Business payments network Bill.com announced this week that JP Morgan Chase will leverage Bill.com’s technology to add an automated payment solution to its digital platform for businesses. The new solution is scheduled to be unveiled in 2018, and is designed to give businesses and easier and faster way to send invoices and get paid.

CEO of Commercial Banking for JP Morgan Chase, Doug Petno, called the partnership part of the bank’s drive to “deliver more value and functionality” to clients. JP Morgan Chase Business Banking CEO Andrew Kresse added that teaming up with Bill.com would enable Chase to become what he called “the easiest bank to work with.” Kresse explained this meant “finding ways to help businesses move toward digital automation and quicker time to money.” He added, “this solution does just that.”

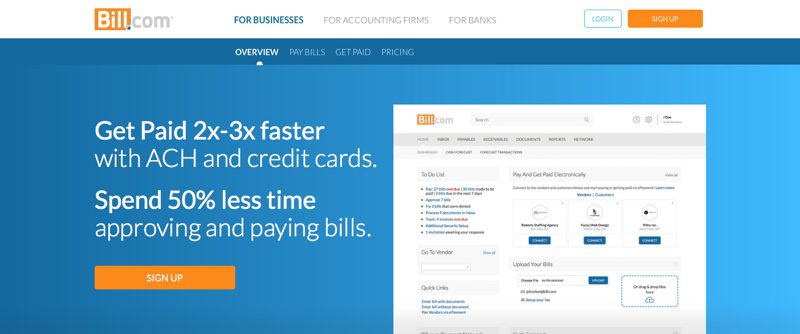

The new B2B solution is slated to reduce bill management time by up to 50%. Businesses will be able to send and receive electronic payments and invoices, electronically store and manage documents, and enable workers and customers to use efficient, digital workflows. The solution will be able to synch with other accounting platforms, removing the need for manual data entry. “Chase clients will be able to say goodbye to sending and receiving paper checks and hello to a new era of time and cost savings,” Bill.com CEO and founder Rene Lacerte said.

In addition to the integration, JP Morgan Chase has made a strategic investment in the Palo Alto, California-based company. The amount of the investment was not disclosed. But Bill.com is believed to have raised more than $159 million in funding. JP Morgan Chase joins Bank of America and Silicon Valley Bank, as well as Scale Venture Partners and Emergence Capital Partners among Bill.com’s investors.

Founded in 2006, California, Bill.com demonstrated its CashView solution at FinovateSpring 2012. The company has more than 2.5 million members in its networking sending and receiving more than $36 billion in payments each year. Partnered with four of the top 10 banks in the U.S. and more than half of the top 100 U.S. accounting firms, Bill.com teamed up with Commerce Bank in July to help FI launch its automated AR/AP service CashFlow Complete. Also this summer Bill.com announced deeper integration with Intuit’s QuickBooks and a similar initiative with fellow Finovate alum, Expensify. The company began the year by forging a strategic partnership with Capital One – and Gusto – to help development financial management solutions for SMEs.