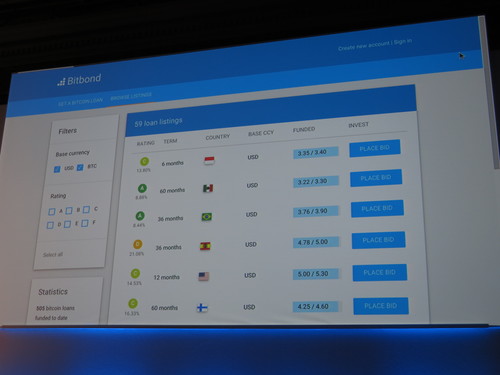

Bitbond AutoInvest allocates funds on behalf of lenders according to their chosen investment profile. AutoInvest will create a loan portfolio according to predefined criteria. The criteria are: investment amount, risk category, base currency, and regions. The regions are North America, Latin America, the Caribbean, Europe, Central Asia, the Middle East, North Africa, Sub-Saharan Africa, Asia, and the Pacific.

The exciting thing about portfolio building according to a profile is that Bitbond allows you to invest automatically into a globally diversified loan portfolio at 0% fees.

Bitbond Launches AutoInvest Feature for Bitcoin-Based Peer-to-Peer Lending Platform

This post is part of our live coverage of FinovateEurope 2015.

Bitbond launched AutoInvest feature for its bitcoin-based P2P lending platform.

Presenters: Co-founders Radoslav Albrecht, CEO, and Robert Nasiadek, CTO

Product launch: February 2015

Metrics: €200,000 equity raised; 4 employees; more than 6,000 signed-up users from 120 countries

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

HQ: Berlin, Germany

Founded: January 2013

Website: bitbond.com

Twitter: @Bitbonds