Has Google found its iPod? Not the music player, but an end-to-end ecommerce system that is safe, convenient, and above all, drop-dead simple to use. Something that does for online commerce what Apple did for digital music. That's a tall order, but we believe the search giant may have just such a hit on its hands with Google Checkout.

Has Google found its iPod? Not the music player, but an end-to-end ecommerce system that is safe, convenient, and above all, drop-dead simple to use. Something that does for online commerce what Apple did for digital music. That's a tall order, but we believe the search giant may have just such a hit on its hands with Google Checkout.

For more than a year, there has been a great deal of speculation about Google’s entry into the payments arena. After months of quiet testing with carefully selected beta merchant partners such as Starbucks and Buy.com, Google Checkout was officially released June 29 <checkout.google.com>. Although the reaction in online blogs was mixed, we think it's a winner. The only question is whether it's a home run or a grand slam (or World Cup equivalents, one goal or four).

For more than a year, there has been a great deal of speculation about Google’s entry into the payments arena. After months of quiet testing with carefully selected beta merchant partners such as Starbucks and Buy.com, Google Checkout was officially released June 29 <checkout.google.com>. Although the reaction in online blogs was mixed, we think it's a winner. The only question is whether it's a home run or a grand slam (or World Cup equivalents, one goal or four).

Google Checkout (previously known as Google Payments or Gbuy) is an online-payments tool integrated with the user's Google account. On the surface, it's similar to PayPal, but the true strength and potential threat is its close ties to Google’s already industry-dominant search function.

At this point, Checkout's functionality is more limited than PayPal's. There is no stored value, no subscription payments, no eBay integration, no non-credit card options, no integrated debit card, or money market account. For the end-user, it's closer to a virtual wallet than a PayPal substitute. However, it goes way beyond what the ewallets of the late 1990s offered, taking control of the entire checkout process, a potentially disruptive technology in online retailing.

How it works

Searches that match a Google Checkout advertiser include a shopping cart icon embedded within the AdWords text box (see Google search on "Starbucks store" above). Users can buy products from these merchants in a few clicks without having to enter any additional information (see Google Checkout icon in lower left of the Starbucks shopping cart shown at right). This eliminates the dreaded merchant-account set-up process that causes massive shopping card abandonment problems, especially at relatively unknown merchants where privacy fears are greater.

Searches that match a Google Checkout advertiser include a shopping cart icon embedded within the AdWords text box (see Google search on "Starbucks store" above). Users can buy products from these merchants in a few clicks without having to enter any additional information (see Google Checkout icon in lower left of the Starbucks shopping cart shown at right). This eliminates the dreaded merchant-account set-up process that causes massive shopping card abandonment problems, especially at relatively unknown merchants where privacy fears are greater.

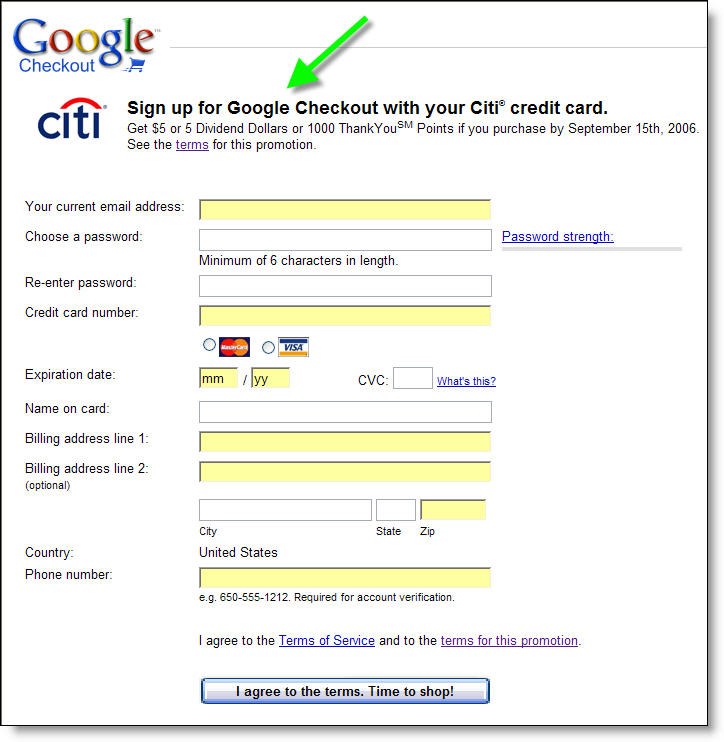

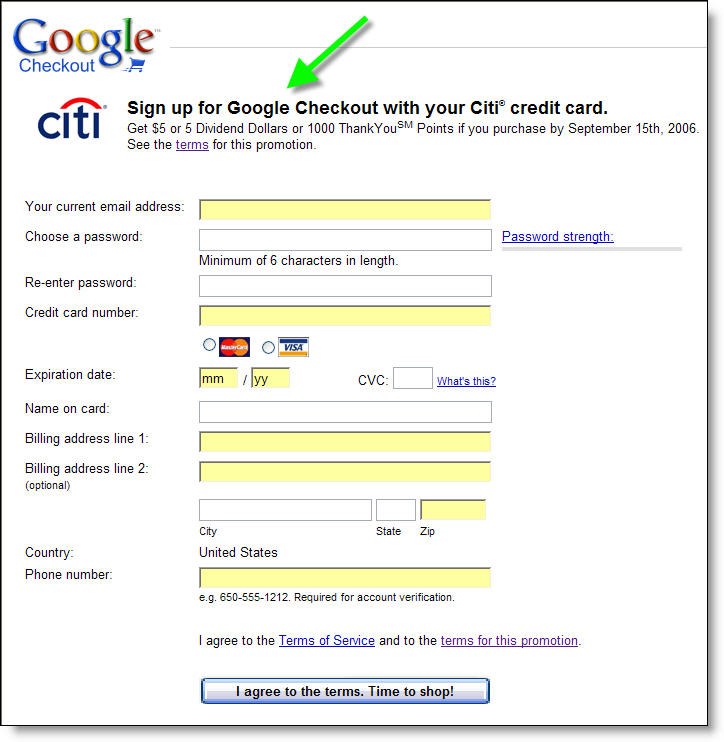

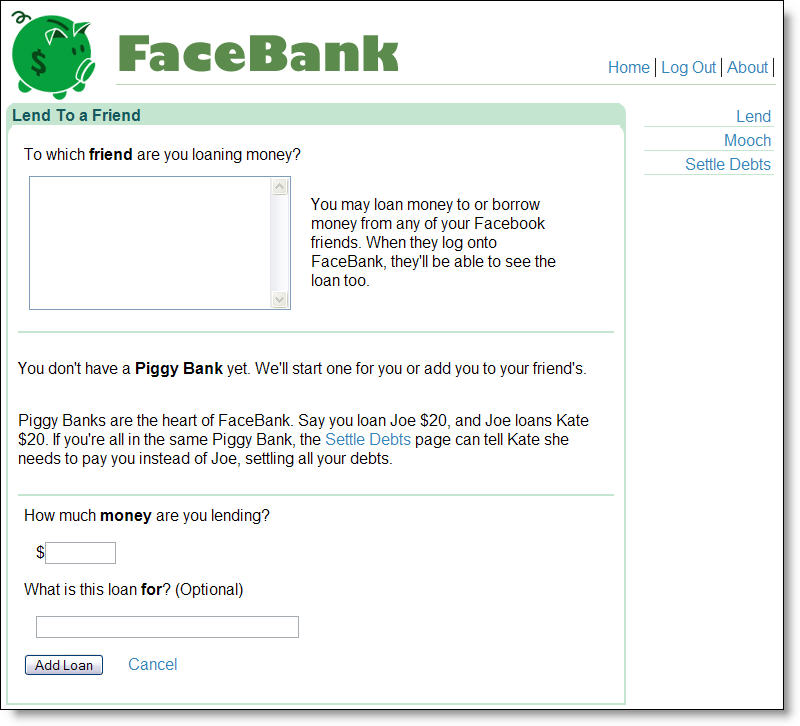

First-time users are prompted to enter their credit card, billing, and shipping information, which Google stores in its servers (see screenshot left). Subsequent purchases can be made with a simple Google username and password. Users can store additional payment and/or shipping options at any time. Complete purchase histories can then be monitored from their Google account.

First-time users are prompted to enter their credit card, billing, and shipping information, which Google stores in its servers (see screenshot left). Subsequent purchases can be made with a simple Google username and password. Users can store additional payment and/or shipping options at any time. Complete purchase histories can then be monitored from their Google account.

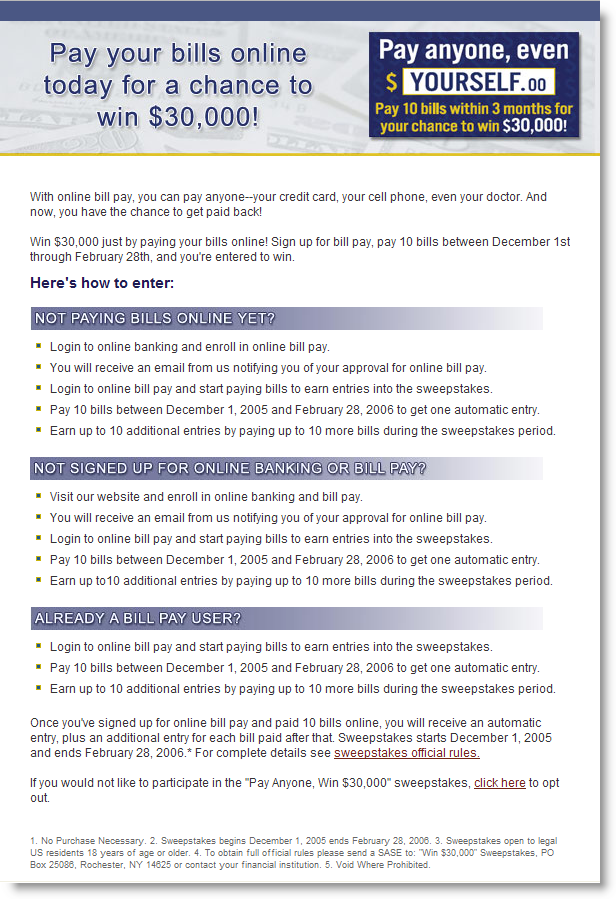

Currently, just 100 merchants are participating (see places to buy), but given the potential merchant savings, expect that to change quickly. Twenty-four of the 100 Checkout users offer a $10 discount on purchases of $20 or more (see DayDeals screenshot below).

Like PayPal, Google shields the buyer’s credit card number and other personal information beyond what is necessary for shipping purposes. However, Google also provides the option of keeping the user's email address confidential, a spam-limiting function not available via PayPal.

Like PayPal, Google shields the buyer’s credit card number and other personal information beyond what is necessary for shipping purposes. However, Google also provides the option of keeping the user's email address confidential, a spam-limiting function not available via PayPal.

When a user selects the confidential option (see screenshot below), Google forwards the seller's confirmation message to the end-user.

Sellers are paid directly through their own Google Checkout account. Google has significantly undercut PayPal on pricing, at least for smaller merchants. Google's fee is 2% of the sales amount plus a flat $0.20 transaction fee compared to PayPal’s typical 2.9% plus $0.30 (PayPal has a sliding scale with higher-volume, $100k/mo and above, merchants paying 1.9% plus $0.30).

In addition, Google advertisers earn credits against their processing fees. For every dollar spent on Adwords, sellers can process $10 worth of sales with no processing charges other than the $0.20 transaction fee. It amounts to a 20% discount on AdWords spending, provided there is sufficient Google Checkout volume (i.e., at least 10 times the amount spent in AdWords).

Finally, sellers can create their own Buy Now buttons at the Google site, then drag and drop the HTML code into their websites. This allows small business sellers who are not currently ecommerce-enabled to immediately begin accepting Google Checkout.

Google is expected to provide additional data as the service matures. Having a hand in the process from product search all the way through to the purchase will allow Google to keep tabs on which ads actually result in a sale. This could mean changes to Adwords pricing or structure.

Analysis

The pitch to consumers is appealing. In addition to the privacy shields, Google promises to mediate disputes, and gives users a central place to track purchases. But the biggest consumer benefit: a common user interface for checkout, something that previous ewallets never provided. As you can see in the screenshot below, after shopping the merchant site, the contents of the cart are transferred to Google. At that point, Google takes over, offering the end-user the following options:

- Change shipping method with all costs itemized

- Add a coupon code

- Change credit card

- Change shipping address

- Shield email address from merchant

- SIgn up for promotional messages from merchant

- Links to the user's Google account

- Concise summary of the billing info, including exactly how the charge will appear on the user's credit card statement

- Concise summary of the merchant's return policy

Will consumers give up more personal information to the largest data repository on earth? Initial polls seem to suggest so. In addition, you can bet that merchants will create incentives to move credit card and/or PayPal volume to Google to save as much as 3% on card processing. For a retailer with a 10% margin, that's a potential 30% lift.

You might be thinking that free credit card processing is a short-term loss leader that will end as soon as a critical mass of merchants adopts Google's system. We don't think so. Put yourself in the shoes of a Google advertiser. You now know that you'll earn a 20% discount on your A dWords buy. Will you let that drop to the bottom line, or might you use some of that windfall to goose your bids on Google a bit? If it's an efficient market, eventually much, if not all, of the "free" card processing will flow back to Google in the form of higher bids. And since not all merchants will qualify for the 20% discount, Google might actually increase its total take due to the "discount." Brilliant.

dWords buy. Will you let that drop to the bottom line, or might you use some of that windfall to goose your bids on Google a bit? If it's an efficient market, eventually much, if not all, of the "free" card processing will flow back to Google in the form of higher bids. And since not all merchants will qualify for the 20% discount, Google might actually increase its total take due to the "discount." Brilliant.

Citibank's role

Citibank's role

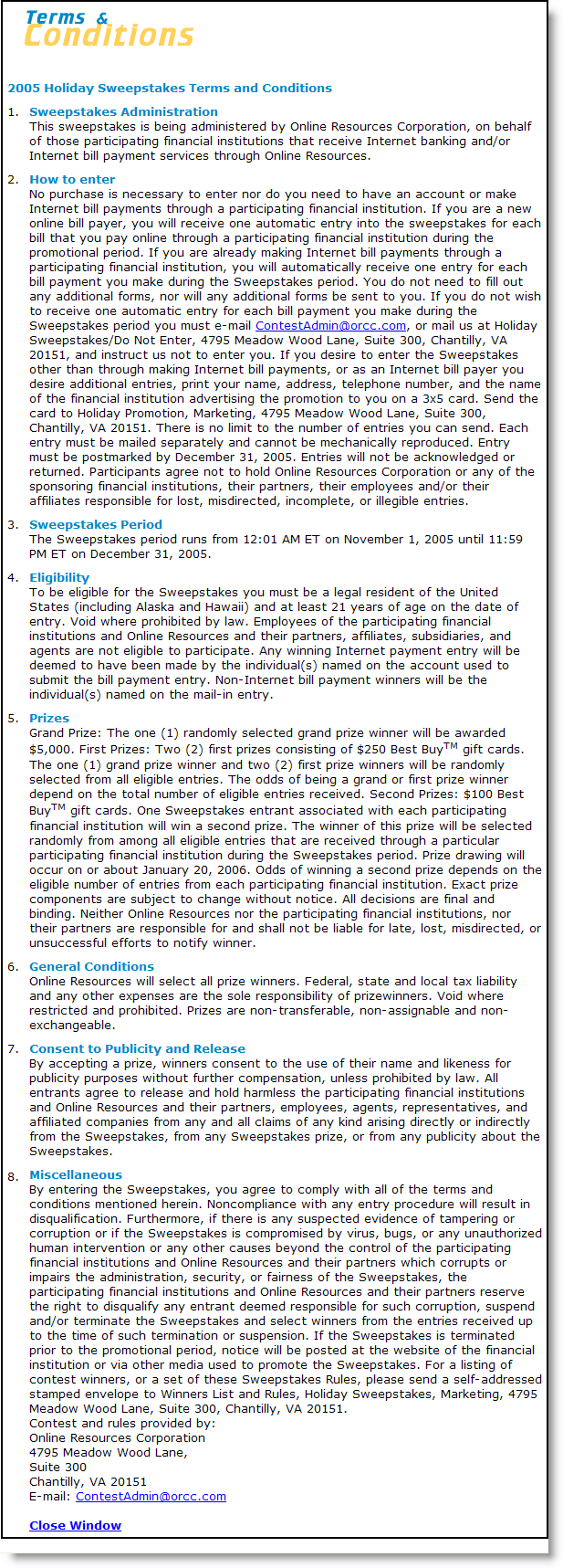

The program should have little impact on retail banks, since at this point Google Checkout must use a bank-issued credit or signature debit card to participate. However, Citibank is paying Google to be the "preferred card" on both the Google sign-in page (click on inset above for closeup) and the credit card registration page (click on inset right). The credit card giant is hoping the $5 (or 1000 Thank-you points), will entice users to enter their Citi card into the Google wallet. The $5 bonus offer ends Aug. 1.

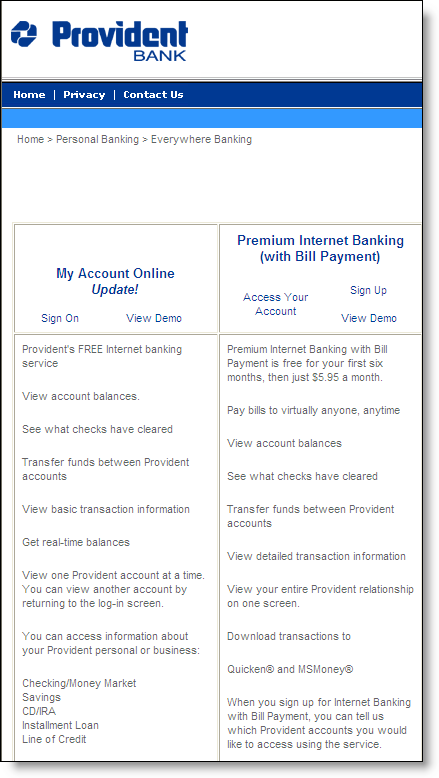

Retail banks might want to consider supporting the payment service with a secure gateway to various online payment alternatives so users can manage their PayPal, Google, and other accounts directly from a secure online banking area.

If you are a credit card processor, however, this could eventually pose a threat to your market share and/or margins. Even without factoring in the AdWord's credit, Google's highly publicized 2% discount rate, along with a lack of monthly fees, is a bargain, especially for small businesses. However, given the reluctance of businesses to change banking relationships, it will be years before the impact is felt.

—JB

ous post), Bank of America continues to hold a large lead over the next largest U.S. online banking base, Wells Fargo's 8 million.

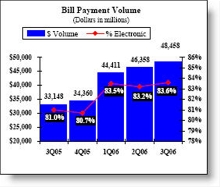

ous post), Bank of America continues to hold a large lead over the next largest U.S. online banking base, Wells Fargo's 8 million.  On the bill-pay front, the bank processed $49 billion in payments for its users during the quarter, up $2.1 billion over the previous quarter (+4.5%). The average payment amount was $4,500 per active bill pay user, or $1,500 per month with 84% of the payments delivered to the payee in electronic form (ACH).

On the bill-pay front, the bank processed $49 billion in payments for its users during the quarter, up $2.1 billion over the previous quarter (+4.5%). The average payment amount was $4,500 per active bill pay user, or $1,500 per month with 84% of the payments delivered to the payee in electronic form (ACH).

Y

Y