Payroll and benefits provider, Gusto (formerly ZenPayroll), recently closed on $50 million. Specific investors were not disclosed, but the company states that both new and existing investors were involved.

According to Gusto, these funds are part of the Google Capital-led $60 million series B round announced in April. Gusto CEO Joshua Reeves explains, “We decided to take in more capital because we wanted to give investors a chance to increase their position. They’ve been incredibly supportive and helpful.”

Gusto filed with the SEC on 4 December, and closed the round in a week and a half. According to a VentureBeat article, Reeves disclosed that the new installment values Gusto “hundreds of millions of dollars higher” than the company’s $560 million valuation reported in April.

Gusto was founded as ZenPayroll in 2011 with a mission to make payroll delightful. In September, the company changed its name to Gusto and expanded its focus to include health benefits and workers compensation. The move positions Gusto to compete directly with Zenefits, which, having recently expanded into payroll services, describes itself as an “all-in-one HR platform.”

Gusto unveiled its payroll-processing platform at FinovateSpring 2014 in San Jose.

Presenters

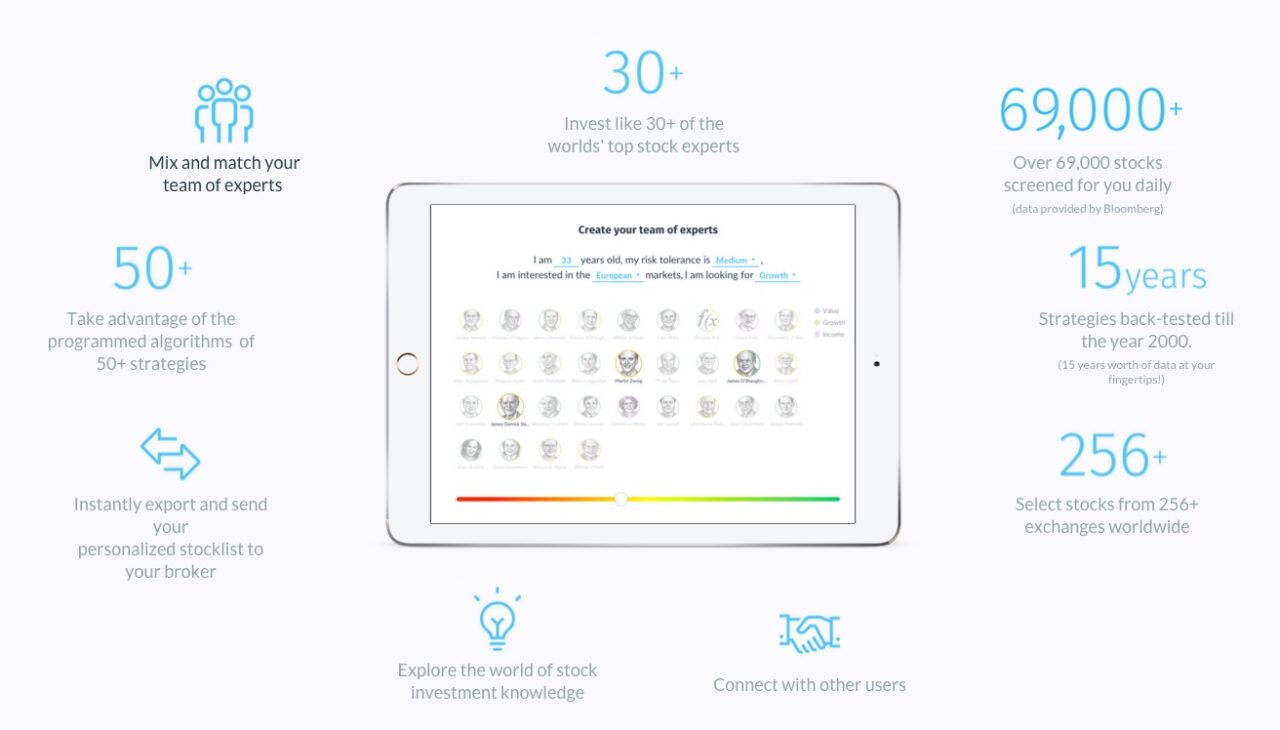

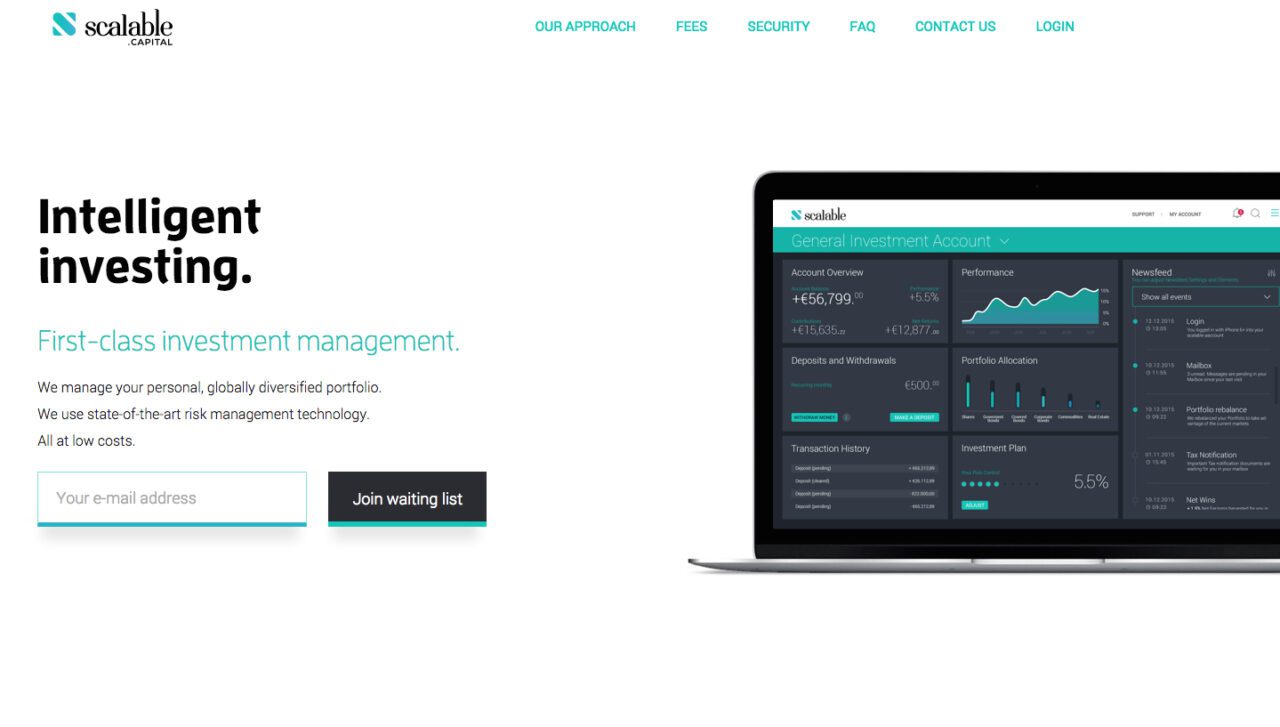

Presenters Adam French, Founder and U.K. Managing Director

Adam French, Founder and U.K. Managing Director

Presenters

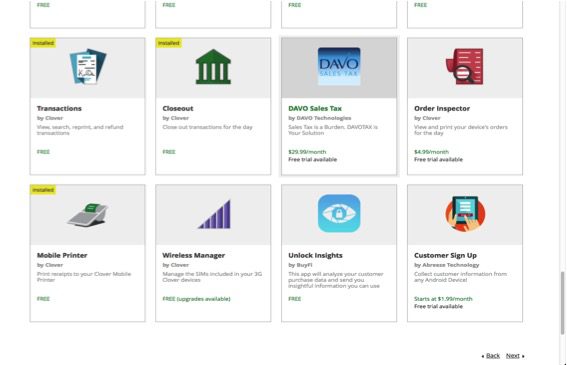

Presenters Bob Youakim, CEO

Bob Youakim, CEO

Presenters

Presenters