Can you imagine spending as much time with your banking app as you do with Facebook or Twitter?

Not only can FINANTEQ imagine it, but with its new banking app, SuperWallet, the Polish spinoff from eLeader is doing everything it can to make it happen across Europe and, soon, across America.

FINANTEQ’s goal is to move banks from the end of the value chain to the front. “Right now the bank is just an icon on a credit slip,” said FINANTEQ customer adviser, Kate Miroslaw. FINANTEQ’s SuperWallet reverses this deficiency by combining mobile banking, payments, and m-commerce all in one mobile banking app. Rather than being an afterthought, the mobile banking app suddenly is at the center of attention when it comes to paying bills, booking a flight, or ordering concert tickets.

From left: Finanteq m-Commerce Operations Manager Tomasz Perski; Customer Adviser Kate Miroslaw; and Marketing Manager Artur Malek demonstrated SuperWallet at FinovateFall 2015.

“Would people love the Starbucks app so much if it were just about payments?” asks Artur Malek, marketing manager for FINANTEQ. His point is that by allowing customers to do things like order ahead, the app transforms the consumer experience for the better. “This is the added value beyond payments,” Malek says. “And this is exactly what we do.”

Company facts:

- Founded in September 2014 as a spinoff from eLeader

- Headquartered in Lublin, Poland

- Employs 100 professionals in Poland and the United States.

How it works

How it works

The way FINANTEQ sees it, banks theoretically have many ways to build relationships with their customers. But the actual interactions between banks and customers often don’t live up to these opportunities. “Selling to customers doesn’t happen very often,” Malek points out. And while payments are frequent, banks are often bystanders to the transaction, and besides, the payment space is increasingly being infiltrated by non-bank actors such as Apple and Samsung.

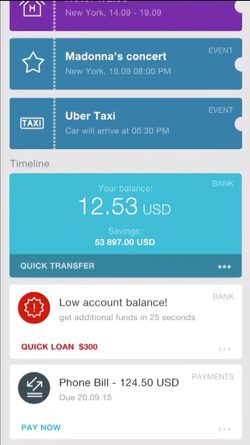

FINANTEQ’s solution is simple: combine e-commerce, banking, and payments in one app provided by the bank. In their demonstration of SuperWallet, the team from FINANTEQ walked through a wide variety of scenarios: checking account balance, booking a hotel, paying for parking remotely, buying concert tickets, hiring an Uber car, ordering groceries or takeout … all without leaving the app.

This means consumers don’t have to install numerous apps and, more importantly, don’t have to share data with scores of merchants. The bank safeguards the sensitive data transmitting only what is required for a transaction.

“Payment is made using data in the app, delivery address and other details of the transaction,” says Tomasz Perski, e-commerce operations manager. “There are many shops inside the app, but once authorized, there is no need for login or password. The services and shops available are chosen by the bank (bank partners) or by Finanteq, and the app can also feature offers and discounts.”

“Payment is made using data in the app, delivery address and other details of the transaction,” says Tomasz Perski, e-commerce operations manager. “There are many shops inside the app, but once authorized, there is no need for login or password. The services and shops available are chosen by the bank (bank partners) or by Finanteq, and the app can also feature offers and discounts.”

The future

Superwallet has been available in Eastern Europe since 2014 courtesy of early client Santander Group. And two new banks in Poland are expected to come online with the technology in early 2016. FINANTEQ is currently building out its U.S. team in anticipation of entering the U.S. market. Malek says the company is building relationships with merchants, especially aggregators. He mentioned that FINANTEQ now offers bus-ticket purchases in more than 130 cities.

Called one of the most innovative mobile banking apps by Forrester Research, Superwallet also won the Citi Mobile Challenge in April 2015 in Warsaw by taking top honors in the digital wallet category.

Currently, FINANTEQ has good traction in the CEE region. Its clients are some of the biggest and most innovative banks in countries like Poland, including Finovate alum, mBank, which is also a client.

Check out this video of FINANTEQ’s FinovateFall 2015 demonstration.

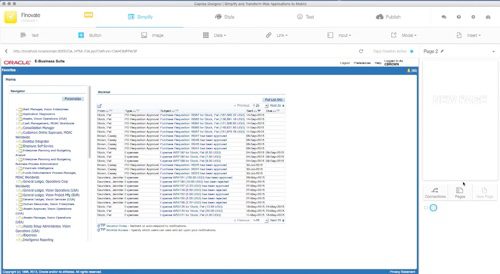

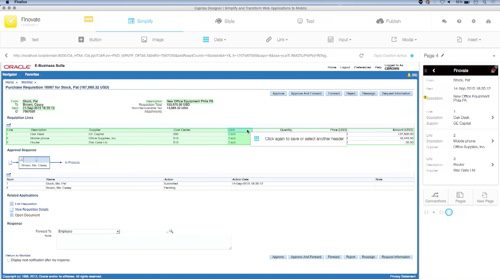

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

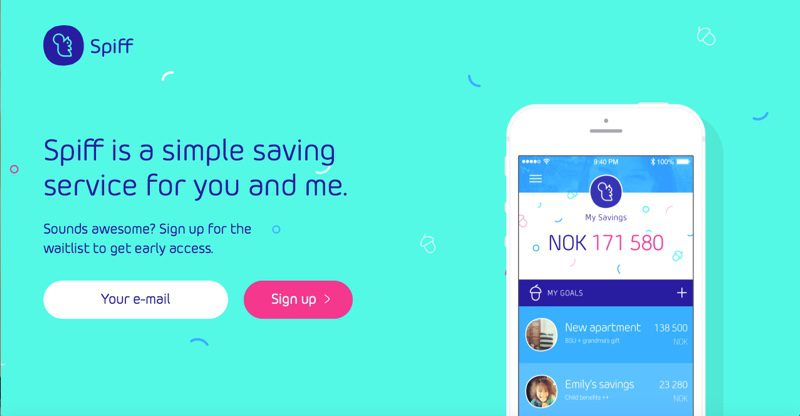

Carl-Nicolai Wessmann, CEO, Founder

Carl-Nicolai Wessmann, CEO, Founder Kristin Juland Moller, Social Media and Communication Manager

Kristin Juland Moller, Social Media and Communication Manager

Ian Dunbar, Country Manager, Australia

Ian Dunbar, Country Manager, Australia Richard Mannell, CEO, Founder

Richard Mannell, CEO, Founder