Digital banking services company Bankjoy may bring a bit of joy this week to the members of Credit Union of Ohio. That’s because Credit Union of Ohio is now leveraging the Michigan-based startup’s online and mobile banking technology to bring its members a new, omnichannel banking experience.

The move is strategic for Credit Union of Ohio. The credit union’s VP of Marketing & Strategic Planning Jill Gerschutz said that the implementation is an “ideal way” to retain members because it shows that Credit Union of Ohio is adapting and evolving with new trends. Gerschutz also hopes the move will boost the number of members who use the credit union’s mobile app. “We see the importance of constant movement to enhance our services – especially when it comes to technology and their online banking needs,” Gerschutz said.

After Credit Union of Ohio’s previous online banking provider announced it was discontinuing its product and would no longer provide updates, the credit union reached out to Bankjoy. “With an ever-changing technology environment,” Gerschutz said, “we knew this was crucial to finding a new product.” And since Bankjoy has already worked with all of Credit Union of Ohio’s third-party vendors, the transition will be an easier one. Other factors swaying Credit Union of Ohio toward Bankjoy include the number of customization options, as well as the startup’s innovative nature, such as offering facial recognition and TouchID login options.

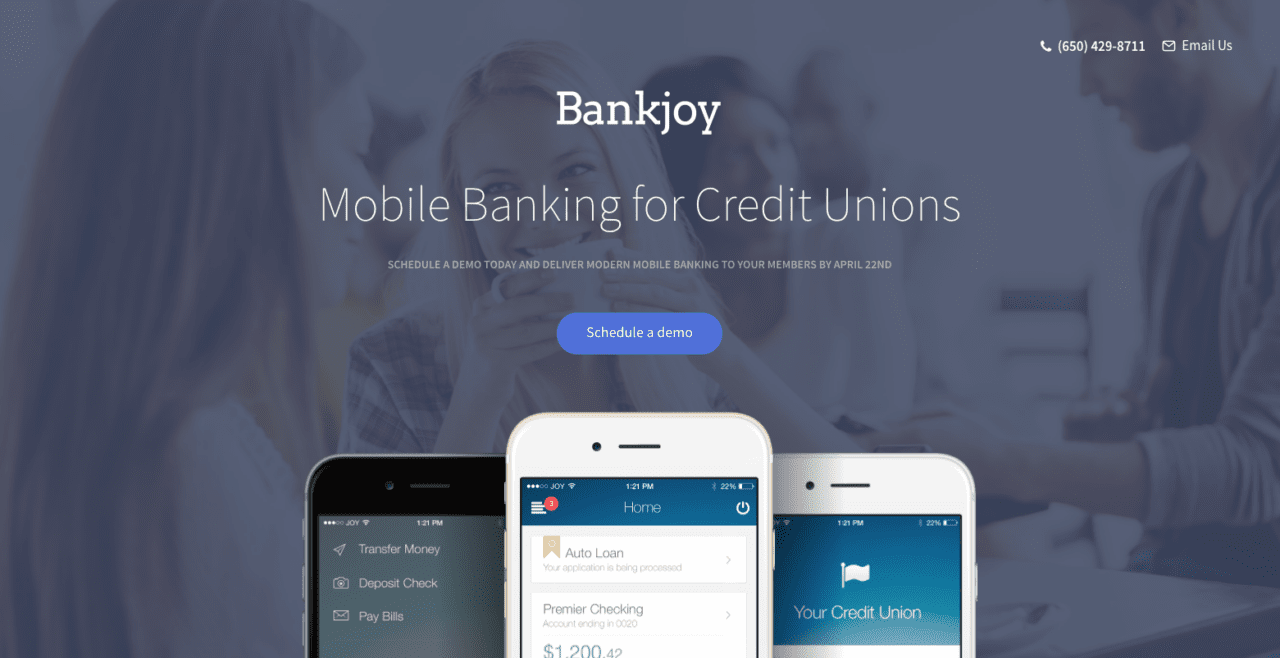

At FinovateFall 2016, Bankjoy Founder and CEO Mike Duncan showcased the company’s API. It is a REST API that offers real-time transaction data and features such as card management, check deposit, money transfer, bill payment features, and loan applications. It has been a busy deal-making season for Bankjoy. The Y-Combinator alum inked a deal with SafeAmerica Credit Union last month to provide the credit union’s 35,000+ members a better online and mobile banking experience.