $2.5 million in funding in a round led by Manutara Ventures.

- Mexico-based microlender Baubap secured $120 million in debt financing.