- Embedded finance and digital banking solutions provider Finotta has announced a strategic partnership with Constellation Digital Partners (Constellation).

- Constellation will integrate Finotta’s Personified platform into its own solution to help credit unions offer personalized financial guidance to their members.

- Finotta made its Finovate debut at FinovateFall 2022 in New York.

Embedded finance and digital banking solutions provider Finotta forged a strategic partnership with Constellation Digital Partners (Constellation). A cloud-native digital banking services provider, Constellation will integrate Finotta’s Personified platform into its own solution to give credit unions new resources to boost member engagement and satisfaction, as well as drive digital growth.

“More than 90% of consumers expect their financial institution to offer a modern digital banking platform, but this is table stakes,” Finotta Founder and CEO Parker Graham said. “The key is differentiating the experience based on what members need and want, which is financial guidance. Unfortunately, this is also where massive missteps are made. Many traditional PFMs inadvertently shame consumers for poor financial habits rather than encourage positive behavior, killing the overall experience. As a result engagement is down considerably.”

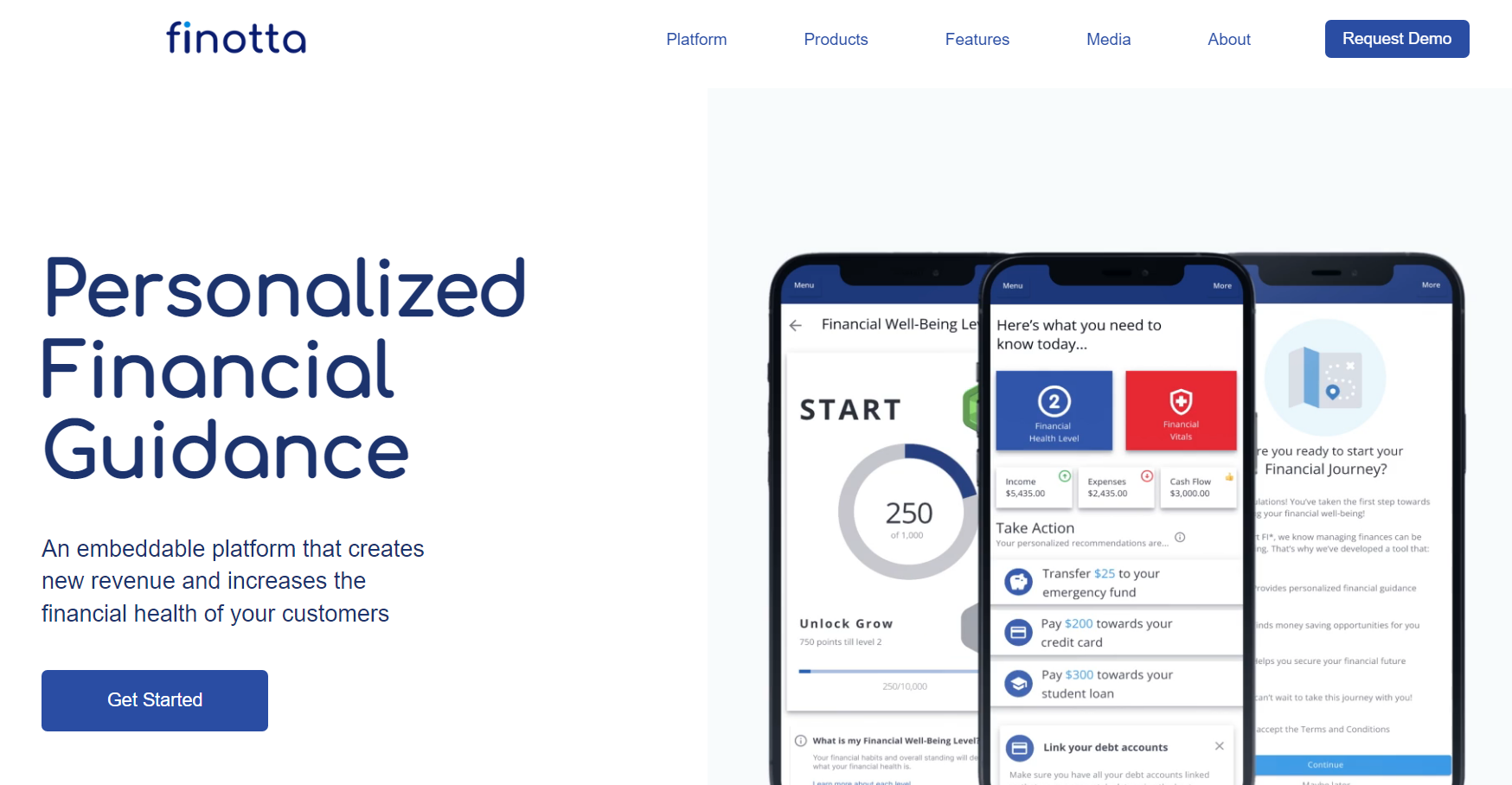

Founded in 2018 and headquartered in Overland Park, Kansas, Finotta made its Finovate debut at FinovateFall 2022 in New York. At the conference, the company demoed Personified, a suite of products that enable FIs to provide personalized financial guidance via their mobile banking apps. Personified helps financial institutions anticipate member and customer needs, increase product conversions, and deliver actionable financial guidance – all in a single solution. The platform helps banks and credit unions leverage the digital channel to generate more revenue, improve financial performance, and boost profitability for members and customers.

Last year, Finotta noted that its Personified platform had increased user engagement compared to other mobile banking apps, with an average use of 13 minutes per month per user. According to Graham, this compares favorably to the “less than one minute per month” that users spend on the average mobile banking app. Not only does this reflect a significant lack of engagement from users, it also limits the FIs ability to cross-sell other products and services. Finotta also pointed to a study from Oracle that suggested as much as 40% of customers believe that independent PFM apps are superior to the offerings provided by most financial institutions.

“Embedded (Finotta’s) technology into our platform will equip credit unions with the tools they need to thrive in the digital age while delivering personalized, seamless, and exceptional service to their members every step of the way,” Constellation SVP and Head of Product Aaron Oplinger said. “We look forward to the value this will bring our industry.”

Founded in 2017 and headquartered in Raleigh, North Carolina, Constellation Digital Partners is a leading provider of mobile and digital banking solutions for community-based financial institutions. The company is dedicated to empowering both credit unions and community banks with innovative solutions for mobile banking, online account management, personalized financial insights, and more. The company has raised $17 million in funding via a Series A round completed in 2020. Kris Kovacs is President and CEO.