Fintech circles were abuzz this week as four massive fundings pushing several companies higher up the billion-dollar valuation ladder (yep, I can avoid the U-word if I really try).

Fintech circles were abuzz this week as four massive fundings pushing several companies higher up the billion-dollar valuation ladder (yep, I can avoid the U-word if I really try).

SoFi’s $1 billion received wide coverage this week, but we’d already covered it a month ago, so it’s not included in this week’s total. But even without that massive inflow earmarked for U.S. student loans, the worldwide fintech total surpassed one billion ($1.265 billion to be precise) thanks to Paytm, $675 million; Avant, $325 million; and 22 others. And every known round, not including Blooom’s grant, was seven figures or more.

Finovate alum fundings included: Kreditech, $92 million; Cloud Lending, $8 million; InForcePRO, $4 million; MX, $4 million from CheckFree founder Pete Kight; Blooom, $50,000 grant; and Elevest, an alum-by-proxy given its co-founder’s (Charlie Kroll’s) CV as founder of charter alum Andera, as well as an acquirer of many Best of Show wins by oFLows.

So far this year, we’ve tracked $14.5 billion flowing to fintech companies worldwide including a whopping $6.3 billion this past quarter.

Funding rounds by size from 26 Sep to 1 Oct 2015:

Paytm

mCommerce and bill payment platform

HQ: Noida, India

Latest round: $675 million; $4 billion valuation

Total raised: $875 million

Tags: Mobile, commerce, payments, shopping, billpay, Alibaba (investor)

Source: Crunchbase, VentureBeat

Avant

Consumer alt-lender

HQ: Chicago, Illinois

Latest round: $325 million; $1+ billion valuation

Total raised: $1.73 billion, includes $1.05 billion in debt

Tags: Consumer, credit, loans, lending, underwriting, near-prime

Source: Crunchbase

Kreditech

Consumer alt-lender

HQ: Hamburg, Germany

Latest round: $92 million Series C

Total raised: $355 million; $140 million equity, $215 million debt

Tags: Credit scoring, lending, underwriting, lending, loans, consumer, Finovate alum

Source: Finovate

Elevate

Consumer alt-lender

HQ: Texas City, Texas

Latest round: $70 million debt

Total raised: Unknown

Tags: Consumer, credit, underwriting, installment loans, line of credit

Source: Crunchbase

PushPay

Mobile payments platform

HQ: Auckland, New Zealand

Latest round: $18.7 million

Total raised: $35.5 million

Tags: Payments, consumer, acquiring, merchants, processing, SMB

Source: FT Partners

Ellevest

Investing platform for women

HQ: New York City, New York

Latest round: $10 million

Total raised: $10 million

Tags: Investing, asset management, wealth management, Charlie Kroll (co-founder and Finovate alum)

Source: Finovate

Credible

Alt-student lender

HQ: San Francisco, California

Latest round: $10 million

Total raised: $12.7 million

Tags: Consumer, credit, lending, loans, students, youth, underwriting

Source: Crunchbase

Zameen

Pakiston real estate hub

HQ: Lahore, Pakistan

Latest round: $9 million Series A

Total raised: $9 million

Tags: Mortgage, home buying, properties

Source: Crunchbase

Cloud Lending Solutions

Enterprise lending platform

HQ: San Mateo, California

Latest round: $8 million Series A

Total raised: $10.25 million

Tags: Lending, enterprise, loans, credit, Finovate/FinDEVr alum

Source: Finovate

Qualpay

Payment processor

HQ: San Mateo, California

Latest round: $8 million Series A

Total raised: $8 million

Tags: Payments, merchants, SMB, acquiring, credit/debit cards

Source: FT Partners

QuanTemplate

Reinsurance platform

HQ: Gibraltar

Latest round: $7.6 million

Total raised: $9.8 million

Tags: Insurance, enterprise

Source: Crunchbase

Chillr

Mobile person-to-person payments

HQ: Cochin, India

Latest round: $6 million

Total raised: $6.5 million

Tags: Consumer, mobile payments, P2P

Source: Crunchbase

MMKT Exchange

Middle market loan-syndication platform

HQ: New York City, New York

Latest round: $5.9 million

Total raised: Unknown

Tags: Commercial lending, loans, secondary market, enterprise

Source: FT Partners

Coinplug

Bitcoin services

HQ: South Korea

Latest round: $5 million Series B

Total raised: $8.3 million

Tags: Virtual currency, cryptocurrency, blockchain, bitcoin

Source: Coindesk

InForcePRO

Insurance policy-holder analytics

HQ: Austin, Texas

Latest round: $4 million Series A

Total raised: $6.55 million

Tags: Insurance, enterprise, metrics, big data, analytics, Finovate alum

Source: Finovate

MX (formerly MoneyDesktop)

Digital banking platform

HQ: Utah

Latest round: $4 million

Total raised: $54 million

Tags: Digital banking, mobile banking, B2B2C, consumer, Pete Kight (investor), Finovate/FinDEVr alum,

Meet them 6/7 Oct at FinDEVr San Francisco

Source: Finovate

AboutLife

Retirement planning

HQ: San Francisco, California

Latest round: $3 million Series A

Total raised: $3 million

Tags: Wealth management, investing, financial planning, consumer, PFM

Source: Crunchbase

Orb (formerly Coinpass)

Digital payments platform

HQ: Tokyo, Japan

Latest round: $2.3 million

Total raised: $2.8 million

Tags: Blockchain, payments, bitcoin, cryptocurrency, digital currency

Source: Crunchbase

Safe Cash Payment Technologies

Blockchain-based payments

HQ: San Francisco, California

Latest round: $1.2 million Seed

Total raised: $1.2 million

Tags: Payments, bitcoin, blockchain, consumer, Naveen Jain (investor)

Source: Coindesk

Blooom

401(k) management

HQ: Kansas City, Kansas

Latest round: $50,000 Grant

Total raised: $300,000

Tags: Retirement planning, consumer, 401(k), investing, LaunchKC Accelerator, Finovate alum

Source: Finovate

Adyen

International payments platform

HQ: Amsterdam, Netherlands

Latest round: Undisclosed; $2.3 billion valuation

Total raised: $266+ million

Tags: Payments, SMB, enterprise, remittances, payment processing

Source: Crunchbase

DwellExchange

Crowdfunding home-equity loans

HQ: New York City, New York

Latest round: Undisclosed

Total raised: Unknown

Tags: Lending, P2P loans, mortgage, real estate, consumer

Source: Crunchbase

WorldCover

P2P platform providing insurance for the unbanked

HQ: New York City, New York

Latest round: Undisclosed

Total raised: Unknown

Tags: Underbanked, insurance, investing, peer-to-peer

Source: Crunchbase

Transaction Mobility International

White-label payment processing

HQ: Singapore

Latest round: Undisclosed Series A; $33 million valuation

Total raised: $550,000+

Tags: Payments, mobile, acquiring, merchants, SMB

Source: Crunchbase

—–

Graphic licensed from 123rf.com

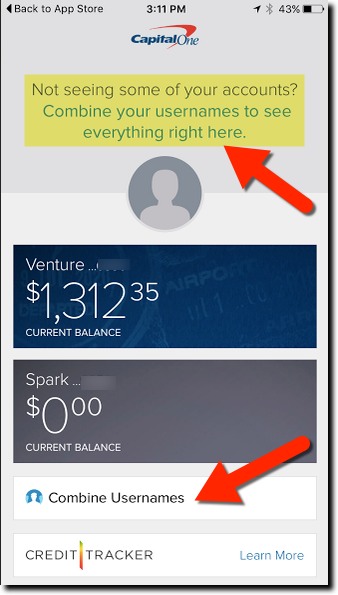

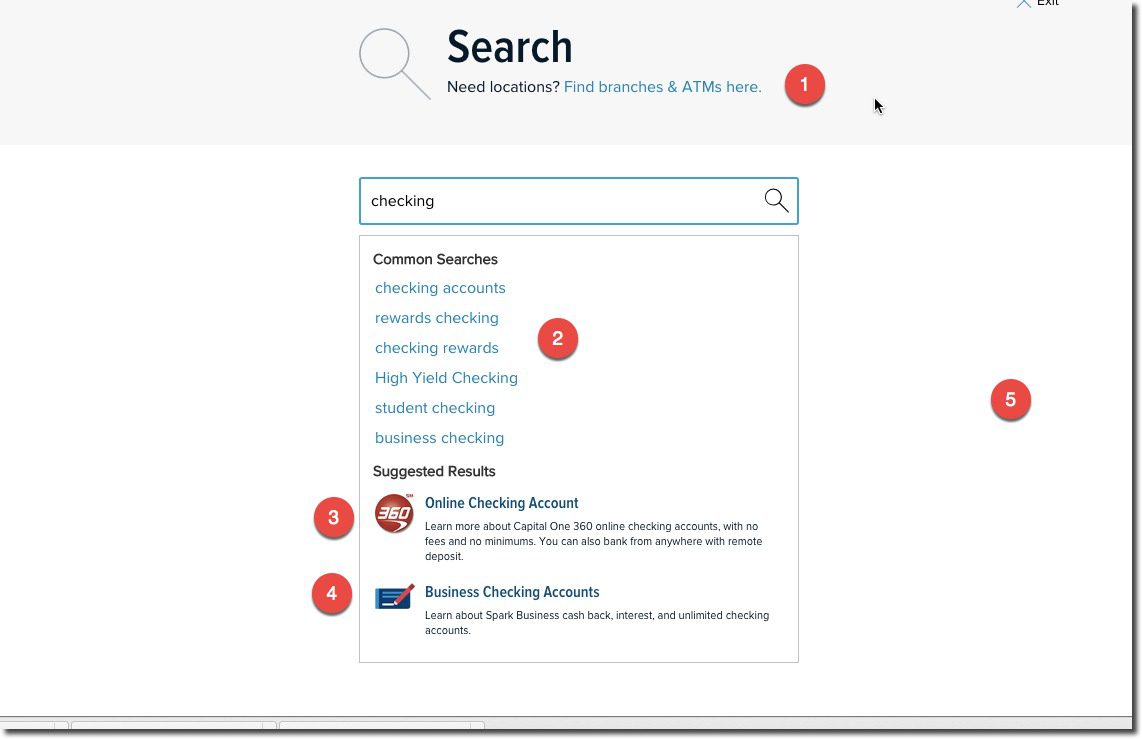

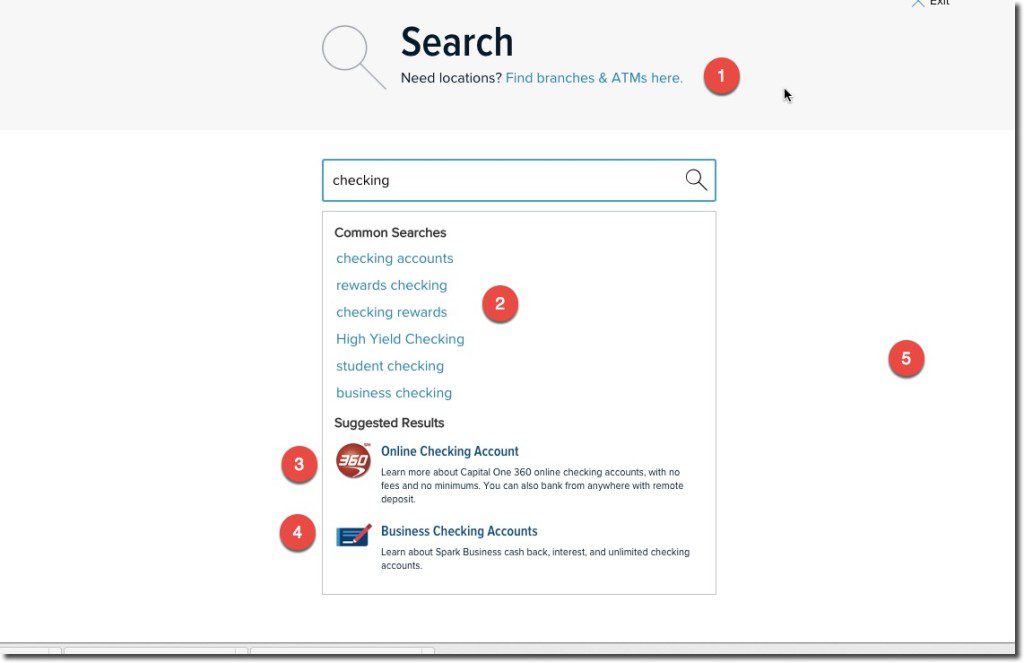

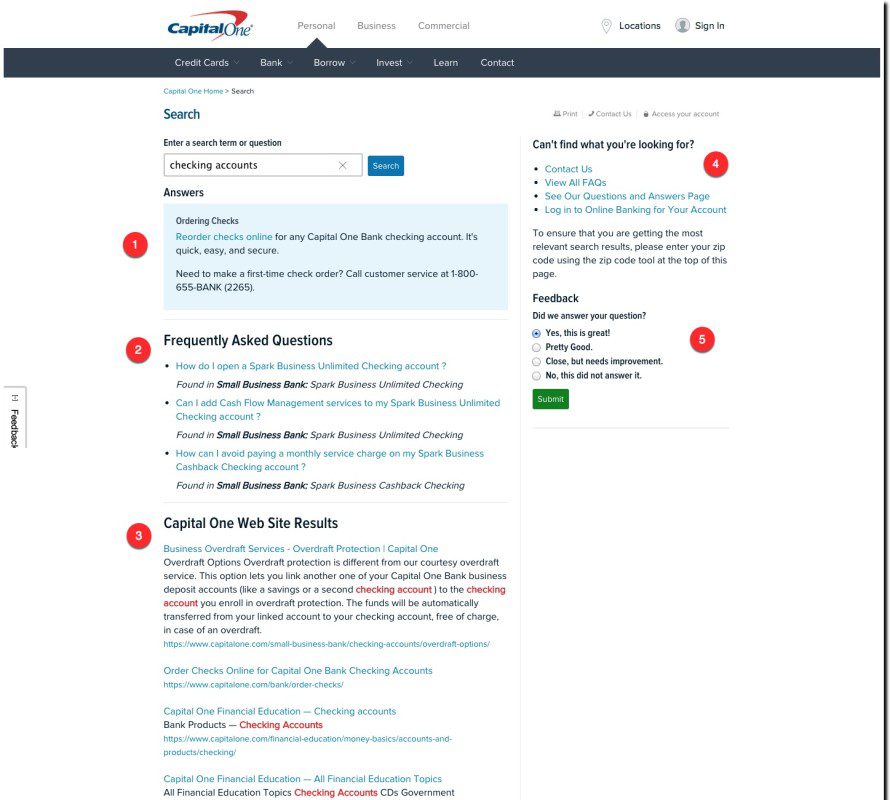

But on the way to checking out the gift card feature, I ran into another new Capital One feature I love. It’s called Combine Usernames and it does just that. The option appeared automatically on the first screen when I first logged into the latest issuer’s standard mobile banking app (not the newer Wallet app) (see inset). The card giant noticed I had two usernames registered and offered to automatically combine them. It’s not something I’ve run into before, and it’s super convenient for those of us who can’t keep their digital life in sync. After selecting Combine Usernames near the bottom of the main screen, you are directed to a new screen with instructions to swipe to combine. I swiped and it worked immediately, although the page warned it could take up to 72 hours. I wasn’t sure what was lurking under my other username, but it turns out it was my old ING Direct (now Capital One 360) account. Now, everything’s visible on the app, and I’m in sync at Capital One. ———– I’ll cover the gift card function after I test it at Starbucks. Enjoy your weekend.

But on the way to checking out the gift card feature, I ran into another new Capital One feature I love. It’s called Combine Usernames and it does just that. The option appeared automatically on the first screen when I first logged into the latest issuer’s standard mobile banking app (not the newer Wallet app) (see inset). The card giant noticed I had two usernames registered and offered to automatically combine them. It’s not something I’ve run into before, and it’s super convenient for those of us who can’t keep their digital life in sync. After selecting Combine Usernames near the bottom of the main screen, you are directed to a new screen with instructions to swipe to combine. I swiped and it worked immediately, although the page warned it could take up to 72 hours. I wasn’t sure what was lurking under my other username, but it turns out it was my old ING Direct (now Capital One 360) account. Now, everything’s visible on the app, and I’m in sync at Capital One. ———– I’ll cover the gift card function after I test it at Starbucks. Enjoy your weekend.

—-

—-