It’s been fascinating to watch mobile banking take hold. The path has been much the same as online (desktop) banking a decade earlier, but at about double the pace (at least in the parts of the world that are highly banked).

It’s been fascinating to watch mobile banking take hold. The path has been much the same as online (desktop) banking a decade earlier, but at about double the pace (at least in the parts of the world that are highly banked).

Modern online banking started 21 years ago this month, when Wells Fargo began web banking in May 1995. It took 12 years before Mint came along and made it all look good and introduced the masses to more advanced concepts such as account aggregation, goal-oriented online budgeting, and expense tracking.

Mobile banking, which got its start in the post-iPhone App Store era (2008), took only about five years before it was “Minted” by Simple and then others. And in fewer than eight years mobile banking is already far better than desktop by almost every measure. From touchID access, to location awareness, to that very useful camera for depositing checks, there is just no way desktop online banking can compete.

But we have just barely scratched the surface of its biggest advantage: the always-on, always-with-you benefits. Account and transaction security is one of the first features having huge impact both on consumers (peace of mind, less hassle) and financial institutions (fewer false negatives, lower fraud costs, less customer-service expense).

Another area where huge benefits exist? Proactive communications about finances. Simple, Moven and Capital One’s Level Money are on the forefront with tools that help mobile customers know where they stand BEFORE they drop another $12 for a fancy cocktail or $35 on Uber.

And while monitoring spending in real-time has big theoretical benefits, it’s universally loathed by most consumers as the ultimate buzz-kill, kind of like having your parents hovering over you at point of sale. A more exciting always-on benefit is guidance to achieve bigger aspirations, like replacing your aging vehicle, trading up from your dinky apartment, or buying a house.

Take home buying. Many of our readers have been through this multiple times. But do you remember how little you knew about it back in the day? It’s a daunting task today even for the financially savvy.

the financially savvy.

That’s why I love tools that help people understand all aspects of the home-buying process: the mortgage, the purchase, and dealing with all of the ancillary expenses. We’ve seen a number of companies working on various aspects of the mortgage process. And next week at FinovateSpring, you’ll be treated to demos by two of the new breed of mortgage startups: Blend Labs which powers mortgage processing on the back-end and Roostify which helps consumers through the process.

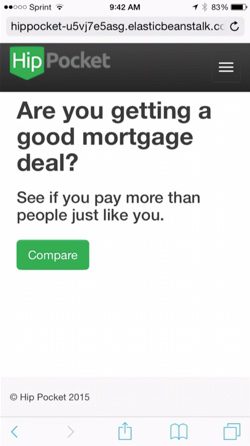

And as luck would have it, last week Mark Zmarzly from Hip Pocket visited Seattle to present at a CU event, and was able to spare a few minutes to meet me for coffee. Mark wowed the crowd when he demo’d at FinovateSpring last year. Hip Pocket’s first product is a mobile app that allows anyone to input mortgage rate and monthly payment to see how their company stacks up against its peers (see inset).

The Hip Pocket mortgage app is a compelling value-prop for users, and potentially a great lead-gen tool for banks and credit unions. While Hip Pocket has had some great traction since then, it is still looking for additional seed funding to build more tools and fine-tune its customer-acquisition model. Hip Pocket is in a sweet part of the market—mobile mortgage (MoMo)—and is at a point in their company arc where relatively small dollars can make a big impact. They are a great candidate for “bank strategic seed funding.”