Five days from the U.S. income tax deadline, tax prep ads are everywhere. I don't usually notice them because I still file the old-fashioned way, via CPA (note 1) and paper check. However, yesterday I noticed H&R Block's banner strung across the top of TechCrunch (screenshot below).

Five days from the U.S. income tax deadline, tax prep ads are everywhere. I don't usually notice them because I still file the old-fashioned way, via CPA (note 1) and paper check. However, yesterday I noticed H&R Block's banner strung across the top of TechCrunch (screenshot below).

It caught my eye for a several reasons:

- 24/7 access to live tax help, a real benefit to the legions of last-minute filers.

- The "Tango" branding really intrigued me. How could a tax service be interesting enough to have its own brand, especially one as off-beat as Tango (note 2)?

The Tango product, complete with YouTube videos, <wannatango.com> URL, and more, deserves a post of its own, but here I want to focus on Block's pricing/segmentation.

The tax-prep giant divided its online services into two distinct categories, both catering to the computer savvy do-it-yourself crowd. Block calls the segments: "Do it Myself" and "Do it With Me" (screenshot below) with pricing as follows:

Do it myself:

- $14.95 for 1040EZ

- $29.95 for 1040 with itemized deductions

- $59.95 for 1040 with state return

Do it with me:

- $70 Tango option — complete online and submit yourself with unlimited 24/7 support (includes state return)

- $99.95 (+$34.95 for state) complete yourself and then route to an H&R Block agent to review and e-file

- $99.95 (+$34.95 for state) and above (note 3) to fill out an online questionaire and submit your data to have someone at H&R Block complete the return for you

NetBanker strategic action item

Banks, take notice. Block's pricing strategy is brilliant and if applied to online banking, could revive the difficult business case. Online banking, like electronic tax prep, is a mature business, and has long ago proven itself as valuable and convenient.

Now it's time to cash in on that convenience. While levying fees across the board would create customer ill-will, it's possible to segment your online banking base into customers who want plain vanilla services for free and those that want the best, and are willing to pay for it. Block's Tango is a good example of how to price for those who want to go it alone for the lowest cost and those that want high-tech online services AND high-touch tech support.

A bank or credit union could mimic the Block program:

- Do it myself (FREE): Download data, set up my bills, create triggered alerts, monitor my own security settings, read my own credit report, store my own statements on my hard drive, and so on

- Do it with me ($5/mo): 24/7 access to an online specialist who will provide advice, assistance, and help doing any of the above. Added bonus: lifetime storage of all transactions, statements, and check images!!!

Call it VIP Banking and start turning online banking into a profit center. With dedicated fee income you will have fewer problems during the looming crisis in online banking measurement.

For more on online banking pricing and how to develop a premium-priced online banking service, see our Online Banking Report: Pricing – The "Fee" vs. "Free" Controversy (#109).

H&R Block Banner on TechCrunch (9 April 2008, 1 PM Pacific)

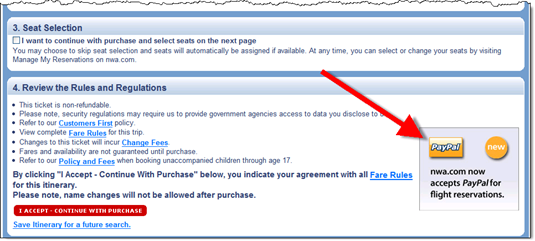

Landing page from TechCrunch banner (9 April 2008)

Tango homepage (9 April 2008)

Notes:

1. In testing Turbotax and TaxCut, I have found both to be intuitive and surprisingly easy to use, even for relatively complicated returns with business deductions. This year, I did my teen's return on the free TurboTax online site, which was very slick. My son's already deposited his $2 refund into his online bank account.

2. H&R Block's Tango actually has a Wikipedia listing (within the H&R Block entry). That's something you don't see too often. According to Wikipedia, the Tango service first appeared last year for 2006 returns, but was plagued by computer glitches that forced the company to issue refunds. But it received good reviews this year, scoring an 82 here, just two points less than leader TurboTax Online. Tango finished ahead of the other four sites reviewed (here).

3. My federal returns would cost $199.80 through this most expensive option, about $500 less than my CPA.

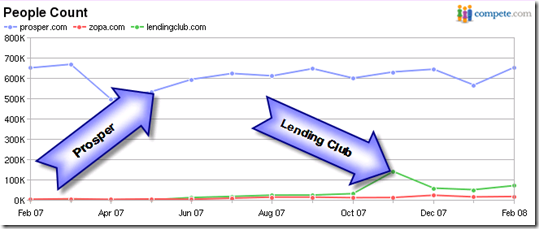

While Prosper still had twice the overall loan volume of Lending Club in Q1 ($21 vs. $10 million), Lending Club is closing the gap in the prime/near-prime market (FICO 640+) originating two-thirds the volume of Prosper in March ($4 vs. $6 million). But if you take into account Lending Club's more stringent debt-to-income requirements (max 30%), the newcomer actually surpassed Prosper in these lower-risk loans ($4.1 vs. $3.7 million in March).

While Prosper still had twice the overall loan volume of Lending Club in Q1 ($21 vs. $10 million), Lending Club is closing the gap in the prime/near-prime market (FICO 640+) originating two-thirds the volume of Prosper in March ($4 vs. $6 million). But if you take into account Lending Club's more stringent debt-to-income requirements (max 30%), the newcomer actually surpassed Prosper in these lower-risk loans ($4.1 vs. $3.7 million in March).

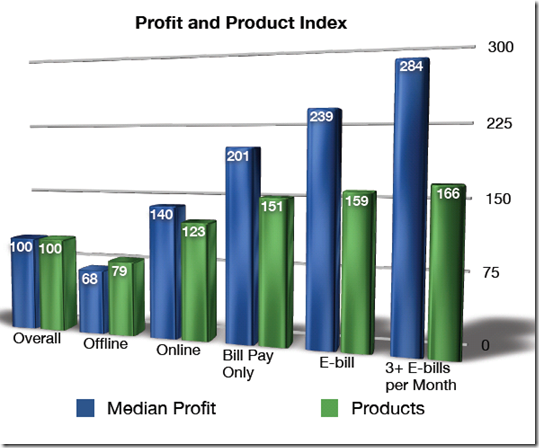

It comes as no surprise to anyone that online banking and bill pay customers are more profitable than non-adopters. This correlation, driven by the favorable demographics and lower attrition of online adopters, has clearly been established since the early days of the Web.

It comes as no surprise to anyone that online banking and bill pay customers are more profitable than non-adopters. This correlation, driven by the favorable demographics and lower attrition of online adopters, has clearly been established since the early days of the Web.