Is there anyone out there who is NOT trying to secure a digital banking license in Singapore?

The Monetary Authority of Singapore (MAS) announced last week that it has received 21 applications for digital bank licenses. A decision is expected in June, and the fortunate five who receive licenses will be able to launch their businesses by the middle of next year. Applicants have included a wide range of companies, from e-commerce and telecommunications firms, to fintechs, PSPs, and crowdfunding platforms.

Specifically, MAS is making available two different types of license: a digital full bank license and a digital wholesale bank license. There are two digital full bank licenses available, which would enable non-banks to accept deposits from retail customers. There are seven applicants for these licenses, which come with initial, temporary restrictions on deposits and capitalization.

The digital wholesale bank license will permit firms to lend to SMEs. Fourteen companies have applied for the three digital wholesale bank licenses MAS is making available. These new businesses would be required to meet the same regulations as existing wholesale banks, including capitalization of $74 million (S$100 million). Among the more well-known firms competing for these digital wholesale bank licenses are rideshare startup Grab and Ant Financial.

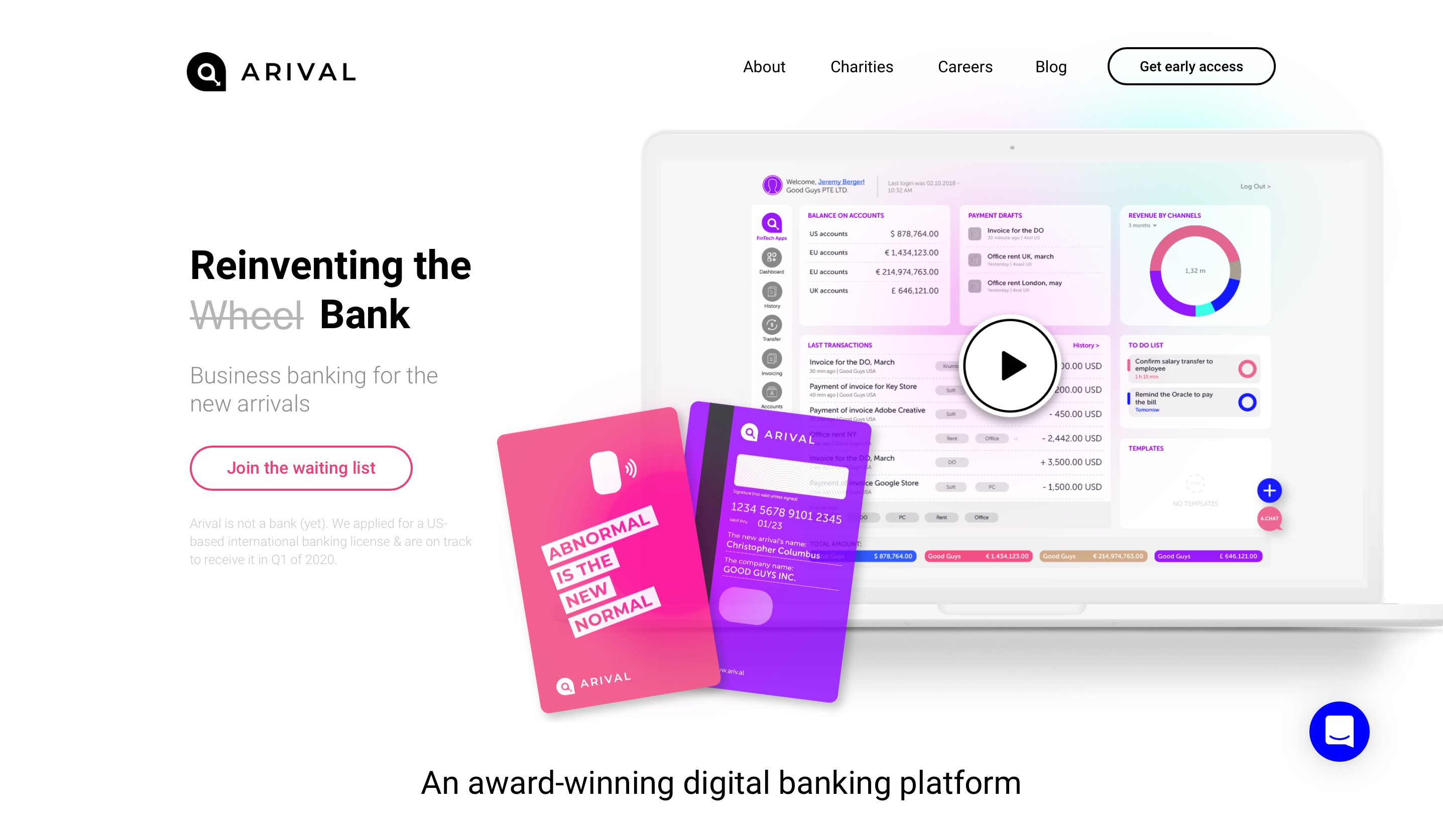

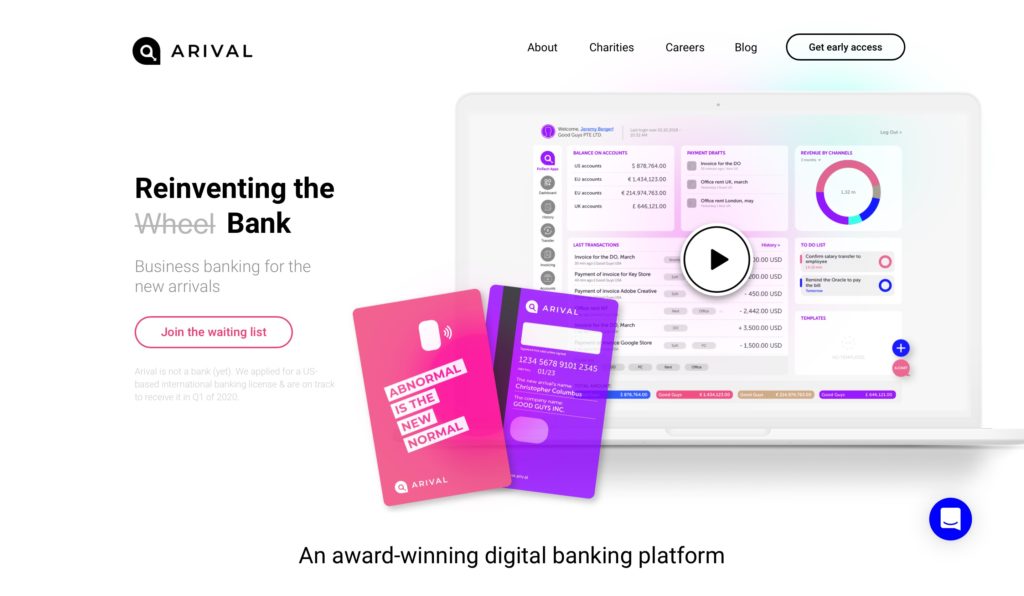

Also in the running for a digital wholesale bank license is Finovate alum and Best of Show winner Arival Bank. The firm announced its application earlier this week, noting that securing the license “will add tremendous value in Arival’s quest to becoming a borderless fintech bank.” The company plans to leverage its ArivalOS digital banking technology, as well as its banking-as-a-service (BaaS) platform to serve the freelancers, micro businesses, and startups that it believes remain underserved within the broader SME market worldwide.

In other international news on the Finovate blog this week, we talked with João Pinto of Portugal’s ITSCREDIT ahead of the company’s Finovate appearance next month in Berlin. We also featured German insurtech Getsafe’s expansion to the U.K., looked at European deposit marketplace Raisin’s acquisition of U.S. fintech Choice Financial Solutions, and profiled French mobile payments app Lydia as it locks in $45 million in new funding.

Here is our weekly look at fintech around the world.

Central and Southern Asia

- Business Maverick looks at PayU’s decision to merge its consumer lending business, LazyPay, with Indian digital credit platform, PaySense.

- EpiFi, a Bengalaru, India-based digital banking startup founded by a pair of former Google executives, raises $13.2 million in funding.

- Entrepreneur India features B2B digital ledger mobile app, KhataBook.

Latin America and the Caribbean

- Resuelve tu Deuda, a Mexican fintech that specializes in helping consumer repair their credit, raises $24 million in funding.

- Nasdaq.com lists online payments, banking, billpay, proptech, and lending in its feature, 5 Opportunities for Fintech Disruption in Latin America.

- Brazilian neobank Nubank announces its first acquisition, purchasing local consulting company Plataformatec largely to access the firm’s crew of engineering and developer talent.

Asia-Pacific

- Digital-only neobank Tonik secures banking license in Philippines ahead of planned launch.

- Arival Bank is the latest fintech to throw its hat into the Singapore digital banking license ring.

- CredoLab earns listing from Indonesia’s Financial Services Authority OJK) as an official provider of financial services in the country – the first fintech in Indonesia to be granted this recognition.

Sub-Saharan Africa

- EverSend founder Stone Atwine talks about trends in the African fintech industry with CNBC Africa.

- Kenyan fintech Alternative Circle earns recognition as “One to Watch” in the first global fintex index ranking 2020 by Findexable.

- What can we expect from South African fintech in 2020? Ventureburn examines the country’s prospects.

Central and Eastern Europe

- Euromoney takes a look at the complicated relationship between banks and fintechs in the CEE region.

- The Paypers interviews Valeri Valtchev of the Bulgarian Fintech Association on the evolution of Bulgaria as a fintech hub.

- Latvian fintech Jeff App locks in €150,000 to help improve financial inclusion for borrowers in Southeast Asia.

Middle East and Northern Africa

- Salaam African Bank in Djibouti selects core banking technology from Oracle FSS.

- A partnership between crypto exchange Huobi and Dubai-based real estate firm fäm Properties will enable investors to pay in a digital assets such as Bitcoin, Ether, and XRP.

- Qatar Islamic Bank (QIB) introduces its Instant Credit Card service via its mobile app.

As Finovate goes increasingly global, so does our coverage of financial technology. Finovate Global is our weekly look at fintech innovation in developing economies in Asia, Africa, the Middle East, Latin America, and Central and Eastern Europe.