The year is off to a big start with 24 companies raising $569 million in the first week of 2016. However, three-quarters of that ($425 million) was additional debt for three big alt-lenders: Finovate alum LoanNow ($50 million) along with CommonBond ($275 million) and Qredits ($100 million).

The year is off to a big start with 24 companies raising $569 million in the first week of 2016. However, three-quarters of that ($425 million) was additional debt for three big alt-lenders: Finovate alum LoanNow ($50 million) along with CommonBond ($275 million) and Qredits ($100 million).

The $138 million in new equity last week was 25% more than the $110 million from the same week a year ago. And the number of deals was up 40% (24 compared to 17).

In addition to LoanNow, Finovate alums attracting new capital included:

- Gem, which pulled in $7.1 million to advance its blockchain efforts

- CUneXus, which added $1 million for its loan origination platform

Here are the deals by size from 1 Jan to 8 Jan 2016:

CommonBond

Person-to-person student loan lender

Latest round: $275 million Debt

Total raised: $319.7 million ($44.7 million Equity, $275 million Debt)

HQ: New York City, New York

Tags: Consumer, credit, lending, loans, underwriting, investing, P2P, student loans

Source: Crunchbase

Qredits

Dutch person-to-person SMB lender

Latest round: $100 million Debt

Total raised: Unknown

HQ: The Netherlands

Tags: SMB, credit, lending, loans, underwriting, investing, P2P, alt-lender, marketplace lender, European Investment Bank (lender)

Source: Crunchbase

NuBank

Brazilian neo-bank

Latest round: $52 million Series C

Total raised: $98.3 million

HQ: Sao Paulo, Brazil

Tags: Consumer, mobile, debit card, neobank, personal finance, PFM

Source: Crunchbase

LoanNow

Consumer alt-lender

Latest round: $50 million Debt

Total raised: $56 ($6 million Equity, $50 million Debt)

HQ: Santa Ana, California

Tags: Consumer, credit, lending, loans, underwriting, Finovate alum

Source: Finovate

Toast

Person-to-person lender

Latest round: $30 million Series B

Total raised: $30 million

HQ: Boston, Massachusetts

Tags: SMB, point-of-sale, merchants, restaurants, bars, credit/debit cards

Source: Crunchbase

Lendful Financial

Online alt-lender

Latest round: $15 million

Total raised: $15 million

HQ: Vancouver, British Columbia, Canada

Tags: Consumer, credit, lending, loans

Source: Crunchbase

freee

Online accounting

Latest round: $8.3 million Series D

Total raised: $55.5 million

HQ: Tokyo, Japan

Tags: SMB, accounting, billpay, invoicing

Source: Crunchbase

Street Contxt

Financial communications platform

Latest round: $8 million Series A

Total raised: $8 million

HQ: Toronto, Ontario, Canada

Tags: Advisers, wealth management, investing, enterprise

Source: Crunchbase

Gem

Blockchain technology

Latest round: $7.1 million Series A

Total raised: $7.1 million

HQ: Venice, California

Tags: Enterprise, bitcoin, cryptocurrency, database

Source: Finovate

Direct Match

Trading venue for U.S. Treasuries

Latest round: $6 million Series A

Total raised: $9 million

HQ: New York City, New York

Tags: Investing, trading, enterprise, SMB

Source: Crunchbase

StartEngine

Equity crowdfunding platform

Latest round: $5.5 million

Total raised: $5.5 million

HQ: Santa Monica, California

Tags: SMB, equity crowdfunding, capital, investing, P2P

Source: FT Partners

KnCMiner

Bitcoin mining hardware

Latest round: $3 million

Total raised: $32 million

HQ: Stockholm, Sweden

Tags: Bitcoin, cryptocurrency, hardware, blockchain

Source: Crunchbase

Xfers

Asian payment gateway

Latest round: $2.5 million Seed

Total raised: $2.5 million

HQ: Singapore

Tags: Consumer, payments, remittances

Source: Crunchbase

Snapcart

Consumer receipt manager

Latest round: $1.68 million

Total raised: $1.68 million

HQ: Jakarta, Indonesia

Tags: Consumer, debit/credit cards, mobile, spending, PFM

Source: Crunchbase

CUneXus Solutions

Consumer lending software for financial institutions

Latest round: $1 million

Total raised: $1.65 million

HQ: Santa Rosa, California

Tags: Consumer, credit, lending, loans, underwriting, enterprise, Finovate alum

Source: Finovate

Deposit Solutions

Deposit software for financial institutions

Latest round: $1.0 million Series A

Total raised: $7.0 million

HQ: Hamburg, Germany

Tags: Consumer, Peter Thiel (investor)

Source: Crunchbase

Zebpay

Person-to-person lender

Latest round: $1 million Series A

Total raised: $1.1 million

HQ: Singapore

Tags: Consumer, payments, P2P, bitcoin, blockchain, cryptocurrency, mobile

Source: Crunchbase

Toborrow

SMB P2P lender

Latest round: $350,000

Total raised: $2.74 million

HQ: Stockholm, Sweden

Tags: SMB, loans, credit, peer-to-peer, underwriting, crowdfunding, investing

Source: Crunchbase

Cuvva

Short-term automobile insurer

Latest round: $590,000

Total raised: $590,000

HQ: Edinburgh, Scotland, United Kingdom

Tags: Consumer, insurance, automobile, mobile

Source: FT Partners

Nestiny

Homebuyer education website

Latest round: $350,000 Angel

Total raised: $350,000

HQ: Manakin Sabot, Virginia

Tags: Consumer, mortgage, real estate, home buying, agents, lead gen

Source: Crunchbase

Buckit (StashLLC)

Consumer receipt manager

Latest round: $143,000 Seed

Total raised: $143,000

HQ: Toronto, Ontario, Canada

Tags: Consumer, debit/credit cards, mobile, spending, PFM

Source: Crunchbase

Agent Review

Insurance education and agent referrals

Latest round: Undisclosed

Total raised: Unknown

HQ: Bellevue, Washington

Tags: Consumer, insurance, agents, lead gen

Source: FT Partners

Patientco

Healthcare payment technology

Latest round: Undisclosed

Total raised: $3.75 million prior to latest round

HQ: Atlanta, Georgia

Tags: SMB, healthcare, payments

Source: FT Partners

Tiendo Pago

Short-term working capital provider

Latest round: Undisclosed

Total raised: Unknown

HQ: Lima, Peru

Tags: SMB, lending, loans, commercial lending, underwriting, alt-lender, Accion (investor)

Source: FT Partners

While I have

While I have

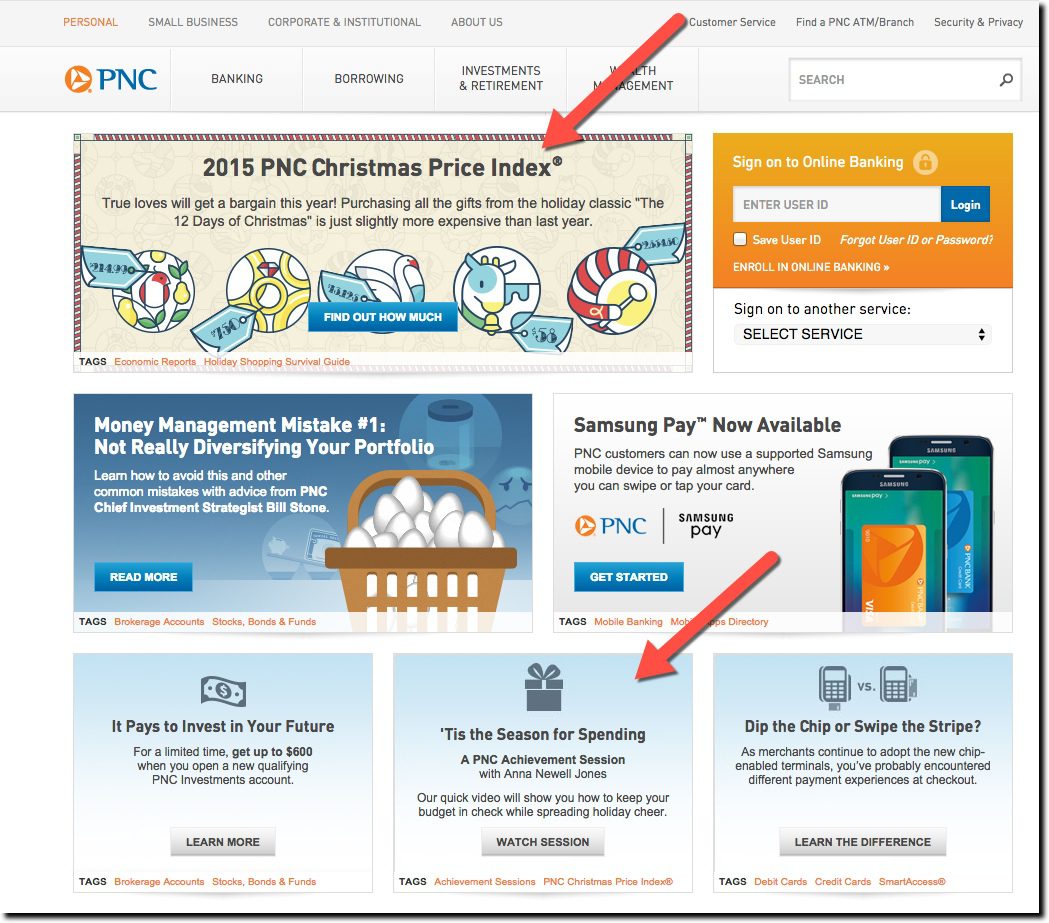

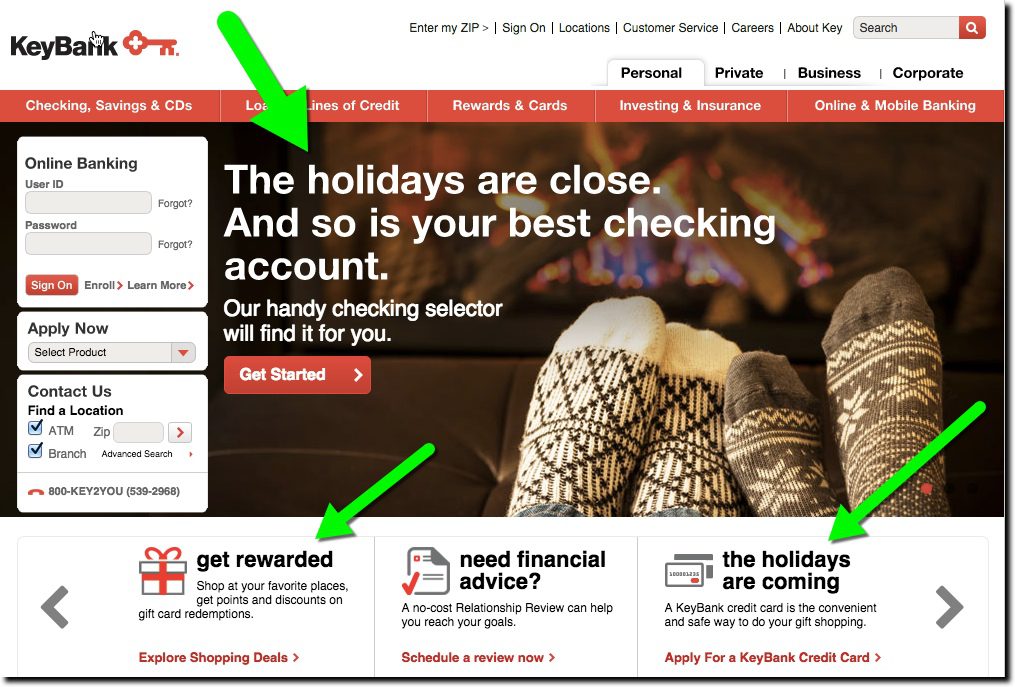

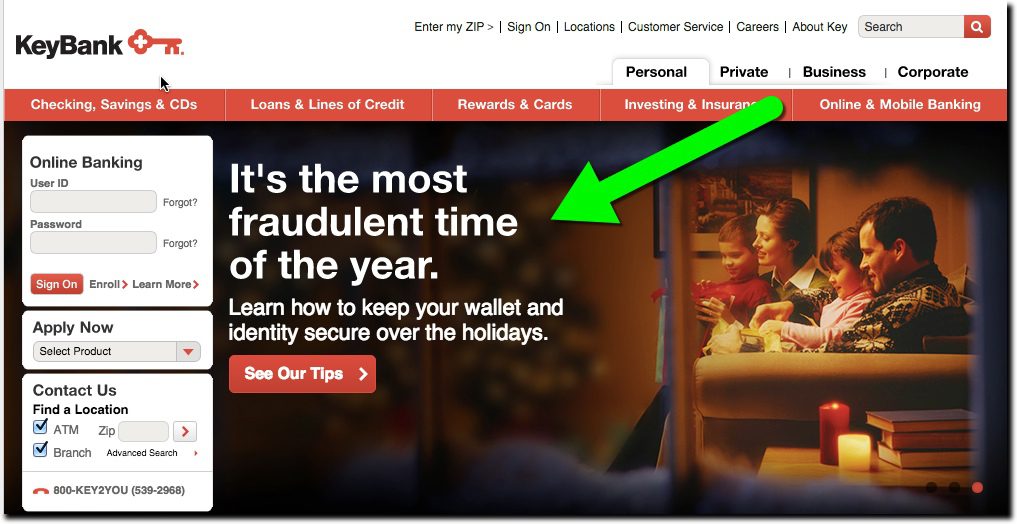

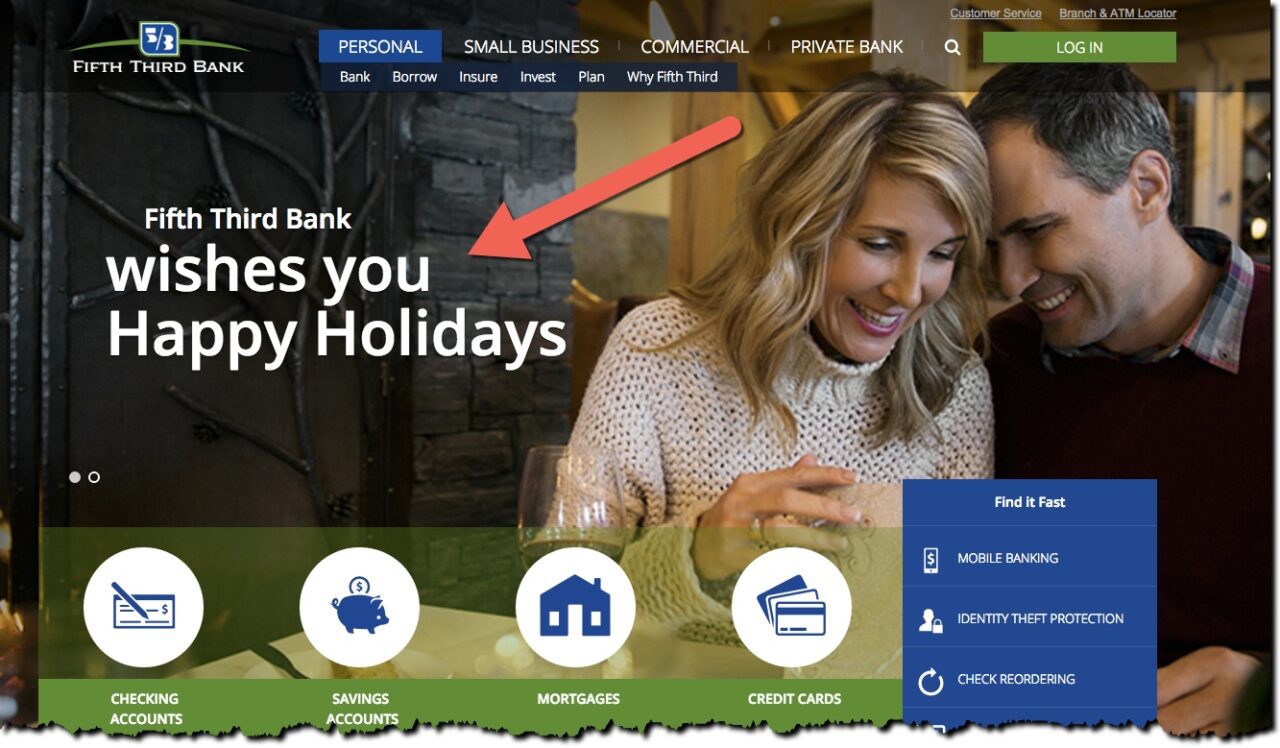

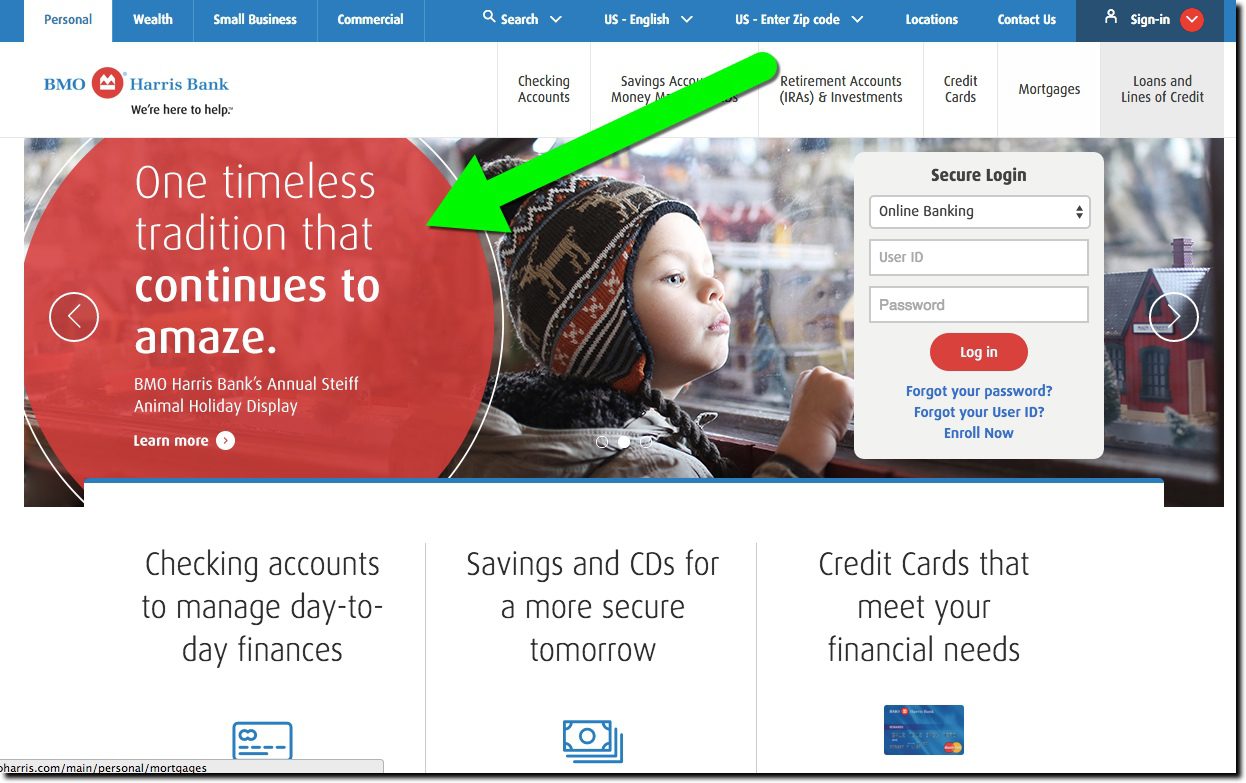

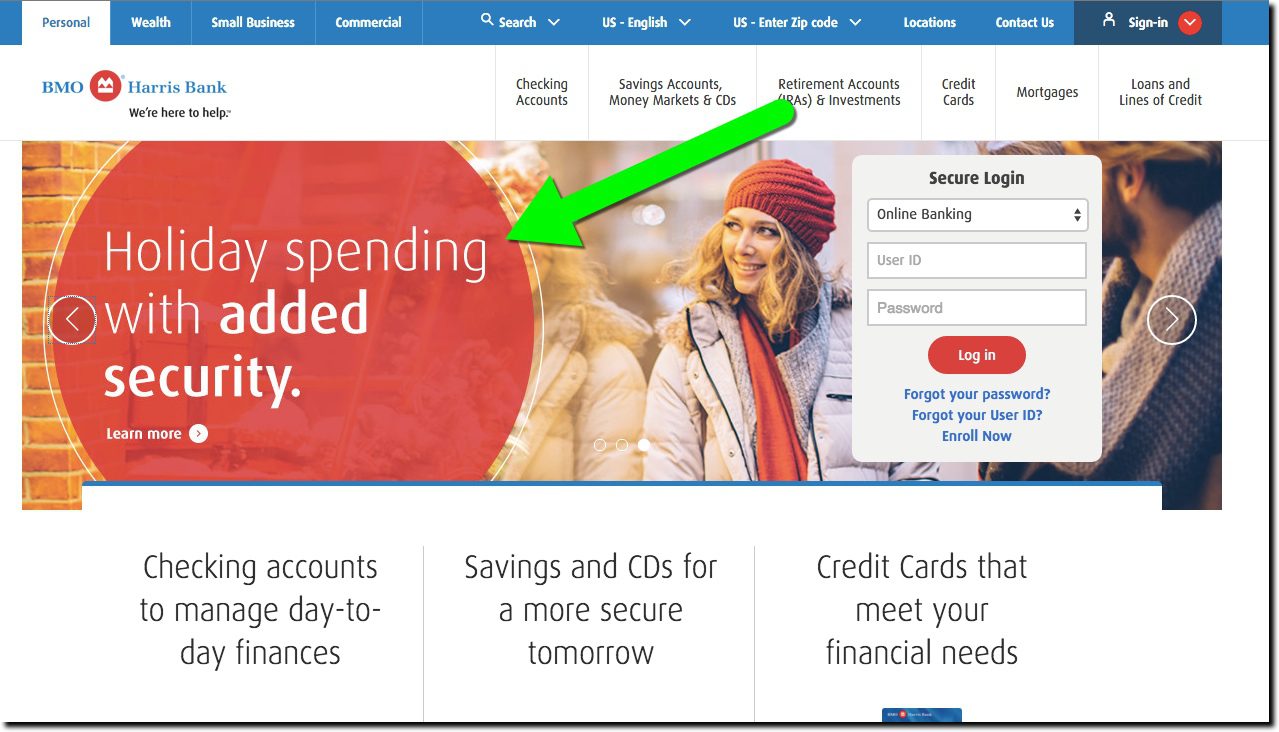

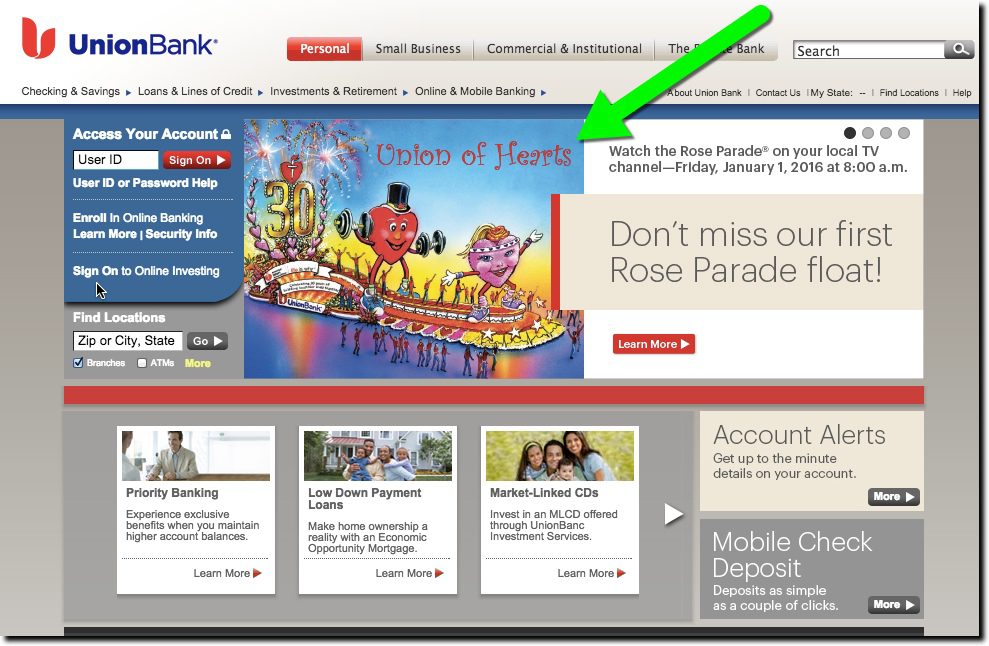

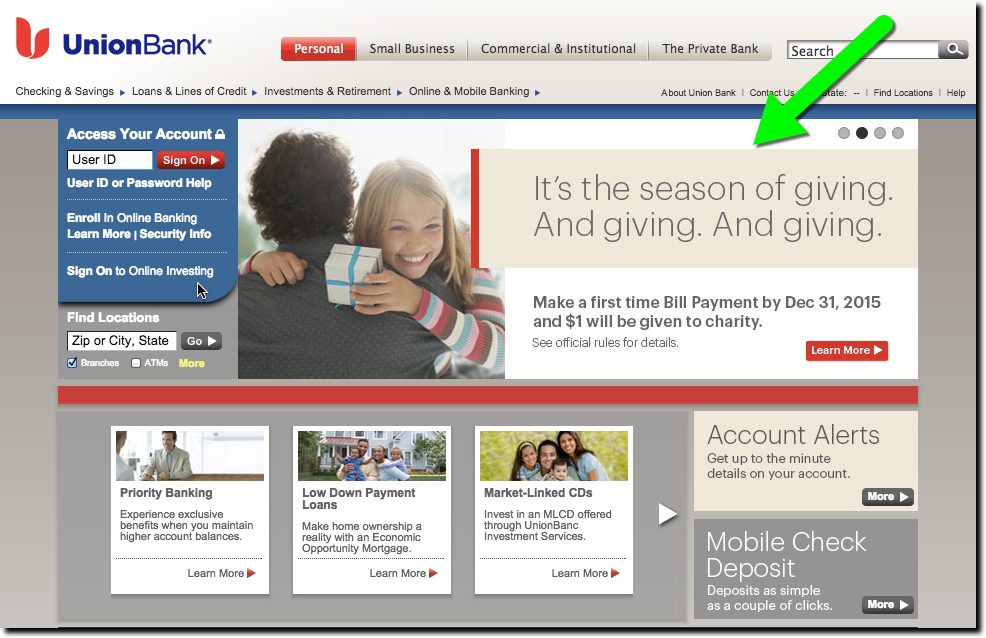

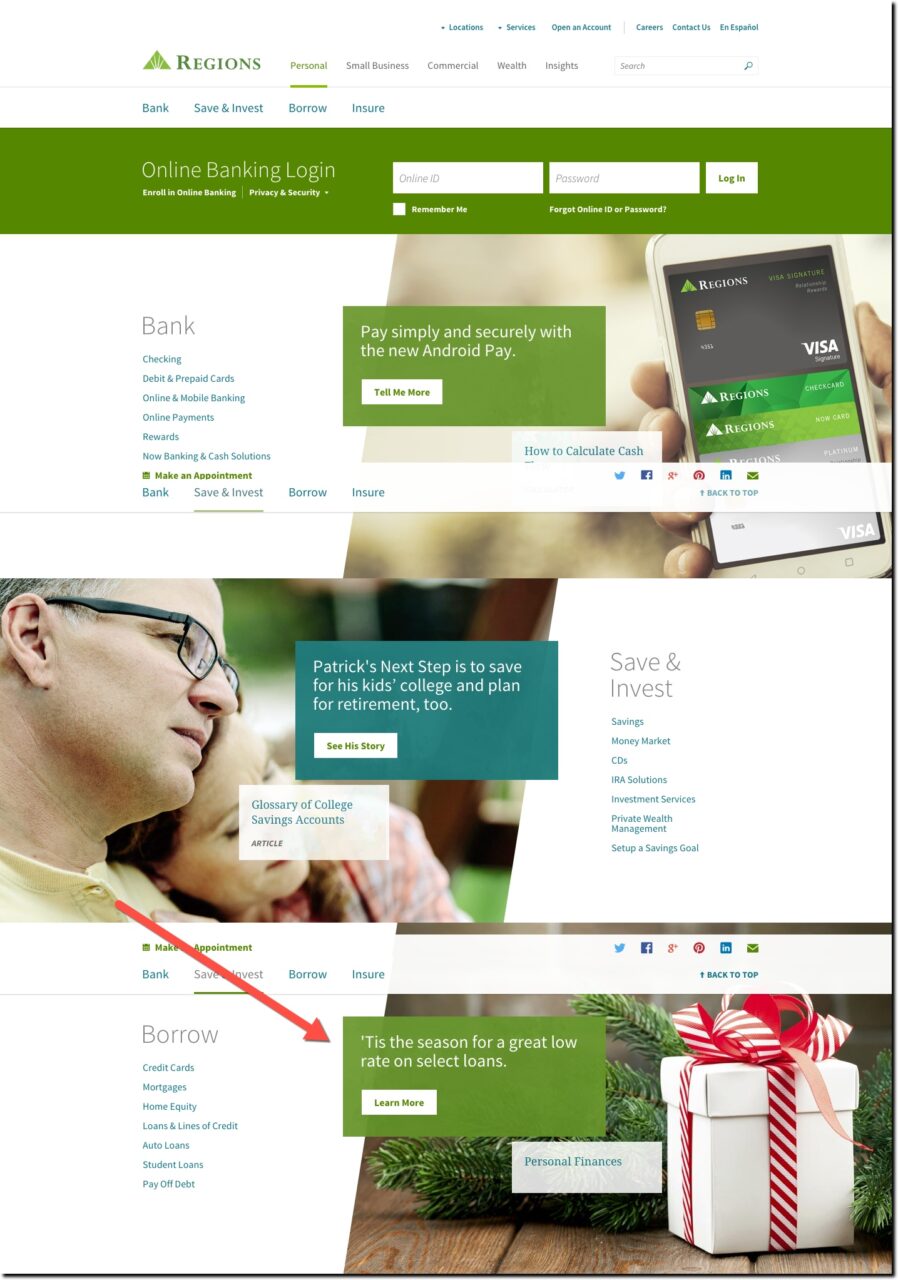

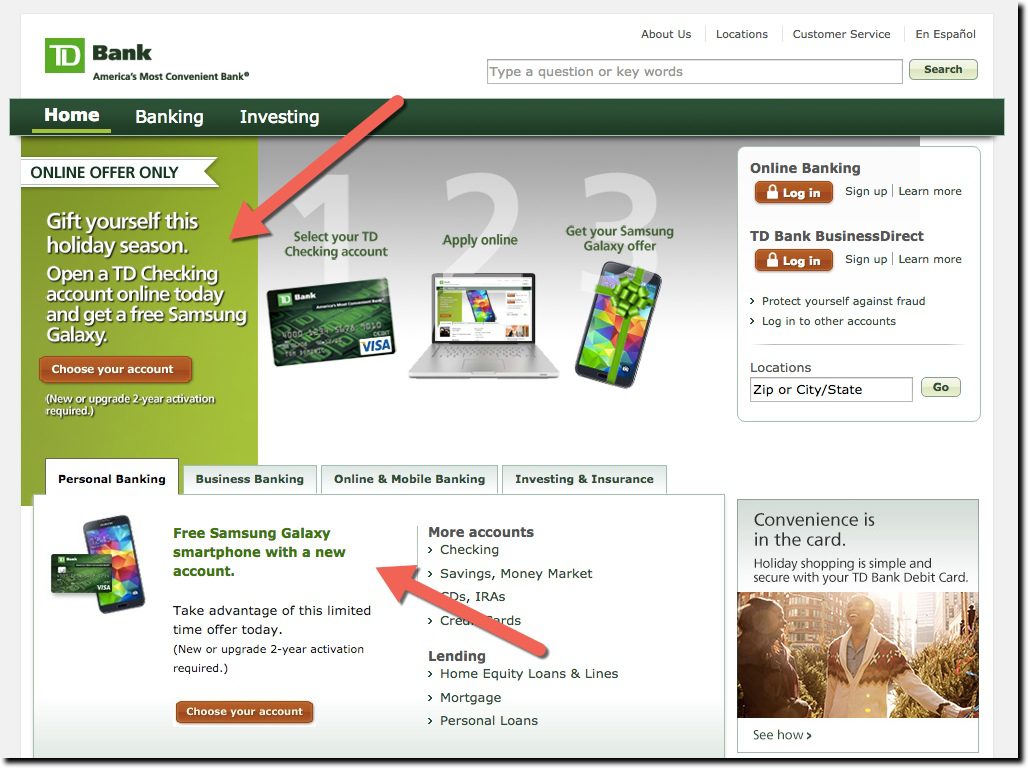

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.

Buoyed by 7 Startupbootcamp Insurance entrants—each grabbing $17,000—a record 30 fintech companies raised money this week for a total of just under $100 million ($95.8 million). Only two companies topped 7 figures: real estate specialist EasyProperty ($37.6 million) and Lemonade, a P2P insurance play ($13 million).

Buoyed by 7 Startupbootcamp Insurance entrants—each grabbing $17,000—a record 30 fintech companies raised money this week for a total of just under $100 million ($95.8 million). Only two companies topped 7 figures: real estate specialist EasyProperty ($37.6 million) and Lemonade, a P2P insurance play ($13 million).