Mortgage rate comparison site Hip Pocket announced last week it has padded its own hip pockets after closing a recent $150,000 funding round. The convertible note round brings the Nebraska-based company’s total funding to $180,000.

Hip Pocket founder and CEO Mark Zmarzly says the funds will be used to expand into the employer financial wellness market and to further build out Hip Money, Hip Pocket’s latest product. Hip Money is a savings-focused PFM app that leverages Swipe to Save, a Tinder-like UX to encourage users to save for their personalized savings goals by swiping. Hip Money does not have a launch date but is launching “soon” and is taking requests for early access.

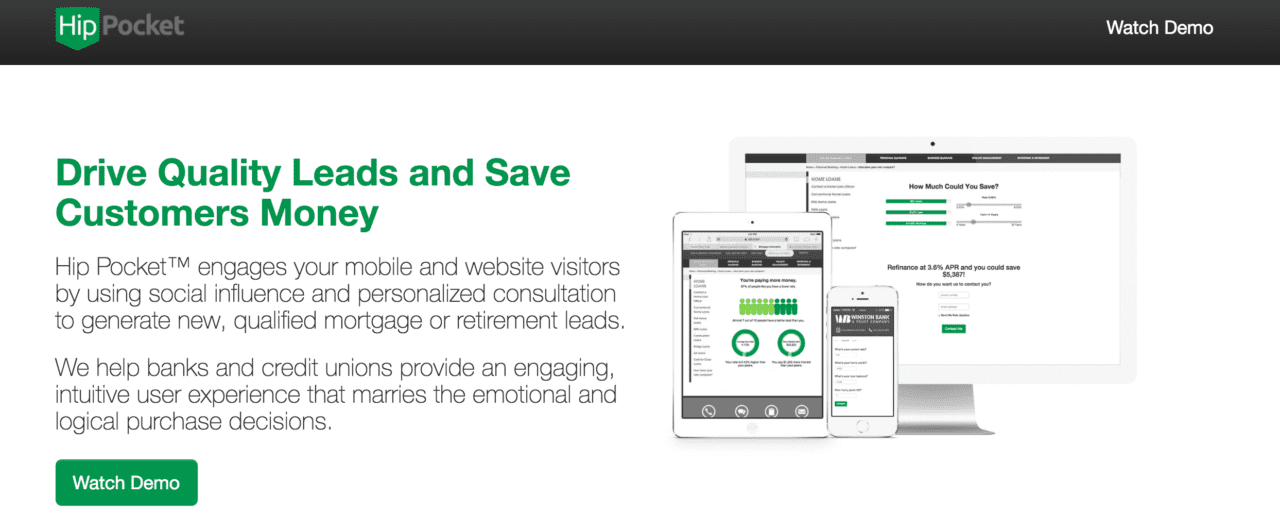

“Hip Pocket engages your mobile and website visitors by using social influence and personalized consultation to drive new, engaged mortgage and retirement leads,” CEO Zmarzly said at the start of the company’s FinovateSpring 2015 demo. Hip Pocket’s white-labeled web app helps banks increase consumer engagement by comparing the borrower’s current mortgage rate not only to that of their peer group, but also to the bank’s own rates. By offering this transparency, banks foster consumer trust and encourage borrowers to increase engagement.

Founded in 2013, Hip Pocket was featured in Inc.’s overview of the Silicon Prairie and was featured as one of three finalists for Techli’s Startup Voodoo competition in the Most Promising Startup category.