This post is part of our live coverage of FinovateFall 2015.

D3 Banking launched its Small Business Banking solution:

D3 Banking launched its Small Business Banking solution:

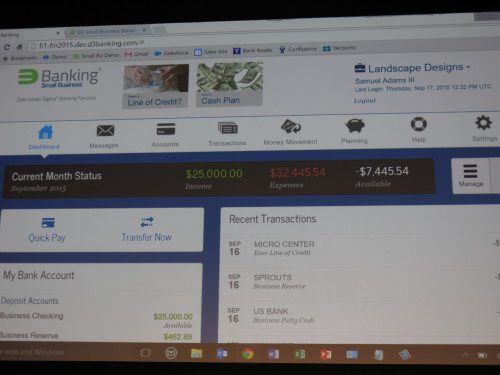

D3 Small Business Banking allows FIs to provide business owners access to the basic financial tools from any digital device. Using transactional analysis, D3 Small Business Banking automatically generates pre-formatted cash flow and income statements, provides budgets based on either a three-month average by category and/or manually inputted data from the end user, and creates reports that provide current and time-over-time analysis of both expense and income categories. In addition, D3 Small Business Banking includes a robust user management and dual approval system with alerting capabilities that work with any digital device, including wearables such as the Apple Watch.

Presenters: CMO Michael Carter and Andy Holdt, director, sales support

Product launch: September 2015

Metrics: D3 Banking has 67 employees; more than 250,000 FI customers use D3’s legacy products; by 2016, a projected one-million+ users will be on its data-driven digital banking platform.

Product distribution strategy: Direct to business (B2B)

HQ: Omaha, Nebraska

Founded: October 1997

Product Demoed: D3 Small Business Banking

Website: d3banking.com

Twitter: @D3Banking