I had been intrigued about rumors that Microsoft and Citibank were partnering on a joint personal-finance venture called Bundle. I was hoping for the financial services version of an Apple launch.

I had been intrigued about rumors that Microsoft and Citibank were partnering on a joint personal-finance venture called Bundle. I was hoping for the financial services version of an Apple launch.

OK, that’s a little too high of a bar to set. I was really just hoping for the next Mint or at least something we hadn’t seen before. To some extent, Bundle delivered, with Mint-like attention to design and deeper data than we’ve seen previously. But in other ways it’s just a me-too personal finance site, FiLife 2.0. Bottom line, Bundle has been open only a week so it’s way too early to predict where it’s going or how it makes money.

Bundle is a personal finance startup backed by Citibank, Microsoft, and Morningstar. Two of the key execs, including CEO Jaidev Shergill, are from Citi Growth Ventures, the group charged with commercializing products and ideas that have bubbled up within the banking giant. The startup also enlisted professional journalists, including Janet Paskin who’s written for Dow Jones’s SmartMoney Magazine among others.

Bundle is a personal finance startup backed by Citibank, Microsoft, and Morningstar. Two of the key execs, including CEO Jaidev Shergill, are from Citi Growth Ventures, the group charged with commercializing products and ideas that have bubbled up within the banking giant. The startup also enlisted professional journalists, including Janet Paskin who’s written for Dow Jones’s SmartMoney Magazine among others.

Given that pedigree, the new site is kind of a SmartMoney Magazine meets your credit card statement with some social networking thrown in the mix.

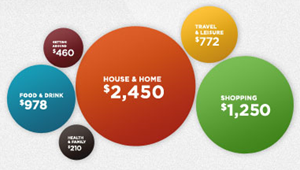

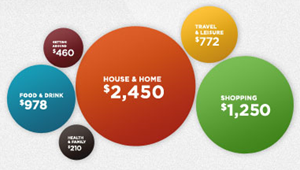

What distinguishes it from most personal finance content providers is that Bundle showcases proprietary data, sourced from Citibank’s massive card-spending warehouse. The site gives center stage to data and shows household spending personalized to your specific location.

There’s also professional personal finance advice mixed with stories and comment from the community. Even the articles use the database to illustrate points (screenshot 3).

Naturally, it’s well-integrated to Facebook. You cannot even comment unless you log in via Facebook Connect. You can follow Bundle on Twitter, of course, but surprisingly there is no blog or RSS feed.

Naturally, it’s well-integrated to Facebook. You cannot even comment unless you log in via Facebook Connect. You can follow Bundle on Twitter, of course, but surprisingly there is no blog or RSS feed.

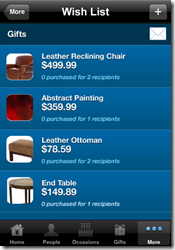

And Bundle already has its own iPhone app called Vice Tracker (iTunes link) that makes shopping for non-essentials into a tongue-in-cheek game. The unique app was added to the store two weeks ago in the Lifestyle category.

According to the FAQs, Bundle’s business model is advertising, but there are no ads on the site yet, other than the logos of the backers (Microsoft is using its MSN Money brand). Presumably, they are looking for financial advertisers, but the Citibank connection might make that a harder sell.

Analysis

I like what Bundle is doing, creating a consumer-facing company around Citibank’s cardholder data. But I can’t figure out who they are targeting. Maybe they haven’t decided yet.

If they want to attract data junkies like myself, the data needs to be more transparent and they need more robust tools to play with it. I enjoyed being able to compare the spending of my Seattle neighbors against that of my home town in Iowa (it’s surprisingly similar). But I was left with a number of questions:

- Where does the spending data come from? The FAQs are vague on saying that it comes from Citibank card data, government sources and “other third parties.”

- If it’s primarily Citibank card data, is it really representative of the entire town or just the people that hold Citibank cards? For example, Bundle tells me (screenshot #3) that the average dining out expense in Seattle is $115 and the most common spot is Starbucks followed by McDonalds. Something seems wrong with that.

- And furthermore, are these estimates of all spending or just that on Citibank cards? And which Citi portfolios are included? What about business cards?

- The graphical bubbles are nice, but I like to view data in tables, especially when trying to drill down and do meaningful analysis. Is there some way to see the underlying numbers?

On the other hand, if Bundle is trying to attract readers looking for personal finance advice and discussion, the data is kind of in the way, more window dressing than anything else.

Final thoughts

The graphics are great and the spending data is interesting. But why would I come back? There’s only so many times in one’s life that you want to compare the shopping habits of your city vs. somewhere else.

Presumably, future versions will allow you to compare your actual spending to the Bundle averages using account-aggregation technology. This is a popular feature of Wesabe, and is one of the major tenets of what we’ve called “social personal finance” (note 1, 2).

I also expect they’ll integrate Bundle into the Citibank cardholder site so its customers can do online comparisons while they are checking their statement online. If Citi can document a spending lift from bundled Bundle, then the startup has proven its value. Armed with that success, it could be licensed to other big card issuers, increasing the value of the Bundle data for all users, attracting more users and more advertisers. The network effect. Perhaps that’s the end game here.

#1: Main Bundle page after selecting “Seattle” as location to show spending (29 Jan. 2010)

#2: Main page after drilling down through the “Food & Drink” bubble (link)

Note: Top five restaurants for dining out in Seattle are Starbucks, McDonalds, Subway, Red Robin and Cheesecake Factory. That sounds possible, but then the average purchase size is listed at $115. That’s a lot of lattes or Big Macs.

#3: The ever-present “spending balls” hover above an article by Bundle Managing Editor Janet Paskin’s short post. The balls compare the spending in Brooklyn with her hometown Seattle

Note: Brooklyn comes out cheaper, see the solid circles (Brooklyn) in front of the cross-hatched ones (Seattle).

Notes:

1. See our previous reports on Social Personal Finance (2007) and Online Investment Communities (2008).

2. Wesabe would seem to be a great acquisition if Bundle wants to add the aggregation technology piece and jump-start its user base. Blippy-like features would also make the site more sticky.

3. For more background on the software tools being used, see the article on Bundle in Microsoft’s Financial Services publication published 22 Nov. 2009.

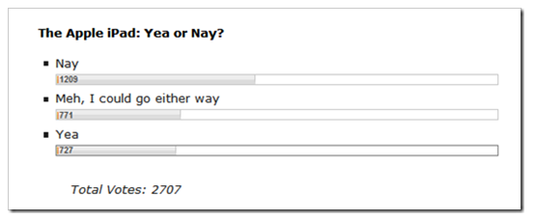

Apple today said it has shipped one million iPads (one of which went to a lucky Mint user, see inset). I don’t think that’s a surprise to anyone who’s even mildly interested in tech.

Apple today said it has shipped one million iPads (one of which went to a lucky Mint user, see inset). I don’t think that’s a surprise to anyone who’s even mildly interested in tech.