Having just gone through the exercise of calling four banks to tell them I may be using their card outside the country

Having just gone through the exercise of calling four banks to tell them I may be using their card outside the country

(see note 1), I’m convinced it’s high time for banks and card issuers to upgrade their online services for travelers. It would not only be convenient for customers, but also develop into a sizable profit center for banks.

Newspapers have supported automated vacation stops/holds for many years primarily to reduce customer service costs. But credit and debit-card issuers have a much stronger business case. For example:

- Fewer fraud losses

- Lower customer service expenses

- More interchange, exchange fees, and interest income from authorizing more transactions

- Cross-sales of travel-related services

- Advertising/sponsor revenues

- Potential subscription or per-trip fees

Here’s the features I’d like today:

- Web-based form to input travel itinerary

- Ability to update the itinerary when changes occur

- Ability to establish withdrawal limits while traveling

- Ability to order foreign currency

- Ability to switch my email alerts to text-message alerts while traveling (see Alaska Airlines screenshot below)

- Ability to purchase trip insurance

- Ability to order prepaid travel card(s)

- Ability to see exchange rates and have them automatically forwarded to me on a periodic basis while abroad

- Info on using my debit/credit card abroad, including fees, what to do if it’s lost or stolen, calling customer service, cash advances from international banks, and so on

- ATM/bank maps at my destination

- A few disposable card numbers I could use if purchasing online while out of town

- And finally, something I wouldn’t have thought of until this past trip, a guarantee that the bank won’t cancel and reissue my card while I’m traveling (see Wells Fargo, note 1).

And a few more items for the future file:

- Automatically track my whereabouts via GPS

- Ability to forward travel confirmations (e.g., Tripit.com) so I wouldn’t be bothered to input my itinerary

- ATM/bank location on my mobile

- Automatic coverage of any bills that come due during the travel period

Pricing

Depending on the package, a one-time travel fee of $5 to $20 would make sense. Or, using the telecom model where every value-added service is sold on a subscription basis, a $4.95/month “frequent traveler” upcharge would be palatable.

Alaska Airlines message service (14 July 2009)

Allows user to choose different messaging options depending on whether they are home or on the road

Notes:

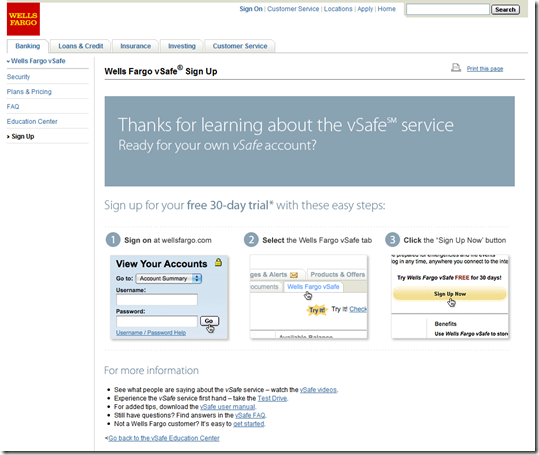

1. And despite my advance call, Wells Fargo canceled my credit card mid-trip, without telling me (there was a letter waiting when I got home), despite the fact the fraud the bank was concerned about happened more than two months prior (see previous post).

2. Image courtesy of http://etc.usf.edu/clipart.