Could 2024 turn out to be the Year of the Regtech?

As more and more processes in financial services become AI-enabled, the impact of AI on regulatory technology and compliance solutions has been profound. From automating manual processes to more comprehensively engaging data, AI is helping regtech firms better serve their customers at a time when their customers – in banking, in fintech, in financial services in general–need it most.

We caught up with one such regtech, Tennis Finance, and its Co-Founder and CEO Jake Pimental. Headquartered in San Francisco, California and founded in 2022. Tennis offers an automated AI compliance and risk management solution to help businesses better manage customer complaints and external communications.

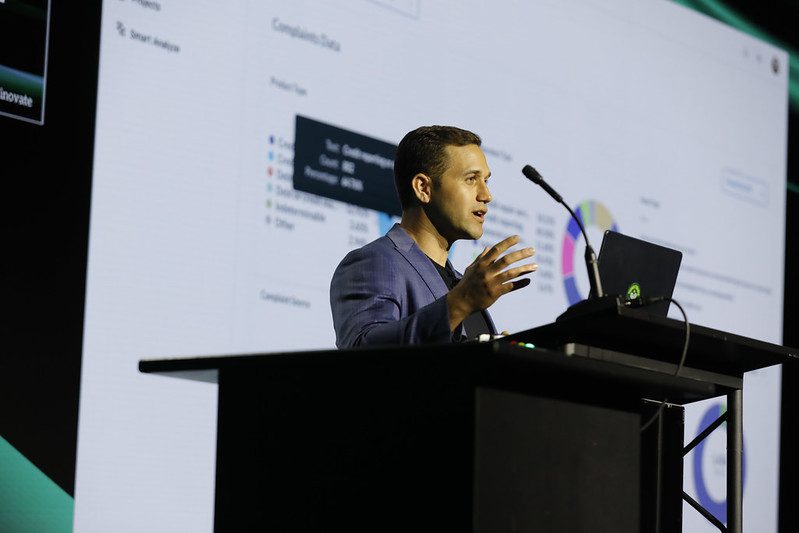

At its Finovate debut at FinovateSpring earlier this year, the company demoed Rally, its solution that enables financial institutions to intake customer complaints and data to automatically identify compliance issues as well as uncover trends in customer conversations.

What problem does Tennis Finance solve and who does it solve it for?

Jake Pimental: Tennis Finance addresses the growing complexity of compliance and risk management for banks, financial institutions, and debt collectors. As regulations tighten and customer complaints rise, these organizations face significant challenges in handling compliance effectively and efficiently. We specifically focus on automating the processing and analysis of customer communications to prevent regulatory breaches and lawsuits, while also optimizing customer service and operational efficiency.

How does Tennis Finance solve this problem better than other companies or solutions?

Pimental: We leverage AI-driven technology to analyze calls and customer interactions, providing actionable insights that streamline workflows. Our platform parses customer communications, automatically categorizing and tagging them for compliance risk. This automation reduces overhead by 80%, increases regulatory safeguards, and improves customer retention, giving our clients a significant competitive edge. Unlike other solutions, we don’t just automate tasks – we provide a comprehensive view with tailored action plans, ensuring our clients not only meet regulatory standards but exceed them.

Who are Tennis Finance’s primary customers, and how do you reach them?

Pimental: Our primary customers include banks, accounts receivable companies, and financial institutions that are heavily regulated and at risk of non-compliance. We reach them through industry conferences like Finovate, strategic partnerships, and referrals through consulting networks. We also work closely with compliance officers and decision-makers, demonstrating how our platform can save time and reduce compliance risk.

Can you tell us about a favorite implementation or deployment of your technology?

Pimental: One of our most impactful deployments was with a major debt collection agency that was struggling with complaint handling and agent oversight/coaching. Our AI solution reduced their operational overhead by 80% and helped them identify risks early, preventing costly litigation.

What in your background gave you the confidence to tackle this challenge?

Pimental: Before founding Tennis Finance, I was a compliance officer at SoFi, where I helped launch their investments arm and navigated complex regulatory environments. This experience, along with my background in compliance strategy and risk management across multiple startups, gave me a deep understanding of the challenges financial institutions face. My track record of building solutions that solve these problems, combined with the ability to scale AI-driven technologies, gave me the confidence to build Tennis Finance.

There has been a great deal of interest in regtech and compliance in recent years. Is this a trend you saw coming? What is driving it and where is it going?

Pimental: Yes, the rise in interest was anticipated, given the increasing complexity of financial regulations and the growing number of customer complaints. What’s driving it is a mix of stricter regulatory scrutiny, rising operational costs, and the need for faster, more efficient compliance processes. The future of regtech is all about automation and AI – providing real-time risk management, reducing manual tasks, and enabling institutions to stay ahead of the regulatory curve while improving customer experiences.

You demoed at FinovateSpring earlier this year. How was your experience?

Pimental: FinovateSpring was an incredible experience. It allowed us to showcase the unique capabilities of our platform in front of an audience of industry leaders, investors, and potential clients. The feedback we received was overwhelmingly positive, especially around our AI-driven approach to compliance automation. It was also a great platform to build valuable partnerships and foster industry connections.

What are your goals for Tennis Finance? What can we expect to hear from you in the months to come?

Pimental: Our primary goal is to scale our platform to serve more financial institutions and expand into new markets. In the coming months, you can expect to see us deepening our partnerships, launching new features focused on advanced predictive analytics, new AI workflows, AI coaching, and exploring new use cases beyond just compliance. We’re committed to pushing the boundaries of what AI can do in the financial services space.

Photo by Josh Calabrese on Unsplash