A look at the companies demoing at FinovateSpring Digital on May 10 through 13, 2021. Register today and save your spot.

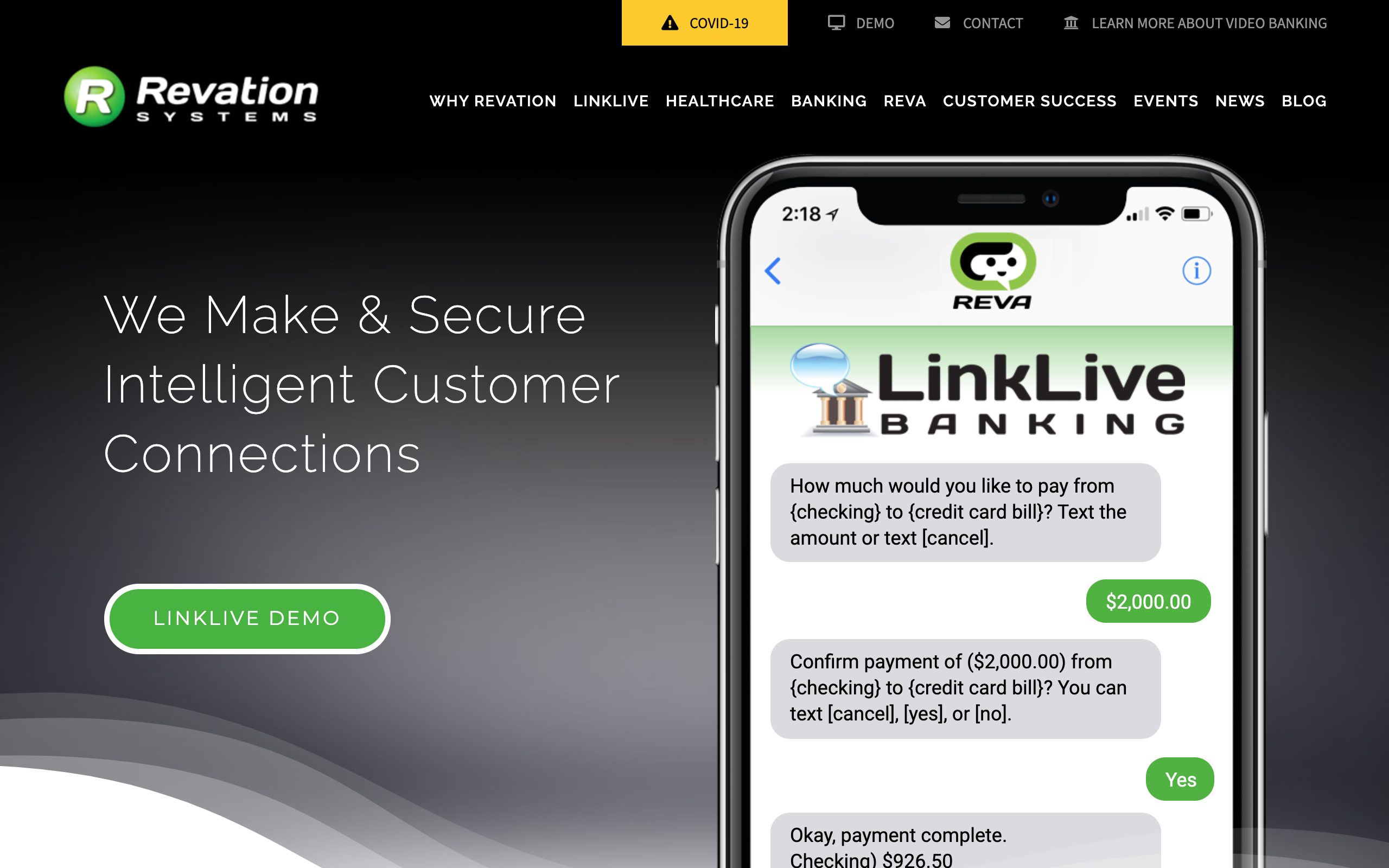

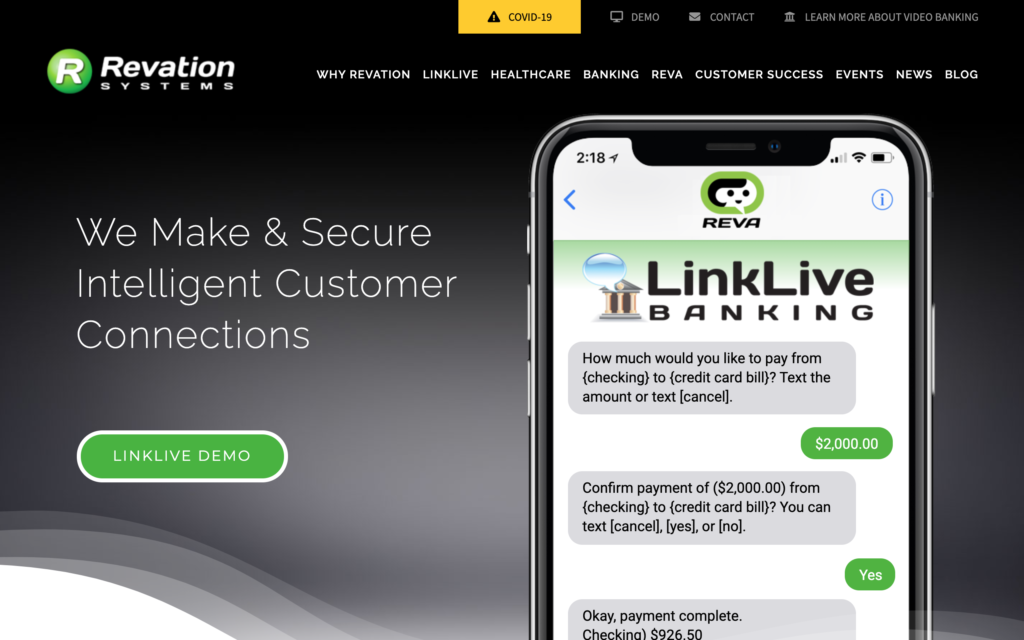

Revation‘s LinkLive brings the virtual lobby to the customer and simplifies digital appointment scheduling and conferencing – all in one solution.

Features

- Digital appointment scheduling built on top of secure messaging

- Dynamically routed calendar requests for real-time servicing

- Permanently eliminating the need to schedule a web conference

Why it’s great

Layered on top of LinkLive’s secure messaging foundation, online appointment scheduling and conferencing help banks digitize and virtualize all silos of their business.

Presenters

Patrick Reetz, SVP of Products & Markets

Reetz is an innovator who has helped banks define and deliver on their digital destinations. Reetz supports Revation’s mission of elevating digital customer service.

LinkedIn

Perry Price, CEO

Price is a lifelong entrepreneur and a veteran in the telecommunications industry. Price set out to create the most secure platform in the marketplace.

LinkedIn