When we think of fintech in Asia, China often comes quickly to mind, as do Singapore, Hong Kong, and a few other places. But Japan? Not so much.

Why is this so? One of the more interesting reads on the topic of fintech in Japan that I’ve come across is a Deloitte study Japanese Fintech in the Global Context. In the report, Deloitte Tohmatsu Consulting Social Impact Director Yasuyuki Ogyu explains some of the challenges that prevent Japan from having the sort of fintech industry we see in countries like the U.S. – or neighbor and rival China.

Ogyu notes that Japan has “a favorable B2C market environment.” Unfortunately, the country also has a “rock-solid yet inflexible financial infrastructure.” This has made investors hesitant to commit capital to new financial services businesses for fear that the return of investment would be low and slow compared to other opportunities in the region. Ogyu shows how, in contrast to the U.S., the high level of quality demanded of Japanese IT systems makes them “ill-suited (in terms of speed and cost) to new initiatives like fintech.” Comparisons between API laws in the U.S. and Europe compared to Japan show that there is still a great deal of work to be done educating the public on the value of “services that utilize personal data.”

Check out the full report. Deloitte’s study is an interesting look at the relationship between fintech innovation and the incumbent Japanese financial services industry. The report also provides a handful of recommendations that might help fintechs make greater inroads in the country.

That said, what are some of the more interesting developments on the Japanese fintech scene of late?

Just a few months after securing a deposit-taking license and one month after going live with its mobile app, Japanese digital bank Habitto announced that it surpassed 12,000 downloads. Habitto has also received more than $922,500 (¥130 million) in new deposits over the past month. But the download milestone news almost was overshadowed by a report that the neobank had opened a new office in the fashion district of Cat Street Uruhara.

Habitto co-founder and CEO Samantha Ghiotti explained. “Despite being a mobile-first finance brand, we still believe that it’s essential to connect with customers at ground level and with a human approach,” Ghiotti said. “Trust in financial brands is built over time. We can only achieve this trust through a combination of positive customer experiences both on mobile and face-to-face.”

Ghoitti and Chief Creative Officer Liam McCance founded Habitto in 2021. The Tokyo-based neobank offers an interest rate of 0.3% on deposits up to ¥1 million as well as a Visa debit card. The company’s mobile app includes free financial advice, personalized money plans, and in-app chat and video call services. Habitto has raised a total of $7.3 million in funding from investors including Saison Capital and Cherubic Ventures.

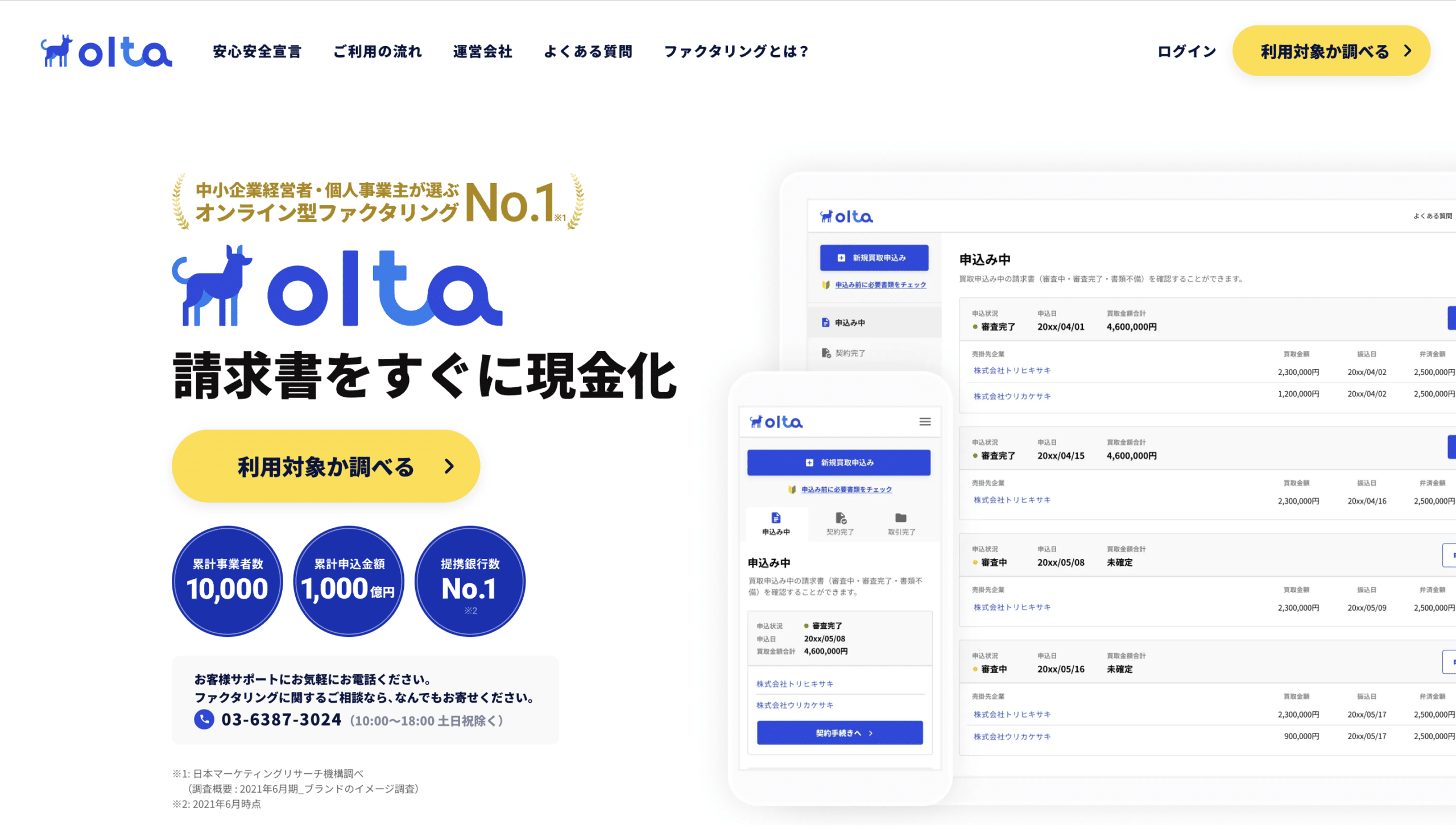

Turning to the B2C end of the country’s fintech sector, we note that Olta, a Japanese fintech that helps SMEs secure funding, has raised $17.8 million in funding. The investment in the Tokyo-based fintech takes the company’s total capital raised to more than $60 million. A sizable number of investors participated in the Series B round. These investors include SBI Investment, Spiral Capital, DG Ventures, WingArc 1st, AG Capital Delight Ventures, Tottori Capital, Nobunaga Capital Village, BIG Impact, and Aozora Corporate Investment.

Olta was founded in 2017. The company provides cloud-based factoring services for the procurement of funds to meet short-term funding needs without resorting to debt. Olta’s role in supporting small businesses during the COVID pandemic was highlighted by Nikkei Asia in the spring of 2020. One meat wholesaler described how he was able to convert several hundred thousand yen in accounts receivable into cash using Olta’s services.

Here is our look at fintech innovation around the world.

Sub-Saharan Africa

- Kenyan telecommunications company Safaricom partnered with U.K.-based TerraPay to launch mobile money transfer service to Bangladesh and Pakistan.

- FinTech Global looked at the Nigeria’s dominance in overall African fintech deals in Q2 of 2023.

- Senegalese interbank group GIM-UEMOA teamed up with a quartet of Luxembourg-based companies to support development of its GIMpay offering.

Central and Eastern Europe

- Lithuanian regtech AMLYZE unveiled a new screening module for risk mitigation.

- Germany-based digital bank N26 introduced new Chief Risk Officer Carina Kozole.

- 4Trans, a financial solution provider for the supply chain and logistics industry based in the Czech Republic, secured “substantial” pre-Series A investment.

Middle East and Northern Africa

- Israel-based payments security platform Trustmi raised $17 million in Series A funding.

- Egyptian digital payment services company Masroofi secured $1.5 million in funding to help promote financial inclusion for children.

- Tunisian corporate expense management company Expensya agreed to be acquired by accounts payable automation provider Medius.

Central and Southern Asia

- Swich, a fintech based in Karachi, Pakistan, won a $70,000 (PKR 20 million) grant to support innovation in digital payments.

- India’s central bank, the Reserve Bank of India, made the case for fintech self-regulation to help strike a balance between innovation and risk.

- India-based YES BANK enabled UPI payments via its RuPay credit cards.

Latin America and the Caribbean

- Puntored, a digital and alternative payment services company based in Colombia, announced expansion to Mexico via an acquisition of GestoPago.

- Latin Lawyer looked at how the the growing fintech industry has introduced new compliance and regulatory challenges to Mexico’s financial sector.

- Mattilda, a Mexico-based collections management and payment processing solution provider for private schools locked in $19 million in Series A funding.

Asia-Pacific

- Cryptocurrency exchange Binance announced plans to launch services on a new platform in Japan.

- The Republic of Palau partnered with Ripple for a pilot of its government-backed stablecoin.

- Thailand-based cryptocurrency exchange Bitkub, raised $17.8 million in funding.