This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

The team from Big Data Scoring is making its way to the stage next.

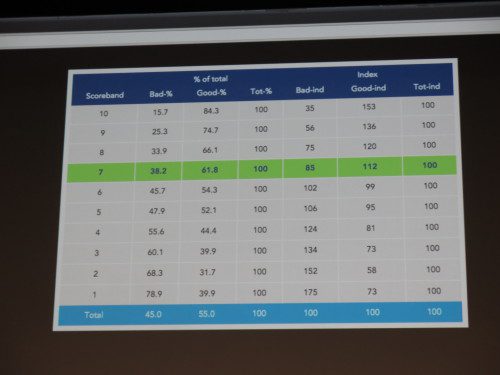

Our big data underwriting models have been used and tested for years and show an average 25% improvement in scoring accuracy over current best-in-class scoring models. For a lender, this translates directly into better credit quality and more clients. The solution can be easily integrated into any platform and the benefits are immediate. We also offer a risk-free testing opportunity.

Presenters: Erki Kert, CEO, co-founder; Meelis Kosk, head of sales

Product distribution strategy: Direct to business (B2B); licensed

HQ: Tallin, Estonia

Founded: February 2013

Website: bigdatascoring.com

Twitter: @bigdata_scoring