The buy now, pay later (BNPL) trend has been accelerating since the beginning of this year, and today PayPal announced plans to get in on the action.

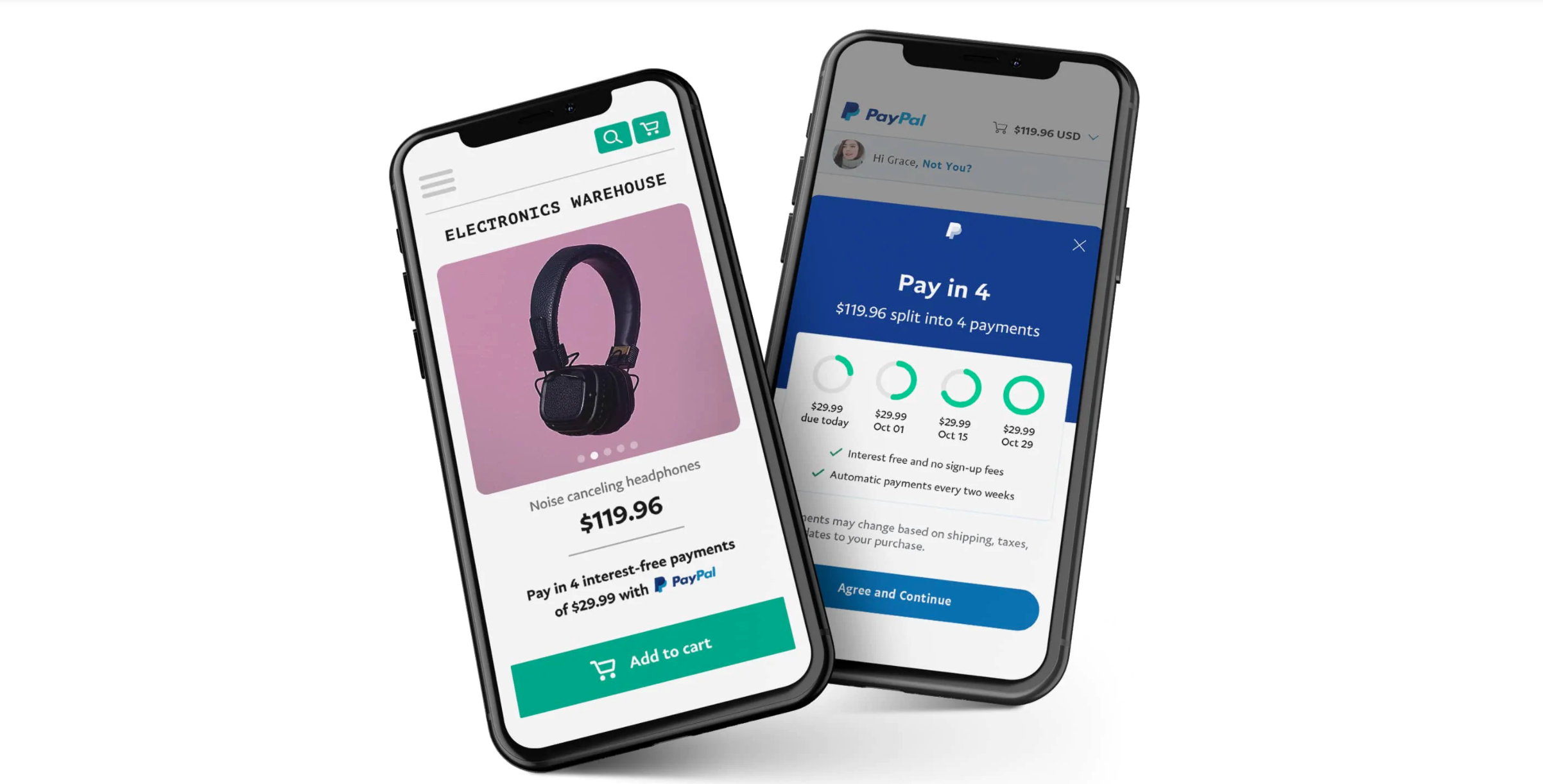

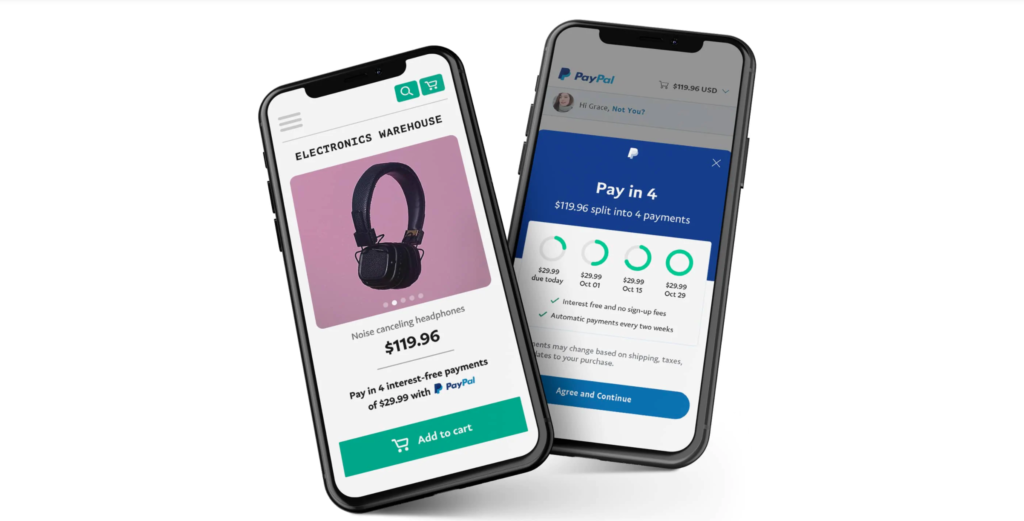

The payments giant is releasing Pay in 4, a short-term payments installment product for U.S. customers. When consumers opt to use Pay in 4, merchants receive payment upfront, and the buyer pays for the purchase over the course of a six week period. PayPal takes on the credit risk.

Consumers can use Pay in 4 for transactions between $30 and $600. Purchases do not incur interest and buyers can set up automatic repayments. Additionally, there are no fees for the buyer or the merchant.

“In today’s challenging retail and economic environment, merchants are looking for trusted ways to help drive average order values and conversion, without taking on additional costs. At the same time, consumers are looking for more flexible and responsible ways to pay, especially online,” said Doug Bland, SVP of Global Credit at PayPal. “With Pay in 4, we’re building on our history as the originator in the buy now, pay later space, coupled with PayPal’s trust and ubiquity, to enable a responsible and flexible way for consumers to shop while providing merchants with a tool that helps drive sales, loyalty and customer choice.”

Today’s release is the newest in PayPal’s line of Pay Later tools. The company’s other financing options include PayPal Credit, a line of credit with built-in promotional offers, Easy Payments, a BNPL service available in the U.S. and U.K. PayPal also offers Pay Later tools across the globe in Germany, France, Australia, Canada, Spain, and the Netherlands.

After the BNPL trend began burgeoning earlier this year, PayPal has joined the likes of Affirm, Sezzle, Klarna, and even Goldman Sachs, as well as a handful of others in offering BNPL options to online shoppers. The popularity of these services is attributed to an uptick in unemployment brought on by COVID-19. Not only are consumers making less money, some have maxed out their credit cards and are seeking alternative ways to keep afloat.

Pay in 4 will be available in the 4th quarter of this year.