FinovateMiddleEast will take place February 26 and 27 in Dubai.

We’re taking the fintech conversation to a new region this year, and with a new territory, comes new themes, trends, banking interests, and startup portfolios. FinovateMiddleEast, scheduled for February 26 and 27 in Dubai, will showcase 20+ companies’ newest fintech innovations in Finovate’s signature 7-minute demo format. For more about these companies, check out the presenter announcement. Then tune into our blog series over the next few weeks for a sneak peek of the new technology we will unveil on stage.

Analyzing regional trends

For the Middle East debut, we’re going beyond our traditional demo-only format. Through keynote speeches, panel discussions, and fireside chats, we’re taking the discussion further. Here are some of the hot-button issues we’ll explore:

Accelerator opportunities

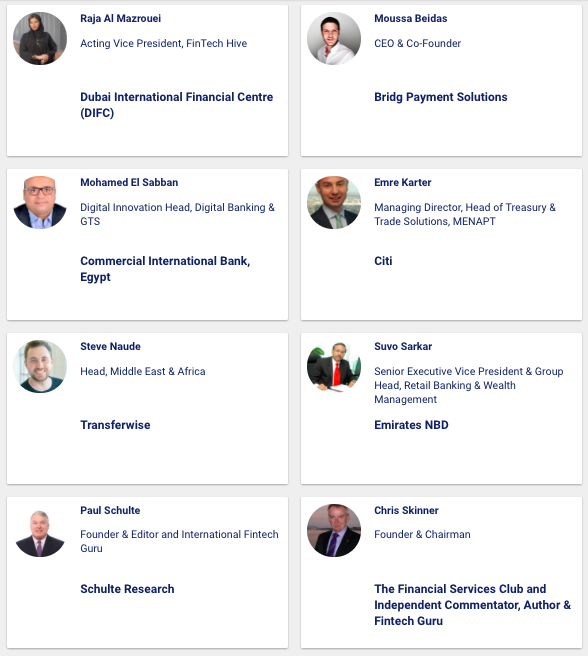

Over the past 10 years, accelerators and bootcamps have played a crucial role in helping startups not only fast-track their ideas into working realities, but also fostering their key partnerships with banks and major financial institutions. And while fintech accelerators have existed for many years, emerging fintech hubs are placing greater emphasis on them as a means to accelerate innovation. In this session, we’ll look at how Fintech Hive at Dubai International Finance Center (DIFC) is doing this.

Through an interactive session, we’ll take a closer look at how Fintech Hive at DIFC is creating a supportive regulatory framework and how it enhances innovation, growth and testing new fintech ideas.

Cross-border payments

Large firms such as IBM and Mastercard are leveraging the blockchain for a less expensive and faster way to transfer funds. Additionally, startups such as KlickEx, Transferwise, and The Currency Cloud have each launched their own competing platforms. The application of this technology is already in place. In fact, last October, India-based ICICI Bank and Emirates NBD announced they made a cross-border transaction using the blockchain. With money on the move in today’s global environment, it’s time to start paying attention.

In a keynote discussion titled The Future of Cross Border Money Movements and The Direction They Are Headed, Steve Naude, Head of Middle East and Africa at Transferwise, will share his vision for the future of cross-border transactions.

Artificial Intelligence

Artificial intelligence (AI) was one of the hottest fintech trends in 2017 and will surely dominate the conversation in 2018, as well. The enabling technology is no longer simply a “nice to have,” add-on feature for banks and fintechs; it is the norm. Common applications include using AI to create chatbots to have a human-like conversation with clients, bolster application security by monitoring consumer behavior to detect non-normalities, and help consumers understand budgets and spending behavior to increase savings.

Fintech guru Paul Schulte will deliver the keynote discussion on AI. Schulte’s resume includes the U.S. House of Representatives, White House, and International Trade Commission. Additionally, he served as an advisor to the IDA in Singapore, Australian Securities and Investment Commission (ASIC), Hong Kong Stock Exchange, SEBI and Malaysian Securities Commission on developments in financial technology. With such a broad outlook, the audience is sure to get a global view of AI usage in banking.

Dubai’s local startup ecosystem

Fintech is global, but the focus of startups is uniquely regional. For a distinctive look at fintech in MENA, several companies will participate in rapid, three-minute pitches, followed by interactive Q&A. Here’s a look at a few:

- Democrance, an insurance technology company with a mission to create partnerships that make insurance accessible for those who need it most but can afford it least

- Maliyya, a platform that is Shariah compliant for both borrowers and investors

- Qlikcash, an app-based payment platform that allows users to send and receive payments both locally and internationally

- ZagTrader, a ready-to-deploy brokerage and asset management platform

Payments

While traditional payment systems exist across the globe, payment technology extends far beyond swapping cash, swiping credit cards, or even clicking “Order now.” Fresh iterations of mobile wallets have been pushing to the forefront of in-person payment methodologies, particularly in the Middle East and Asia. This has been amplified by the increased popularity of IoT devices, especially wearables. New Zealand-based WestPac, in fact, launched its own line of wearable payment devices called PayWear this week.

But how many of these developments are useful or simply noise? In our Payments Transformation panel, a group of experts will discuss and debate what’s working, what’s not, and what’s next.

Blockchain and Bitcoin

Are we in a bubble? That’s the question our panel will investigate during this half hour session. Increasingly, fintech startups are leveraging the enabling capability of the blockchain for more than just payments: The immutable ledger also offers the ability to track and manage identities, manage smart contracts, and create data transparency. While these capabilities are unlikely just a passing fad, what about Bitcoin, other cryptocurrencies, and ICOs?

On the first day of 2017, Bitcoin surpassed $1,000 for the first time since 2014. Now, 10 months later, the price is reaching all-time highs, having spiked up to a record high today of more than $6,200. Between the inflated price and public comments from high-profile players such as Warren Buffet, who proposed Bitcoin is in “bubble territory,” and JPMorgan Chase CEO Jamie Dimon, who suggested Bitcoin is a “fraud,” there’s a lot to consider about its future success.

Featuring industry leaders and big banks

In addition to discussing key trends, industry leaders and big banks will share their views on the state of fintech and how they are addressing key issues.

- Chris Skinner, Founder and Chairman at The Financial Services Club and Independent Commentator, Author, and Fintech Guru

- Suvo Sarkar, Senior Executive Vice President & Group Head, Retail Banking & Wealth Management at Emirates NBD

- Emre Karter, Citi Managing Director, Head of Treasury and Trade Solutions, MENAPT at Citi

And for the latest, check out the full, two-day agenda and stay tuned to the blog!