A look at the companies demoing live at FinovateSpring on April 26 & 27 in San Jose. Pick up your tickets today and save your spot.

MapD is a next-generation database and visualization layer that harnesses the parallel power of GPUs to explore multi-billion row datasets in milliseconds.

Features

- Faster time-to-insight

- Better economics at every level

- Scalable over multiple servers

Why it’s great

Having the capacity to look across at billions of data points and assess opportunity or validate hypotheses has made MapD the weapon of choice for hedge funds and investment banks alike.

Presenter

Presenter

Todd Mostak, CEO & Founder

Mostak conceived of the idea of using GPUs to accelerate the extraction of insights from large datasets while conducting his Harvard Graduate research on the role of Twitter in the Arab Spring.

LinkedIn

Check out more sneak peeks of what to expect at FinovateSpring on April 26 & 27 in San Jose.

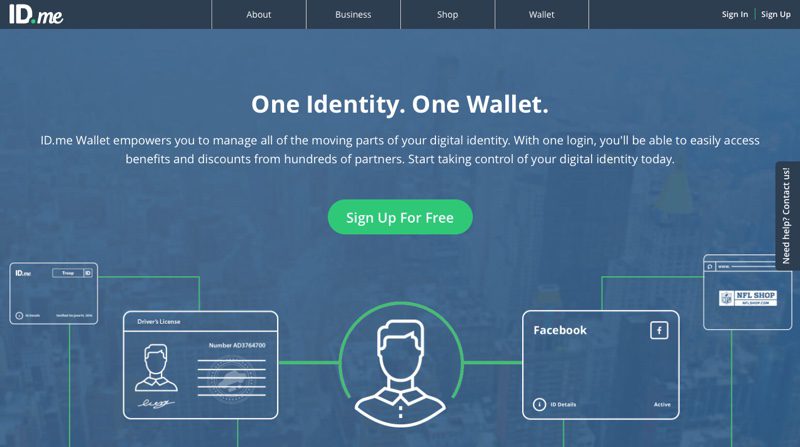

Bruce Chen, CEO

Bruce Chen, CEO

Presenters:

Presenters: Felipe Gil, VP of Product Development

Felipe Gil, VP of Product Development

Presenters:

Presenters: Marc Tomlinson, Co-founder/CTO

Marc Tomlinson, Co-founder/CTO

Dan Michaeli, Co-Founder and CEO

Dan Michaeli, Co-Founder and CEO

Presenters:

Presenters: Stephen Smith, Director of Strategic Partnerships

Stephen Smith, Director of Strategic Partnerships