In this week’s edition of Finovate Global, we take a look at a handful of developments in Estonia’s fintech industry. With a population of more than 1.3 million, Estonia has the Baltic Sea to the west, the Gulf of Finland to its north, Latvia on its southern border, and the Russian Federation on its eastern flank. The Northern European nation achieved its independence from the Soviet Union in 1991 following the “Singing Revolution” between 1988 and 1990. Estonia is considered a high-income economy per the World Bank, and has been referred to as a “Baltic Tiger” due to the country’s rapid growth.

First up is news on the regtech front. Estonian startup Salv announced that it recently secured a $4.3 million (€4 million) seed round extension. The funding was led by New York-based ffVC and featured participation from Germany’s G+D Ventures, as well as existing investors. Salv’s signature offering, Salv Bridge, is a real-time collaborative crime-fighting platform that leverages the power of its network to reduce non-compliance and combat financial crime. The company said that the funding will help accelerate development of its technology, as well as support Salv’s expansion into other markets, starting with Poland.

“The digitalization of the financial industry has resulted in an avalanche of financial crime, and the numbers are only projected to grow,” Salv CEO Taavi Tamkivi said. “Salv Bridge is proven to be effective against money laundering, sanctions, and fraud.”

The new funding takes Salv’s total capital raised to $8.2 million. Headquartered in Estonia’s capital city of Tallinn, Salv was founded in 2018. The company wrapped up 2022 with a pair of new partnership announcements – teaming up with Estonian-based banking platform Tuum and collaborating with greentech innovator Single.Earth.

Speaking of partnerships, Estonia-based identity verification and AML services provider Veriff announced a partnership with digital asset company Baanx. Veriff will provide identity verification services to the firm, enabling Baanx to confirm user identity during the onboarding process. Veriff’s technology can verify more than 11,200 government-issued identification documents from more than 190 countries and in 47 different languages.

“Cryptocurrencies are disrupting the world of finance, and the crypto industry has evolved dramatically over the past few years,” Veriff COO Indrek Heinloo said. “However, transactions between users are generally anonymous and instantaneous, providing more opportunities for fraudsters and criminals looking to evade conventional anti-money laundering controls. And right now, fraud rates for crypto transactions are at an all-time high.” Heinloo added, “it has never been more important for online banking platforms that offer crypto services to be several steps ahead of these bad actors.”

Veriff was founded in 2015 and is based in Tallinn. The company has raised more than $192 million in funding from investors including Tiger Global Management and Alkeon Capital, who led the company’s Series C round in January of 2022. Also this month, Veriff announced the appointment of Javier Ortega as the firm’s new Chief Revenue Officer.

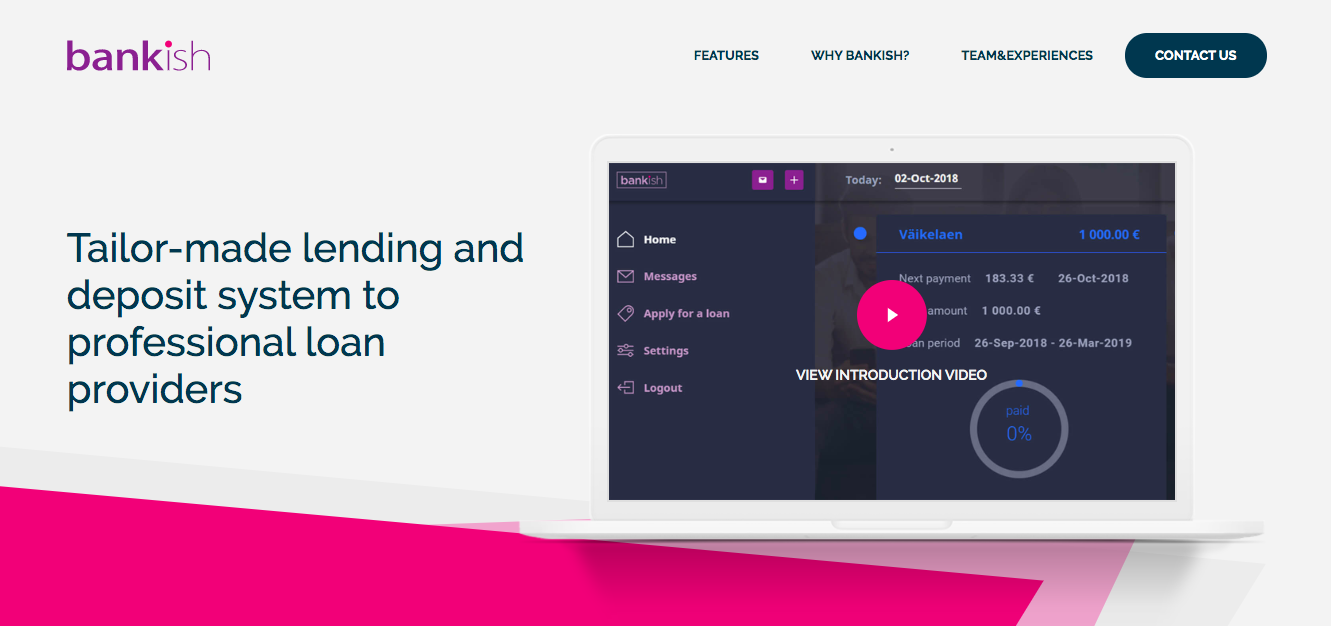

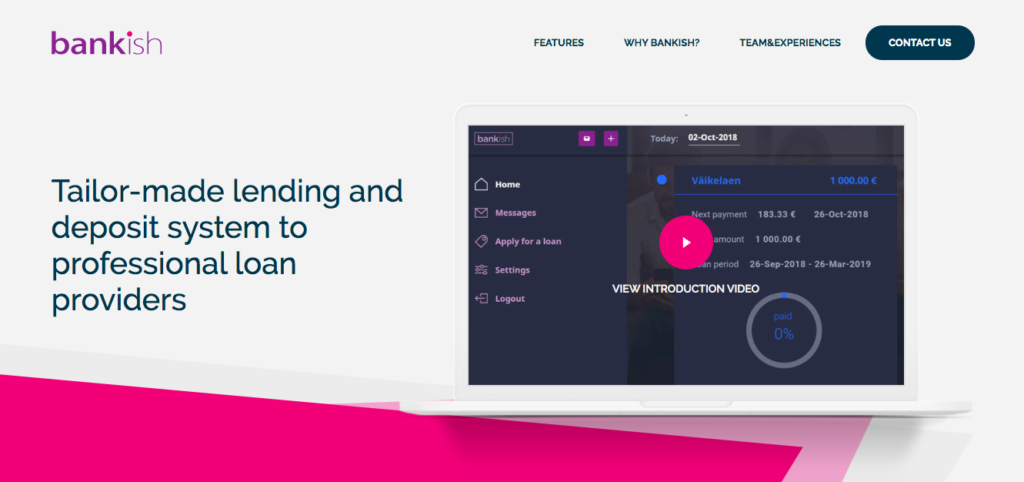

In recent years, Finovate has showcased a handful of Estonian fintechs. Among the Finovate alums that call Estonia their home are: Bankish, which demoed its technology at FinovateEurope 2020; Modularbank, which made its Finovate debut at FinovateEurope 2019; and Crypterium, which demoed its technology at FinovateFall 2018. At FinovateEurope 2023 next month, we will feature our latest Finovate alum from Estonia: call center performance management software provider, Ender Turing. Learn more about our upcoming fintech conference, FinovateEurope, March 14 through 15 in London, at our FinovateEurope hub.

Here is our look at fintech innovation around the world.

Asia-Pacific

- Japan’s Fujitsu forged a partnership with Mizuho Bank to help clients better manage ESG and SDG data.

- Hong Kong-based virtual bank, livi bank, announced its move into wealth management services this week.

- Fintech News Singapore looked at the impact of digital lending on Vietnam’s small business sector.

Sub-Saharan Africa

- South African-based digital lender Lulalend raised $35 million in Series B funding.

- The Central Bank of Nigeria and the Nigeria Inter-Bank Settlement Systems launch a national payment card.

- Google announced that it would ban unlicensed lending apps in Kenya.

Central and Eastern Europe

- Tech.eu profiled Germany-based connectivity platform, Team Viewer, and its new partnership with global consumer goods company Henkel.

- Lithuanian regtech firm AMLYZE teamed up with fraud prevention company Ondato.

- Turkey-based fintech Papara reached 15 million users, ranking the firm among Europe’s largest neobanks.

Middle East and Northern Africa

- Egyptian fintech MNT-Halan earned unicorn status after securing $400 million in funding.

- MENA-based financial services enabler Paymob forged a new partnership with Egypt-based digital warehousing and fulfillment management platform Khazenly.

- Cash Plus and Mastercard partnered to launch an international e-card in Morocco.

Central and Southern Asia

- Samsung Wallet will go live in India as a merged solution combining mobile payments solution Samsung Pay and password management app Samsung Pass.

- India’s Razorpay launched a forex service for startups.

- Worldline introduced its new Buland Bharat digital payments suite for SMEs in India.

Latin America and the Caribbean

- Mastercard and Binance teamed up to launch aa prepaid crypto card in Brazil.

- AstroPay went live with its Visa prepaid card offering in Peru.

- Brazil-based payments fintech Transfeera secured $1.3 million (BRL 7 million) in funding.