Funding was up sharply this week with 18 companies raising a total of $232 million (includes $20 million in debt). The total included five Finovate alums:

Funding was up sharply this week with 18 companies raising a total of $232 million (includes $20 million in debt). The total included five Finovate alums:

- Cachet Financial Solutions (public: CAFN) raised $4.4 million in a private placement, bringing their market cap to $8.6 million

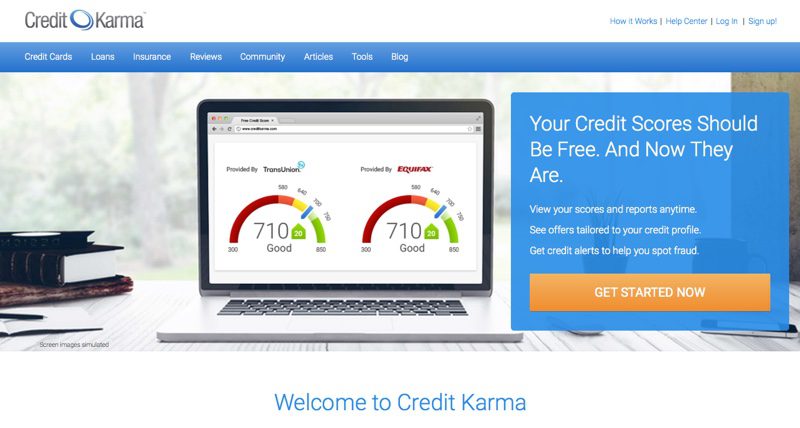

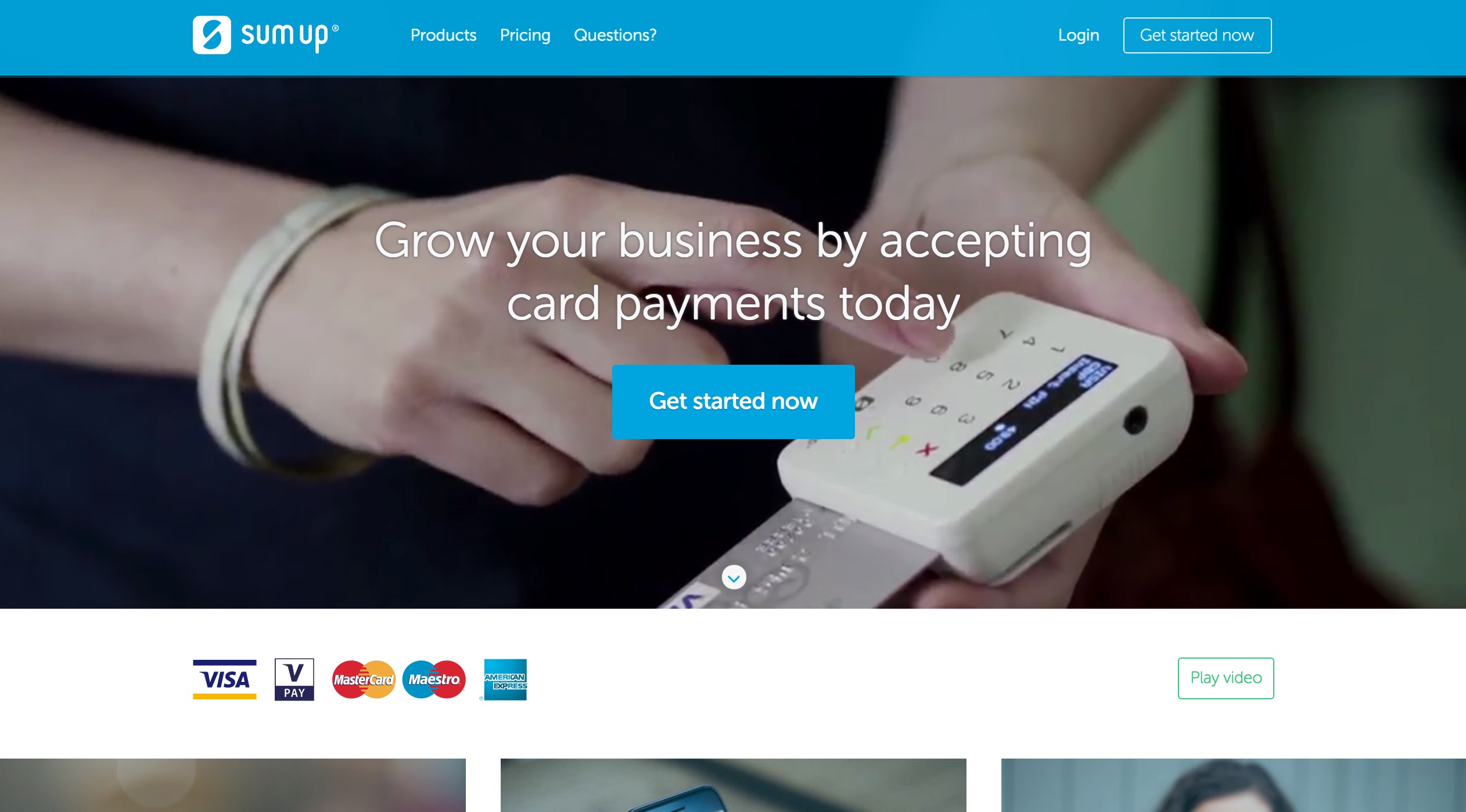

- Mobile POS provider SumUp added an undisclosed amount, bringing total funding to $45 million

- Bright Funds raised a $1.8 million seed round for its charitable giving system that plugs right in to payroll and HR systems

- BanktotheFuture raised $1 million for its about-to-launch equity crowdfunding platform

- CashSentinel scored undisclosed seed funding to help expand its mobile payments and escrow service

So far this year, $7.5 billion has been invested in the sector, an average of $325 million per week.

Here are the deals from 5 to 12 June 2015, ranked by size:

PropertyGuru

Real estate platform

HQ: Singapore

Latest round: $129 million

Total raised: Unknown

Tags: Home purchase, mortgage, real estate search

Source: Crunchbase

Moula

Alt-lending platform to SMBs

HQ: Melbourne, Australia

Latest round:$30 million

Total raised: $30.9 million

Tags: Small business, lending marketplace, underwriting, crowdfunding, peer-to-peer, P2P, investing

Source: Crunchbase

LoanHero

Point-of-sale financing platform

HQ: Carlsbad, California

Latest round: $21.7 million ($1.7 million Seed; $20 million Debt)

Total raised: $22.1 million (includes $20 million debt)

Tags: Lending, POS, underwriting, alt-lending

Source: Crunchbase

Miura Systems

Payments hardware

HQ: Stokenchurch, United Kingdom

Latest round: $16 million

Total raised: $16 million

Tags: POS, point of sale, SMB, security, cards, merchant acquiring

Source: Crunchbase

eFileCabinet

Paperless systems for accounting and other industries

HQ: Lehi, Utah

Latest round: $14 million

Total raised: $25 million

Tags: Storage, fee income, cloud services

Source: Crunchbase

Cachet Financial Solutions

Remote deposit and mobile money solutions

HQ: Minneapolis, Minnesota

Latest round: $4.4 million private placement

Total raised: Unknown

Tags: Remote deposit, payments, funds transfer, mobile, check cashing, Finovate alum

Source: CNN Money

Clip

Mobile payments and rewards app for hospitality industry

HQ: Sydney, Australia

Latest round: $3.6 million (for 31%; $11.6 million valuation)

Total raised: Unknown

Tags: Payments, POS, point-of-sale, restaurant, bar, merchants, SMB, card acquiring

Source: FT Partners

Mobi724 Global Solutions

Mobile payments

HQ: Montreal, Quebec, Canada

Latest round: $3.0 million

Total raised: Unknown

Tags: PIN debit, cards

Source: FT Partners

Bright Funds

Charitable giving solution for enterprises

San Francisco, California

Latest round: $1.8 million Seed

Total raised: $3.0 million

Tags: Payments, enterprise, SMB, payroll, HR, Finovate alum

Source: Finovate

Control

Payments management platform

HQ: Vancouver, BC, Canada

Latest round: $1.5 million Seed

Total raised: $1.5 million

Tags: Payments, enterprise, analytics, business intelligence

Source: Crunchbase

Zane Benefits

Health insurance reimbursement system

HQ: Salt Lake City, Utah

Latest round: $1.5 million Seed

Total raised: $1.5 million

Tags: Healthcare, payments, SMB

Source: Crunchbase

Symbiont

Smart securities on the blockchain

HQ: New York City, New York

Latest round: $1.25 million Seed

Total raised: $1.25 million

Tags: Blockchain, investing, securities

Source: FT Partners

Create

Real estate information and workflow platform

HQ: Washington D.C.

Latest round: $1.1 million

Total raised: $2.2 million

Tags: Mortgage, investing, analytics, collaboration

Source: Crunchbase

BanktotheFuture

Equity crowdfunding platform

HQ: London, United Kingdom

Latest round: $1 million

Total raised: $1 million

Tags: P2P, peer-to-peer lending, underwriting, investing, SMB, small biz, Finovate alum

Source: Crunchbase

Open Bazaar

Bitcoin-based ecommerce marketplace

Latest round: $1 million

Total raised: $1 million

Tags: Cryptocurrency, ecommerce, payments, trading, barter, USV (investor), Andreessen Horowitz (investor)

Source: Coindesk

PrimaHealth Credit

Alt-lending for the elective surgery industry

HQ: Newport Beach, California

Latest round: $1 million Seed

Total raised: $1 million

Tags: Healthcare, payments, financing, credit, underwriting

Source: Crunchbase

SumUp

Mobile point-of-sale system

HQ: London, England, United Kingdom

Latest round: Undisclosed Series D

Total raised: $45 million

Tags: Payments, mPOS, point of sale, SMB, security, cards, merchant acquiring, Finovate alum

Source: Finovate

CashSentinel

Mobile payments with escrow

HQ: Yverdon-les-Bains, Switzerland

Latest round: Undisclosed Seed

Total raised: Unknown

Tags: Payments, SMB, peer-to-peer, escrow, Finovate alum

Source: Finovate

1) Focus on contactless payment hardware.

1) Focus on contactless payment hardware.

Pictured: CashSentinel CEO, Sylvain Bertolus, with client

Pictured: CashSentinel CEO, Sylvain Bertolus, with client