While full-functioned personal financial management (PFM) has its strategic advantages, the truth is that most consumers will never use a financial tool that takes longer than the length of a YouTube video to figure out (note 1).

While full-functioned personal financial management (PFM) has its strategic advantages, the truth is that most consumers will never use a financial tool that takes longer than the length of a YouTube video to figure out (note 1).

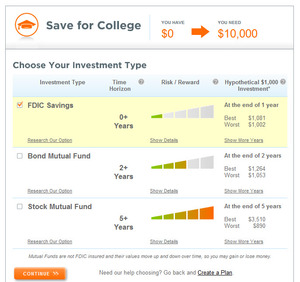

That’s why I’m a big fan of what Wells Fargo has done with My Spending Report, a drop-dead simple method for periodically seeing how out-of-control your spending is. All you do is click on the appropriate tab within online banking and bang, you are instantly looking at a pre-categorized spending analysis. Let’s call it one-click PFM.

ATM Cash Tracker (press release), the newest tool from the bank, is similarly simple to set up and use. Although it’s initially designed for ATM users, the concept would work well online and even better via a mobile app.

Wells customers can add a Cash Tracker button to their personalized ATM menu (see first screenshot). When selected, the new tool will reveal the total cash withdrawn during the current month along with the average during the past 12 months. It tracks only cash withdrawn from Wells Fargo ATMs.

That’s a great ATM innovation, but it will be even better when extended to mobile/online and applied to all cash use. As soon as I take money out of any machine (not just Wells Fargo) or receive cash back at the POS, my total cash use should be reflected on an online/mobile widget along with historical comparison. And users should have the option to tag the cash with spending categories to help assign it to the proper My Spending Report bucket.

And for users opting for emailed ATM receipts instead of paper ones (note 2), the Cash Tracker totals could be added to the virtual receipt (see second screenshot).

Wells Fargo personalized ATM menu

Note: New ATM Cash Finder not shown

Wells Fargo customers can choose to have their ATM receipt emailed

Note: Option E (below) allows users to hide their account balance from showing on the ATM screen.

————————-

Notes:

1. And I’m one of those people, so this is not meant to be a condescending remark. Just a fact.

2. Wells Fargo released the ATM e-receipt option in June (press release)

3. Photo credit: Colin/thetruthabout

4. For more on online personal financial management (OFM), see our recent Online Banking Report.